Featured News Headlines

Lido DAO Surges 17.69% to $1.11 as Buyers Return After Week-Long Dip

Lido DAO (LDO) jumped 17.69% to hit $1.119 before settling at $1.110, marking a strong recovery from last week’s local bottom at $0.85. The rally was supported by a massive 232% volume increase to $225 million, while market cap rose 16.27% to $987 million.

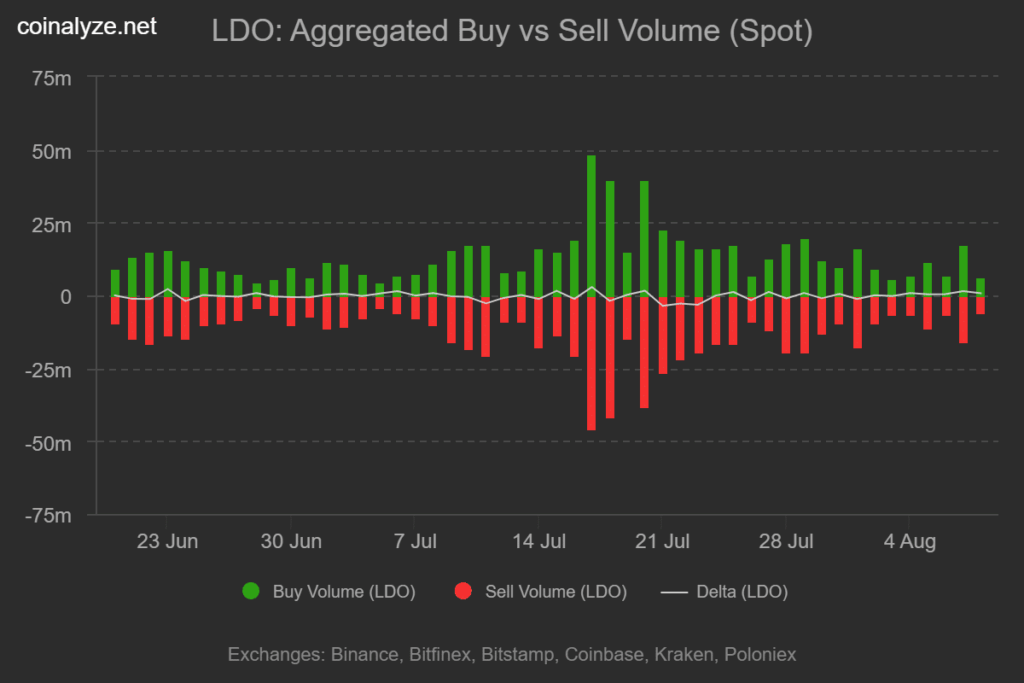

Strong Buying Pressure Drives Recovery

Data from Coinalyze shows LDO has maintained positive Buy Sell Delta for five consecutive days. Current buy volume reached 6.32 million compared to 5.6 million in sell volume, creating a positive market delta of 721,000.

This sustained buying pressure indicates aggressive spot accumulation, typically a precursor to higher prices. Investors appeared to capitalize on the dip buying opportunity when LDO touched its weekly low.

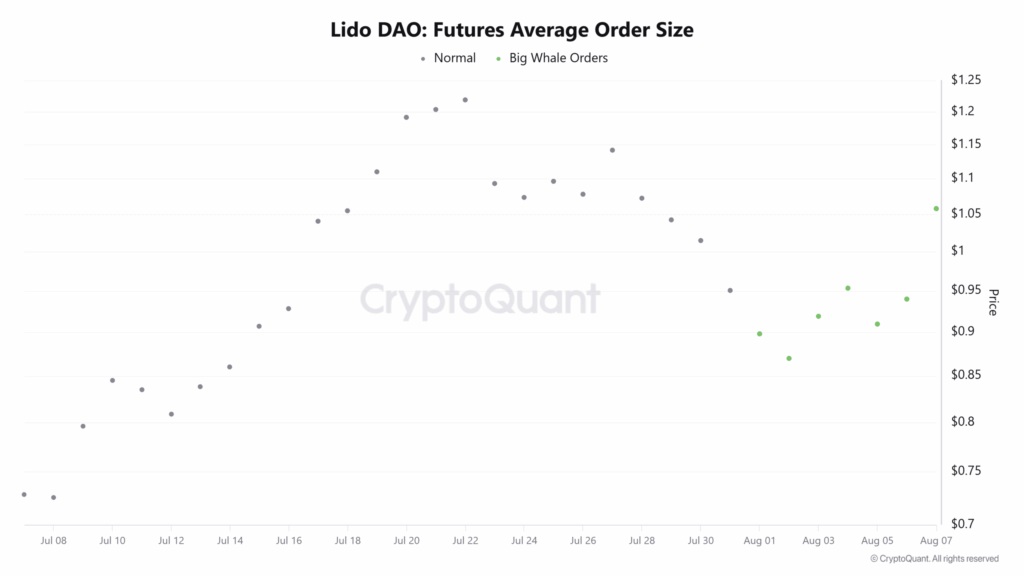

Whale Activity Increases in Futures Markets

After remaining inactive through July, large investors re-entered LDO markets as prices dropped last week. CryptoQuant data reveals consistently large Average Order Sizes in futures trading, signaling significant whale participation.

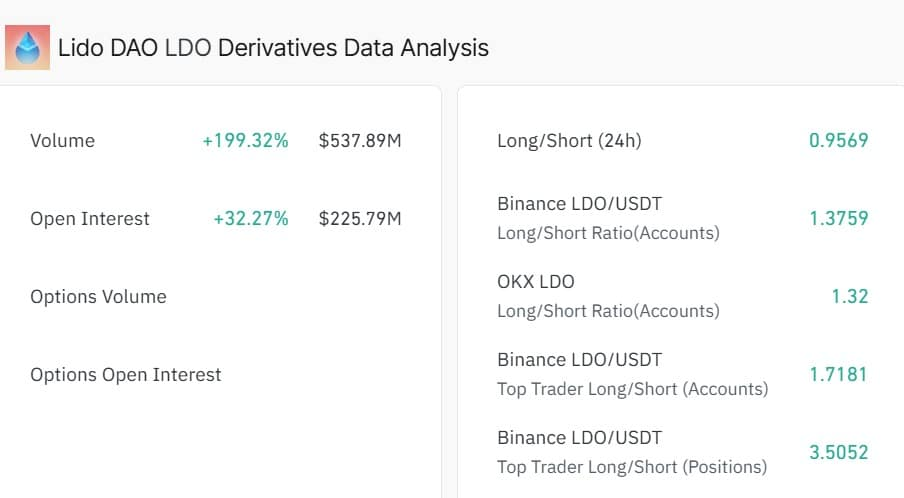

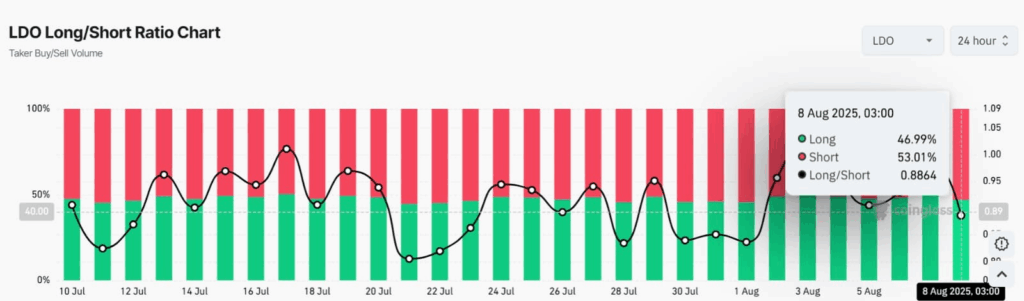

Open Interest jumped 32.2% to $225 million while Derivatives Volume soared 199% to $537.8 million. However, the Long Short Ratio sits at 0.9569, indicating 53% of futures positions are short compared to 46.9% long positions.

This suggests whales are betting against further price increases despite the recent rally.

Profit-Taking Pressure Emerges

As LDO recovered from recent lows, investors began taking profits. Spot Netflow turned positive for four consecutive days, reaching a three-week high of $3.36 million on August 8.

Higher exchange inflows typically indicate selling pressure as holders move tokens to trading platforms.

Technical Outlook

LDO’s Relative Strength Index crossed into bullish territory at 60, while the token flipped above its long-term moving average for the first time in ten days.

If buying momentum continues, LDO could target $1.17 and potentially $1.27 resistance levels. However, increased profit-taking could push prices back to the 50-day moving average at $0.891.

[…] Lido DAO is, in short, a Decentralized Autonomous Organization (DAO) structure that provides a liquid staking solution for various Proof-of-Stake blockchains, most notably Ethereum (ETH), but also including Solana, Polygon, and Polkadot. […]