Featured News Headlines

Layer-1 Prices Fall Sharply, But On-Chain Activity Holds Up

Layer-1 (L1) blockchain tokens endured a brutal year in 2025, with prices collapsing across much of the market. An analysis shared on Dec. 25 by Schizoxbt highlighted severe underperformance among major L1 networks, showing that even large-cap status offered little protection as risk-off conditions dominated.

Major Layer-1 Prices Suffer Steep Drawdowns

Price data revealed widespread losses. Ethereum (ETH) closed the year down 15.3%, while Solana (SOL) fell 35.9%. Declines were even sharper for other networks, with Avalanche (AVAX) and Sui (SUI) dropping 67.9% and 67.3%, respectively.

TON posted the largest drawdown, sliding 73.8% in 2025. Against the broader weakness, only BNB and TRX managed to finish the year in positive territory, gaining 18.2% and 9.8%.

The data underscored a harsh market reality: market capitalization alone did not ensure resilience during sustained sell-offs.

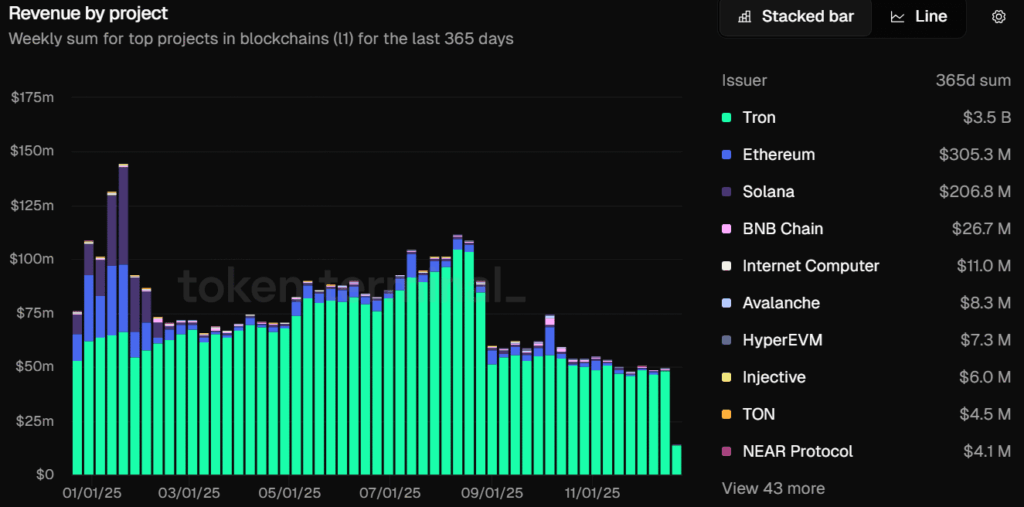

Revenue and Fees Remained Concentrated

Despite falling token prices, on-chain revenue metrics told a different story. According to Token Terminal, network monetization remained concentrated among a small group of L1s.

Tron led all Layer-1 networks, generating approximately $3.5 billion in revenue over the past 365 days. Ethereum followed with $305.3 million, while Solana produced around $206.8 million.

Fee generation mirrored this trend. Solana topped the list with $699.9 million in fees, followed by Ethereum at $549.3 million. BNB Chain also maintained economic relevance, recording $260.3 million in fees despite muted price performance.

User Activity Stayed Surprisingly Strong

User participation did not collapse alongside prices. Monthly active address data showed sustained engagement across major networks. BNB Chain led with 59.8 million active addresses, followed by Solana at 39.8 million and NEAR Protocol at 38.7 million.

Sei Network reported 10.6 million active addresses, nearly matching Bitcoin’s 10.3 million, while Ethereum recorded 9.3 million.

Fundamentals Diverged From Price Action

The defining theme of 2025 was the growing disconnect between prices and fundamentals. While many L1 tokens underwent sharp repricing after peaking near all-time highs in early October, economically productive networks retained usage, fees, and revenue, suggesting consolidation rather than structural decline.

Comments are closed.