Featured News Headlines

JELLYJELLY Trading Activity Sparks Analyst Attention

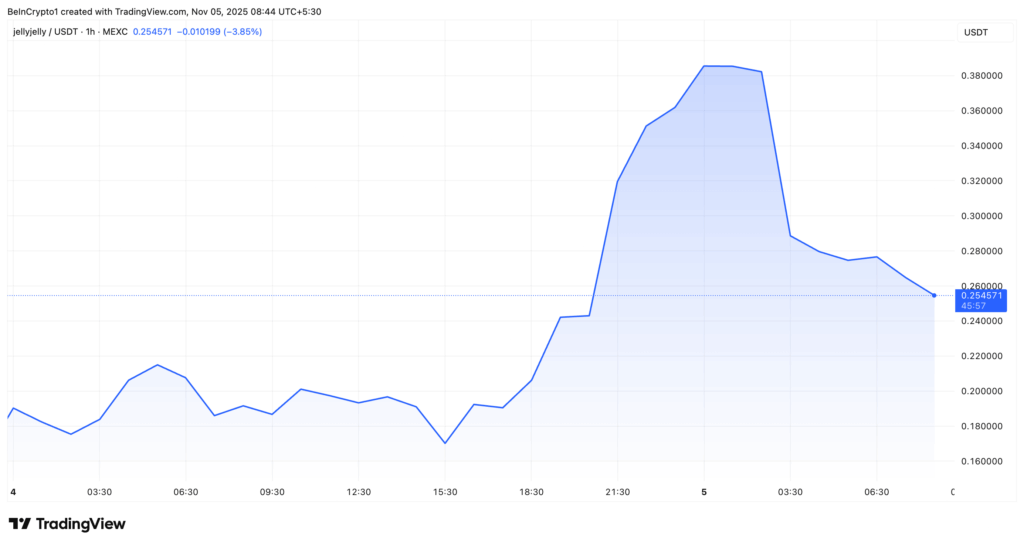

The cryptocurrency market faced a sharp downturn on November 4, with Bitcoin briefly dipping below $100,000 and Ethereum falling to $3,000, a level last observed in July. Amid this market turbulence, JELLYJELLY emerged as a notable performer, hitting an all-time high of $0.5 on the same day. This surge also pushed the token’s market capitalization to approximately $500 million.

JELLYJELLY’s Rapid Rise and Subsequent Correction

Despite reaching record levels, JELLYJELLY experienced a moderate pullback. At the time of reporting, the token was trading around $0.25, marking a 31.7% gain over 24 hours. Its market value adjusted to roughly $250 million, yet trading activity remained robust. According to CoinGecko, daily trading volume spiked by 96%, reaching $462 million.

Coordinated Trading Suspicions

The sudden price spike caught the attention of Bubblemaps, a blockchain analytics platform. The platform highlighted that seven wallets with no prior activity withdrew 20% of JELLYJELLY’s supply from Gate.io and Bitget over a four-day period.

“Shortly after these CEX withdrawals, JELLYJELLY jumped +600%…. after dropping 80% from previous highs,” Bubblemaps reported.

The coordinated withdrawal of a large portion of the token’s supply may have limited liquidity on centralized exchanges, potentially amplifying upward price movements and creating the appearance of strong market momentum.

Historical Context of Market Manipulation

This is not the first instance of unusual activity surrounding JELLYJELLY. In March 2025, the token was involved in a high-profile incident on decentralized exchange HyperLiquid. A whale orchestrated a short squeeze, risking up to $230 million in HyperLiquid’s HLP vault. Following this event, HyperLiquid delisted JELLYJELLY, refunded affected traders, and implemented stricter delisting protocols and open interest caps to enhance security.

The recurring pattern of sharp price movements and concentrated trading activity has raised scrutiny within the crypto analytics community. While JELLYJELLY’s performance stands out during a declining market, Bubblemaps’ analysis underscores the importance of monitoring unusual trading patterns that could influence token liquidity and volatility.

Comments are closed.