Featured News Headlines

Jack Dorsey’s Block Just Entered the S&P 500 — Crypto Goes Mainstream

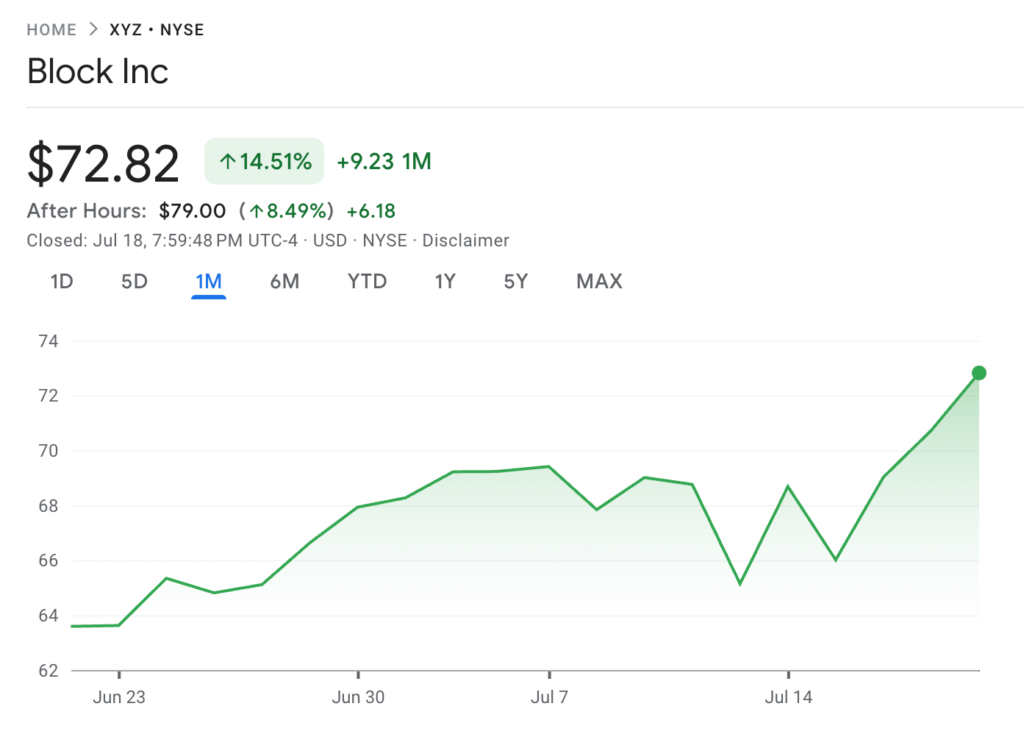

Jack Dorsey’s Block, Inc. made headlines Friday night after news broke that the company will officially join the S&P 500, triggering an 8.49% surge in its stock price during after-hours trading. The move is seen as a major win not just for fintech, but for the broader Bitcoin community.

Block to Replace Hess Corp on the S&P 500

According to a Friday announcement, Block will replace Hess Corp, an energy company, on the S&P 500 index before trading begins on Wednesday. This inclusion cements Block’s place among the 500 largest U.S. companies by market capitalization, meeting all the necessary criteria: over $18 billion market cap, positive GAAP earnings, and a sufficient public float.

Bitcoin Strategy Pays Off

Block isn’t just another fintech company it’s a known Bitcoin advocate. The firm currently holds 8,584 BTC, according to Bitbo data, and has made Bitcoin a key part of its corporate treasury strategy.

Commentators in the crypto space reacted swiftly. WiseSummit called the move “trillions in passive flows inching closer to Bitcoin,” while cryptothedoggy posted, “Crypto roots + Fintech firepower = Wall Street’s new blueprint.”

Square to Launch Bitcoin Payments

Block’s growing crypto commitment doesn’t stop there. At Bitcoin 2025 in Las Vegas, the company revealed that its payment platform Square will start supporting Bitcoin payments using the Lightning Network, aiming for a soft rollout this year and full deployment by 2026.

A New Era for Crypto on Wall Street?

Block follows Coinbase, which joined the index just two months ago, fueling speculation that more crypto-linked companies could be added to the S&P 500 soon. As the space evolves, Block’s inclusion signals a shift: Bitcoin is no longer on the sidelines it’s entering the mainstream.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrencies and stocks, particularly in micro-cap companies, are subject to significant volatility and risk. Please conduct thorough research before making any investment decisions.

[…] joined the S&P 500 before today’s opening bell, replacing Interpublic Group after its acquisition by Omnicom. This […]