RTX’s Stunning Rise: Can the Momentum Really Last?

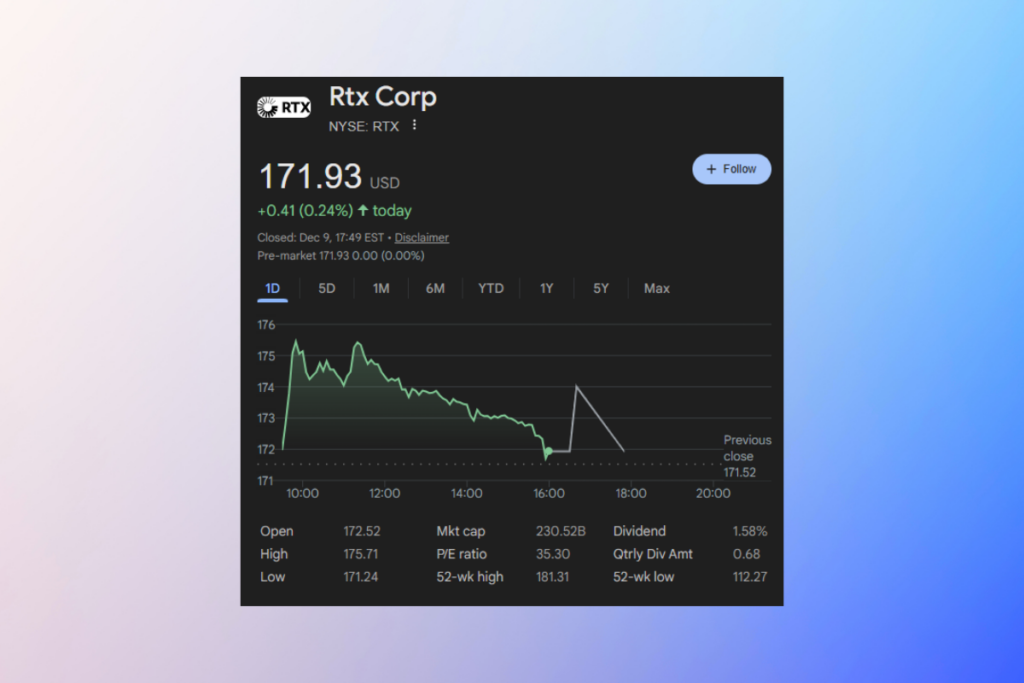

2025 has seen RTX acquire significant momentum, rising by around 48% so far. The action is a result of improved aerospace demand, increased backlog visibility, and growing confidence in defense spending. Now, investors wonder if the company still has the capacity to grow or if these tailwinds have already been factored in by the recent spike. According to market statistics, there may be more selective catalysts in the future, but the upswing may still continue.

Rising Geopolitical Tensions Set the Stage for RTX’s Next Growth Wave

Global defense spending continues to rise as geopolitical tensions escalate. Multi-year contracts are advantageous to RTX, particularly in the areas of advanced military technology, radar improvements, and missile systems. There is still a high need for precision-guided systems. This promotes margin growth and increases revenue stability. Long-term procurement is being given priority by governments, which will let RTX see its cash flow more clearly until 2026 and beyond.

RTX Gains Momentum as Commercial Aviation Rebounds

As airlines upgrade their fleets and spend more on maintenance, commercial aviation is gradually making a comeback. Engine recalls are putting pressure on RTX‘s Pratt & Whitney division, but operational advancements and more aftermarket sales are allaying worries. Increased flying hours directly contribute to the expansion of service contracts and spare parts. A secondary tailwind is created as a result, one that might not yet be fully priced in.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.