Featured News Headlines

- 1 ETH/BTC Signals a Breakout – Is Altseason Imminent?

- 2 Bitcoin Dominance Still a Key Indicator?

- 3 Could Bitcoin Dominance Already Be Peaking?

- 4 ETH/BTC Nearing a Crucial Breakout Zone

- 5 Can Ethereum Spark the Next Rally Alone?

- 6 Macro Trends May Support Altcoin Recovery

- 7 Market Sentiment Divided, But ETH/BTC Is the Key

ETH/BTC Signals a Breakout – Is Altseason Imminent?

The debate surrounding the next potential altcoin season is heating up, and analysts are divided on a key question: does Bitcoin need to break new all-time highs before altcoins can rally, or can Ethereum take the lead this time?

Bitcoin Dominance Still a Key Indicator?

Renowned crypto analyst Benjamin Cowen believes that the market is still in its early phase and that the true expansion phase—often called Altseason—has not yet begun. In his view, two major conditions must be met before altcoins can thrive:

“Ethereum needs to break above $5,000 and hold that level as support,” Cowen said, adding that “the only way to get an ‘ALT Season’ is for BTC.D to first go up as BTC goes to new highs.”

BTC Dominance (BTC.D)—which measures Bitcoin’s share of the total crypto market cap—has historically risen in the lead-up to altcoin rallies. Cowen argues that this trend must repeat for the next altcoin season to materialize.

Could Bitcoin Dominance Already Be Peaking?

Adding complexity to Cowen’s thesis, analyst AG suggested that Bitcoin dominance may have already peaked for this cycle. He noted that:

“Historically, BTC.D tends to drop by about 30% after Bitcoin hits its all-time high. The June 2025 dominance peak around 65% could already be the top.”

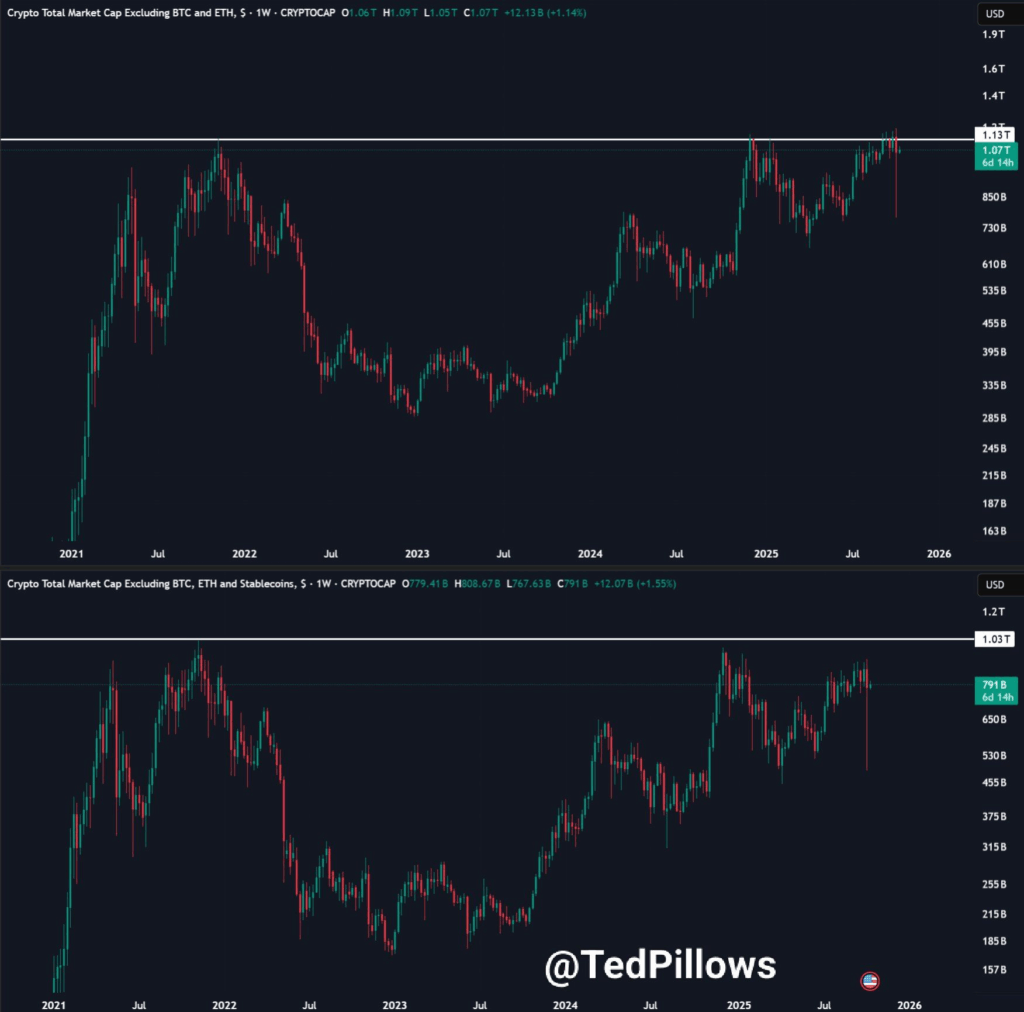

According to data from BeInCrypto, BTC dominance recently reached nearly 59%, while the Altcoin Season Index fell below 75—a level that suggests altcoins are still underperforming. Some market watchers argue that the current “altcoin season” is playing out more in publicly traded crypto stocks than in actual altcoin tokens.

ETH/BTC Nearing a Crucial Breakout Zone

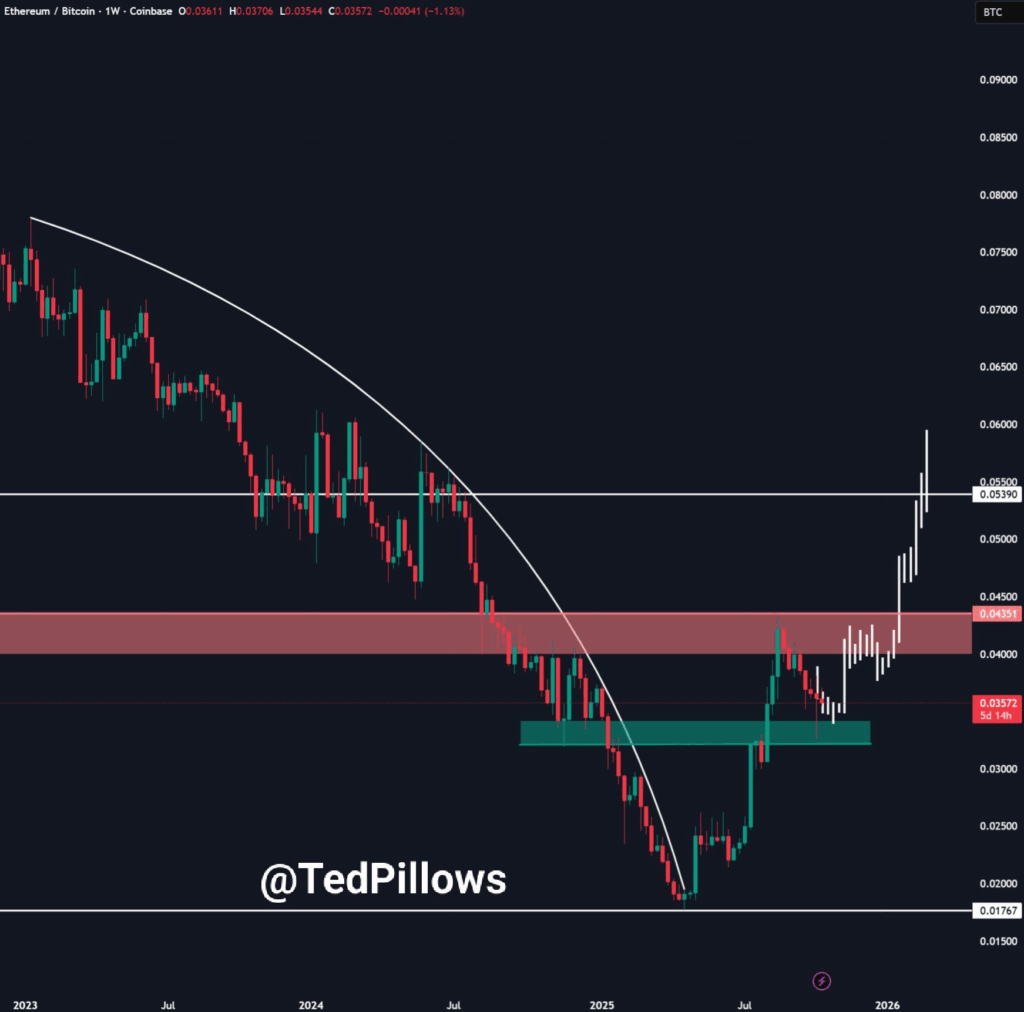

While Bitcoin continues to dominate market sentiment, several analysts are closely watching the ETH/BTC pair, which has shown signs of forming a higher low. Analyst Ted emphasized that altcoin market capitalization (excluding stablecoins) remains 20% below its peak, which points to a market still waiting for confirmation:

“We’re not in Altseason yet. ETH was rejected at key resistance, and most ALT/BTC pairs are declining.”

However, Ted also highlighted a historically strong support zone between 0.032–0.034 on the ETH/BTC chart. In past cycles, this area has marked the beginning of powerful altcoin rebounds, suggesting a possible turning point ahead.

Can Ethereum Spark the Next Rally Alone?

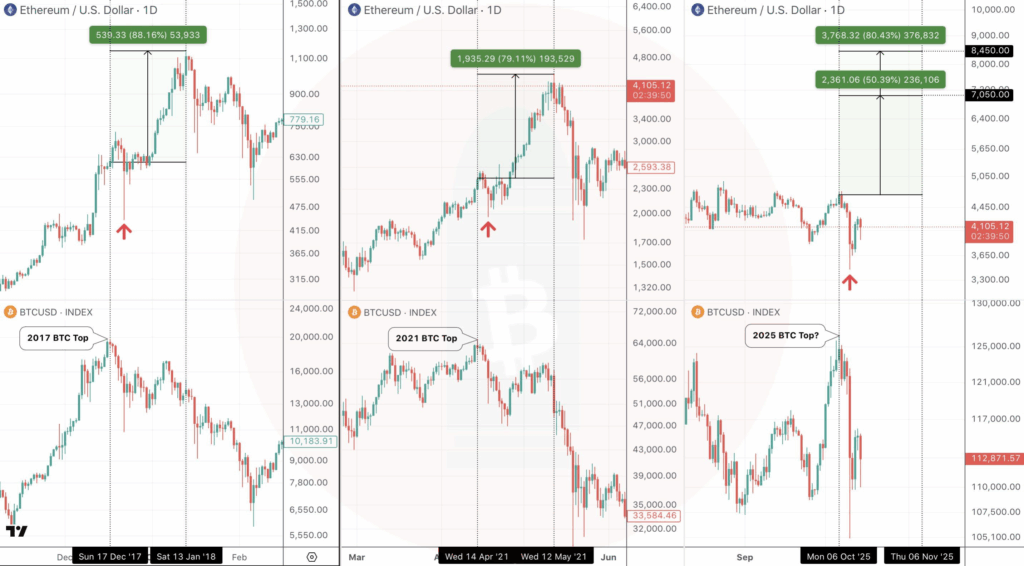

Not all analysts agree that Bitcoin must lead the way. Analyst CryptoBullet pushed back against Cowen’s view, citing Ethereum’s past performance:

“In December 2017, ETH rallied +88% after BTC topped. In April 2021, it jumped +79% again post-BTC peak. ETH doesn’t always need BTC to move higher.”

This counters the narrative that Bitcoin has to set the pace for the broader market and raises the possibility of an Ethereum-led breakout.

Macro Trends May Support Altcoin Recovery

Beyond price charts, macroeconomic developments could also influence crypto trends. The U.S. Federal Reserve has signaled a potential end to its Quantitative Tightening (QT) program—a move that would likely increase liquidity in financial markets. Since altcoins are particularly sensitive to liquidity conditions, any easing by the Fed could favor their recovery.

Market Sentiment Divided, But ETH/BTC Is the Key

Some analysts, like FANG, are leaning more bullish. He emphasized the long-term potential of Ethereum’s relative strength:

“This marks the first ETH/BTC uptrend in four years—one does not simply fade that kind of setup.”

FANG maintains that a move beyond $5,000 for ETH is only a matter of time, especially if this trend holds.

While the timing of the next altcoin season remains uncertain, the market is approaching a critical juncture. Whether led by Bitcoin, Ethereum, or a combination of both, the coming months could define the direction of the broader crypto market. For now, ETH/BTC sits at a pivotal level, and how it performs next may set the tone for what’s to come.

Comments are closed.