ETH RSI Hits Oversold Zone as Supply on Exchanges Drops to 9-Year Low

Ethereum, which led the market rally over the summer, faced a sharp dip earlier today (September 25), briefly falling below the $4,000 mark amid widespread declines across the crypto sector. Although it rebounded past this psychological level, Ethereum remains down approximately 12% over the past week.

Key Indicators Suggest Possible Recovery

Despite the recent downturn, several factors hint at a potential revival for ETH. First, the supply of Ethereum tokens held on centralized exchanges has declined to a nine-year low of roughly 16.3 million coins, according to data from CryptoQuant. This trend suggests investors are moving their assets off exchanges into self-custody wallets, potentially reducing immediate selling pressure.

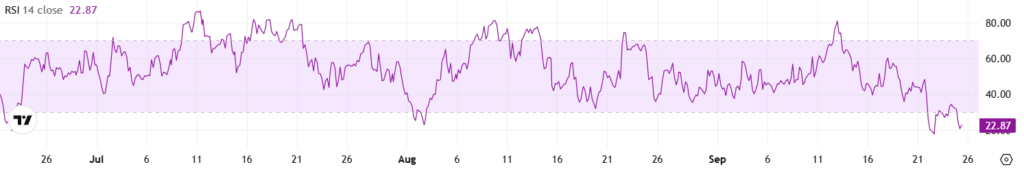

Second, Ethereum’s Relative Strength Index (RSI) stands at about 22, well below the oversold threshold of 30. The RSI is a technical indicator that measures price momentum, with values below 30 often signaling a possible rebound.

Finally, increased whale activity could influence the market. Researcher ZYN on X reported that in the past 24 hours, ten new wallets acquired over 200,000 ETH tokens valued at more than $800 million. Large accumulations like these typically shrink the circulating supply and can precede upward price movements if demand remains steady or increases.

Analysts Weigh In

Market analyst Lennaert Snyder emphasized the importance of Ethereum reclaiming the $4,200 level for confirming any potential uptrend. He stated, “Watching that level for confirmation shorts and longs after the gain. Losing $3,900 support brings us to the $3,700 zone, holding that is key to maintain the weekly uptrend.”

Another analyst, known as Ted on X, expressed a more cautious short-term outlook, predicting a possible retest of $3,800. He noted, “If it holds this level, a rally will happen,” but warned that falling below could lead to a further decline toward $3,500.

Comments are closed.