Ethereum Giant-in-the-Making: More Details on The Ether Machine Private Round

In a private investment round, cryptocurrency startup The Ether Machine has raised $654 million. Leading Ethereum supporter Jeffrey Berns donated 150,000 Ether to the company as part of this. Later this week, the money will be moved to the company’s wallet, Reuters reported on Tuesday. The board of directors will include Berns, who is well-known for his early investments in Web3 projects and Ethereum infrastructure. In preparation for its expected Nasdaq debut later this year, the company is aiming to establish a sizeable Ether treasury, which includes the financing.

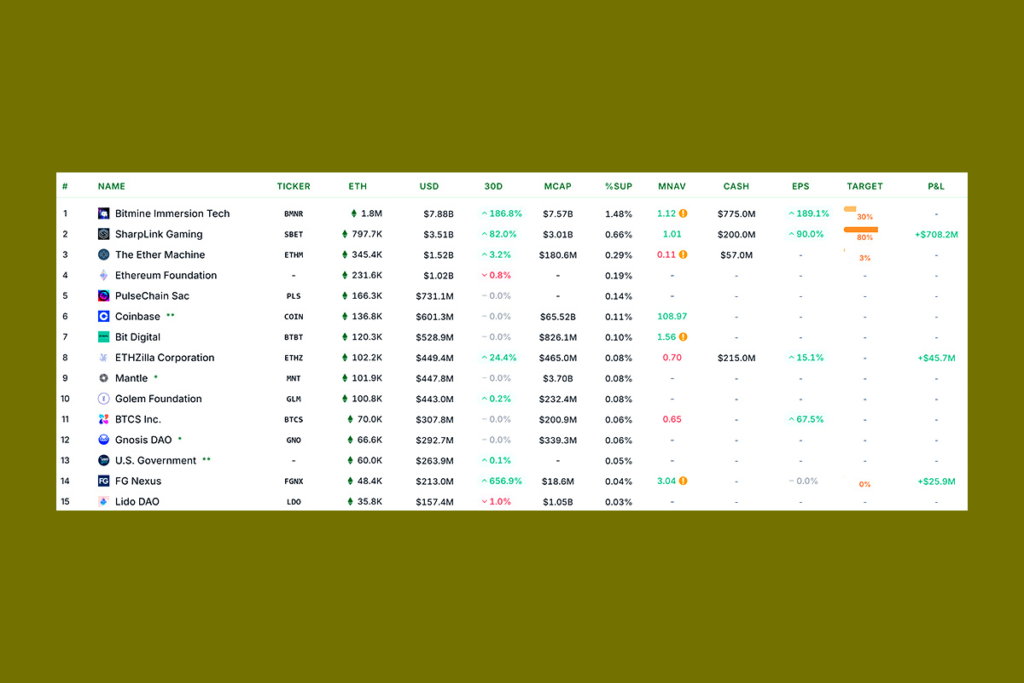

The Ether Machine Becomes Third-Largest Corporate Holder of ETH

The Ether Reserve merged with the blank-check company Dynamix Corporation to produce the Ether Machine. Although raising more than $1.5 billion from investors, such as Blockchain.com, Kraken, and Pantera Capital, was the original objective, the company has subsequently changed its approach. On the other hand, The Ether Machine currently has more than 345,400 ETH, making it the third-largest corporate holder, according to data from StrategicETHReserve. This is more than the 231,600 ETH that the Ethereum Foundation reportedly owns.

Keys: Ether Machine’s Yield Model to Outperform ETFs

To raise capital while maintaining their net asset value per share, treasury firms like Ether Machine frequently use convertible debt and preferred equity. The company’s on-chain yield generation method is anticipated to beat conventional exchange-traded funds (ETFs), according to co-founder and chairman Andrew Keys.

Between debt issuance and yield mechanics, we believe we can maintain a market premium over our net asset value indefinitely,

Keys

Citibank is spearheading Ether Machine’s third funding round. According to Keys, the fresh round will start on Wednesday and aims to raise at least $500 million.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.