Institutional Blockchain Leap: SBI Group and Chainlink Set to Transform APAC Markets

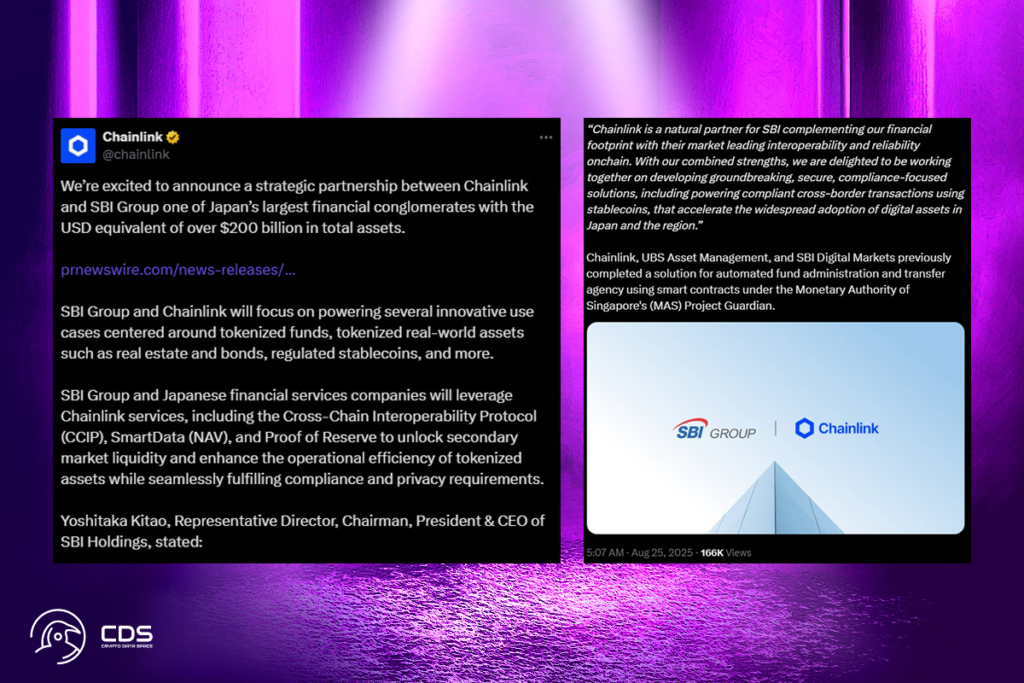

SBI Group, a Japanese financial behemoth, has teamed up with Chainlink, a blockchain oracle platform, to develop cryptocurrency capabilities for financial institutions around Asia. SBI stated on Sunday that many important use cases for financial institutions in Japan and the APAC area will be the main focus of its partnership with Chainlink. The Japanese market will be the initial focus.

On-chain bonds and other cross-blockchain tokenized real-world assets (RWAs) will be examined by the two. Among other things, they intend to employ Chainlink’s technology to offer on-chain verification for stablecoin reserves. After announcing partnerships with Web3 infrastructure company Startale, cryptocurrency company Ripple Labs, and stablecoin issuer Circle Internet Group on Friday, this is the fourth crypto relationship for SBI Group in a few days.

Chainlink and SBI Gear Up for Mass Adoption

SBI further stated that as part of its agreement with Chainlink, the company would tokenize RWAs and use its flagship blockchain interoperability technology for a variety of other use cases. Additionally, it will make cross-border and foreign exchange transactions easier.

I am excited to see our great work move towards a state of production usage at a large scale,

Chainlink co-founder Sergey Nazarov

He continues by saying that his company has long assisted SBI in developing highly sophisticated fund tokenization and stablecoin settlement use cases.

SBI CEO Kitao: Stablecoins to Power Compliant Cross-Border Transactions in Asia

Additionally, the pair stated that it would bring net asset value (NAV) data for tokenized funds on-chain by utilizing Chainlink’s data feed technologies. Yoshitaka Kitao, the chair, president, and CEO of SBI Holdings, stated that the two businesses would also cooperate on using stablecoins to power legal cross-border transactions. The goal of this program is to hasten the region’s and Japan‘s broad adoption of digital assets. Furthermore, according to local media sources earlier this month, the Financial Services Agency (FSA) of Japan is expected to approve a Japanese yen stablecoin for the first time as early as next month, with the fintech company JPYC spearheading the implementation.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.