Featured News Headlines

Hyperliquid’s $15.3B Open Interest Surges While Solana Struggles

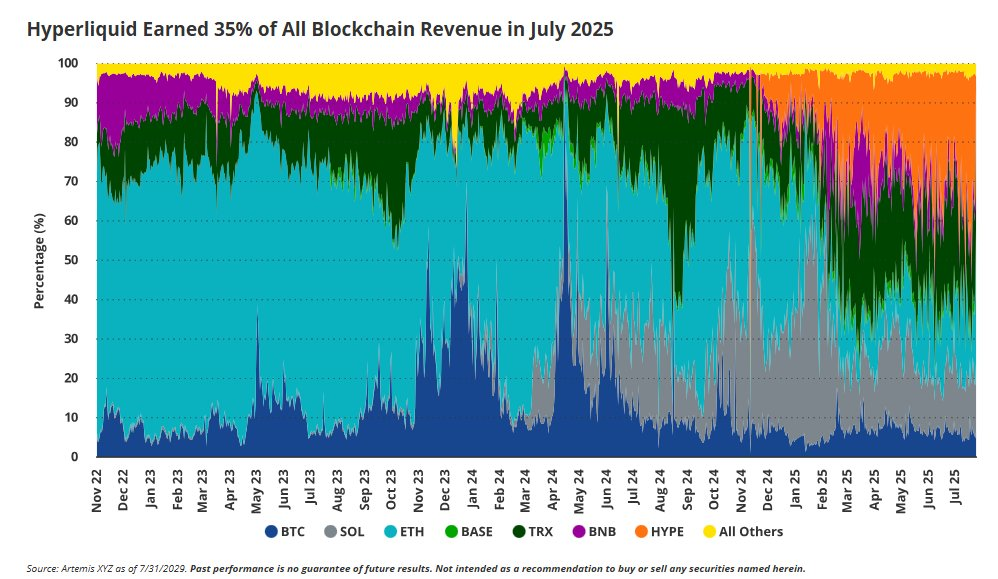

Hyperliquid– July was a breakthrough month for decentralized derivatives exchange Hyperliquid, which captured a massive 35% share of all blockchain revenue—primarily at Solana’s expense, according to VanEck’s latest crypto report.

Why HYPE Outpaced Solana and Others

VanEck analysts highlighted that HYPE “poached” high-value users from Solana by offering a simple, highly functional trading platform. While Solana struggled with reliability issues and missed core software upgrade deadlines, Hyperliquid delivered a smoother, more reliable user experience in derivatives trading, boosting its appeal.

Matthew Sigel, VanEck’s head of digital assets research, emphasized that Hyperliquid retained many of Solana’s former users, further denting Solana’s momentum and market cap.

Explosive Growth in Open Interest

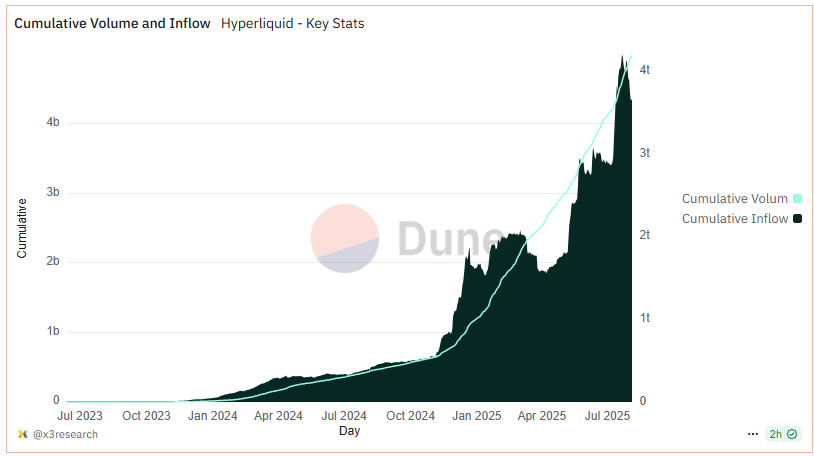

HYPE’s dominance is clear: open interest hit a staggering $15.3 billion in July, soaring 369% year-to-date. Over $5.1 billion USDC has been bridged into the platform, highlighting strong liquidity.

The recent integration of Phantom Wallet, featuring in-app perpetual swaps, drove $2.66 billion in trading volume, $1.3 million in fees, and attracted nearly 21,000 new users—all within July.

Token Performance: HYPE vs SOL

The native token HYPE surged to an all-time high of $49.75 on July 14, skyrocketing from just above $10 in early April. Meanwhile, Solana’s native token SOL has plunged 44% since its January peak, largely impacted by the memecoin craze.

At the time of writing, HYPE was trading slightly down at $37.38 amid a broader market pullback.

[…] million XRP were absorbed within 24 hours—surpassing the early inflow momentum seen during Solana’s recent ETF debut, and occurring despite ongoing Bitcoin outflows. Four XRP ETFs are currently […]