Why HYPE Token May Be Headed for Another Breakout

Hyperliquid’s native token HYPE is gaining momentum, supported by a spike in on-chain activity and user engagement across the network. Recent data suggests that the project’s growth is not just speculative — it’s being driven by real demand.

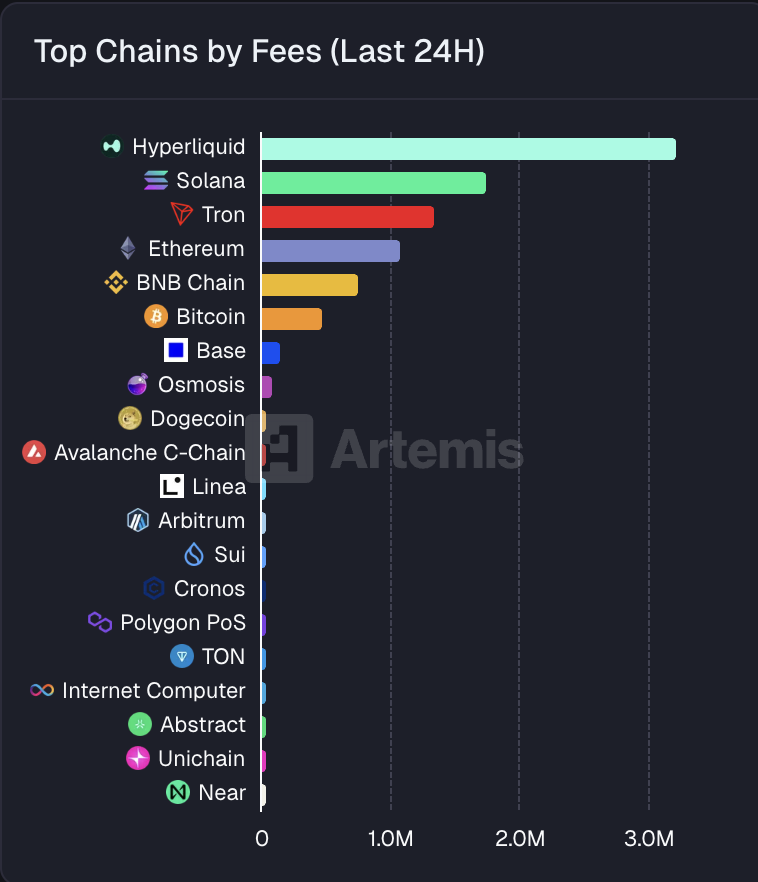

Hyperliquid Tops Fee Charts, Surpassing Major L1s

According to blockchain analytics platform Artemis, Hyperliquid recorded the highest network fees in the past 24 hours, collecting $3.2 million — more than Solana ($1.8M), Tron ($1.4M), and even Ethereum ($1.1M).

Rising network fees are often considered a proxy for actual usage, reflecting growing participation and transaction volume on-chain. “When a network generates more fees than Ethereum or Solana, it’s a strong signal of adoption and activity,” one analyst noted.

Liquidity Surge Adds Fuel to HYPE’s Momentum

Alongside fee growth, there’s also been a visible increase in stablecoin supply on the Hyperliquid network — a key metric for measuring capital inflows and ecosystem liquidity. A rising stablecoin presence typically points to users actively deploying capital, trading, and engaging with DeFi protocols.

This added liquidity strengthens bullish sentiment for HYPE and may help sustain its rally over the short to mid-term.

Comments are closed.