BitMine Emerges as Ethereum King: Could This Trigger the Next Price Rally?

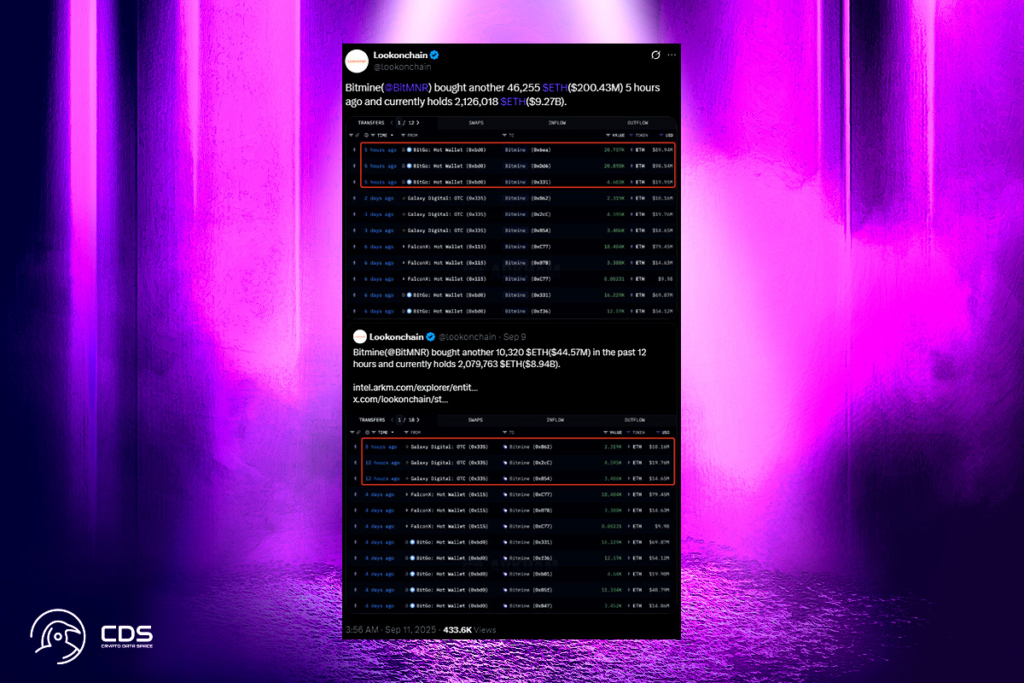

For the second time this week, BitMine Immersion Technologies, a blockchain technology company, has increased its Ether holdings. The business bought $200 million from Bitgo, a digital asset trust. According to blockchain data examined by Lookonchain, BitMine made three transactions with Bitgo on Wednesday, totaling 46,255 Ether.

Out of all the publicly traded companies, BitMine holds the most Ethereum. According to data from the Strategic ETH Reserve, its two acquisitions this week alone nearly equal the quantity of ETH that treasury businesses purchased last week. It coincides with a week of cryptocurrency purchases by treasury firms unrelated to Ethereum, which have caused their own stock prices to jump.

BitMine Overtakes Sharplink as Largest Corporate Ethereum Holder

With the acquisition of 202,500 Ether on Monday, BitMine began the week, and for the first time, its holdings surpassed the 2 million ETH milestone. Due in part to a 2% increase in the price of the token over the previous day, its most recent acquisition has increased its overall holdings to over 2.1 million ETH, valued at over $9.2 billion. Additionally, it places it ahead of Sharplink Gaming, the second-largest Ethereum holding corporation, which has more than 837,000 Ethereum in its treasury.

Bitcoin Acquisition Dips This Week

Meanwhile, this week saw a slowdown in the purchase of Bitcoin Treasury. According to Cointelegraph, public companies have only purchased four Bitcoins since Monday, totaling about $60 million, which is significantly less than the previous week. With a $33 million purchase of 300 BTC on Wednesday, Pop Culture Group (CPOP), a company that promotes Chinese hip hop, is the biggest buyer this week. In early trading, the announcement increased the share price by more than 40%, and it ended the day at $1.62, up 12.5%.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.