Will Sberbank’s First Bitcoin-Backed Loan Spark a New Era?

The biggest bank in Russia has entered the world of cryptocurrency-backed finance in a cautious but symbolic move. As a trial project, Sberbank has introduced its first loan guaranteed by Bitcoin. This indicates that institutions are becoming more at ease using digital assets. The action demonstrates how conventional banking and cryptocurrency infrastructure are starting to converge in regulated settings, even though it is still experimental.

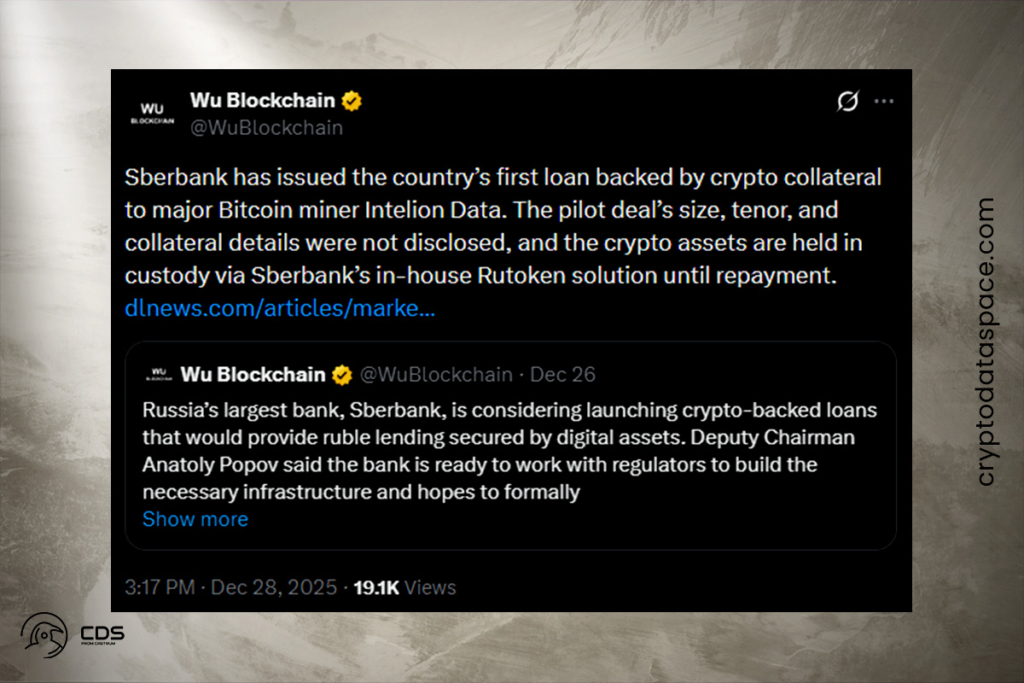

Intelion Data Secures Bitcoin-Collateralized Loan From Sberbank

One of the biggest Bitcoin mining firms in Russia, Intelion Data, received the loan. The usage of mined cryptocurrency as collateral was verified by Sberbank. It did not, however, specify the precise asset, length of the loan, or size. Crucially, Bitcoin produced directly from mining activities made up the collateral. This lowers the risks of provenance and compliance.

Sberbank used Rutoken, its in-house digital custody system, to protect the transaction. Thus, the bank was able to keep possession of the assets for the duration of the loan. Sberbank made it clear that crypto-backed lending is still a controlled test of risk, custody, and regulatory frameworks by characterizing the transaction as a pilot.

Sberbank Signals Cautious Shift Toward Crypto-Backed Finance

Executives from Sberbank referred to the project as a technical and regulatory sandbox. Russia‘s regulations on digital assets are still being developed, according to Deputy Chair Anatoly Popov. In order to influence future requirements for custody, collateralization, and compliance, the bank plans to collaborate closely with the central bank. The lesson is obvious from the standpoint of an investor. Even in highly regulated areas, cryptocurrency-backed lending is transitioning from theory to reality. Adoption is still sluggish and selective, but the trend is clear.

The signal is important for the cryptocurrency sector. The CEO of Intelion Data described the loan as a significant step that represents a maturing market. If successful, similar arrangements might apply to businesses that have cryptocurrency on their balance sheets in addition to miners. The pilot indicates that Russia is exploring crypto integration gradually—without giving up regulatory control—when combined with Sberbank’s concurrent DeFi studies and cautious retail access regulations.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.