Featured News Headlines

HBAR Hits $0.20 After Google Cloud Partnership Boost

Hedera’s native token HBAR has seen a sharp rebound in recent weeks, climbing 88% from its 2025 low to reach $0.20, according to market data. The rally pushed the blockchain project’s market capitalization above $8 billion, securing its position among the top 20 cryptocurrencies globally by market value.

ETF Inflows Drive Renewed Institutional Interest

A major factor behind HBAR’s surge has been strong demand for the newly launched Canary HBAR exchange-traded fund (ETF).

According to blockchain analytics firm SoSoValue, the ETF has attracted over $71 million in inflows since its debut — a significant signal of early institutional engagement.

The fund now holds $69 million in assets, equivalent to roughly 0.91% of Hedera’s total market capitalization.

This ratio, while modest compared to larger crypto ETFs, points to a growing willingness among institutional investorsto gain exposure to the Hedera ecosystem through regulated financial products.

Such ETF-driven demand often signals broader market confidence. For Hedera, this momentum has coincided with a period of relatively stable trading volumes and improved visibility among major blockchain players.

On-Chain Data Still Mixed Despite Price Momentum

While the price action has been bullish, on-chain network activity tells a more complex story.

Recent blockchain data shows that stablecoin supply on Hedera has declined to $127 million, down from a monthly high of $170 million.

Similarly, the total value locked (TVL) in Hedera-based DeFi protocols has dropped from $400 million earlier this year to around $192 million as of mid-November.

These figures highlight a disconnect between token price appreciation and ecosystem usage — a common trend across several mid-cap blockchain projects in 2025.

Analysts note that while speculative inflows have lifted prices, sustained adoption and network activity will be critical for long-term growth.

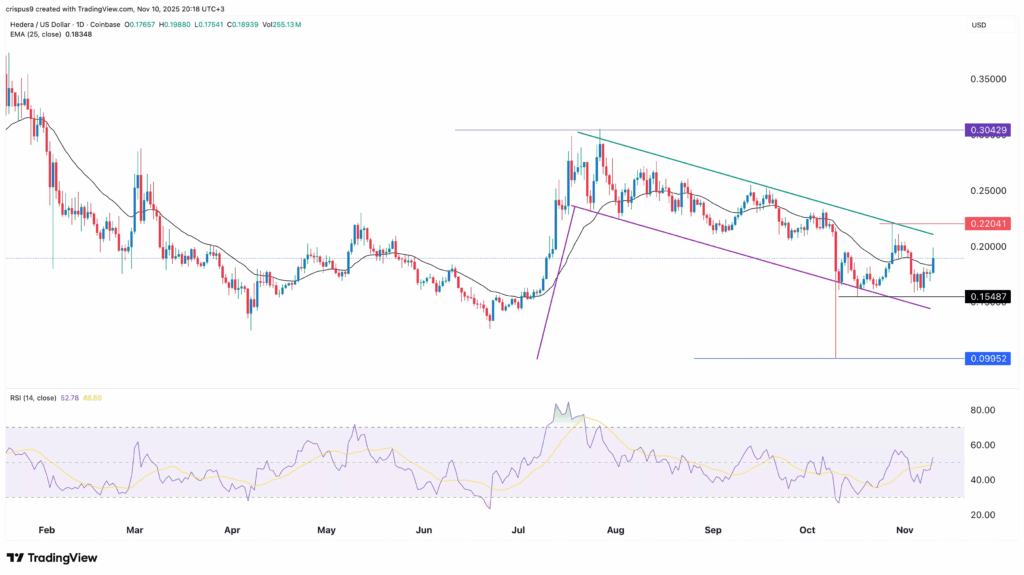

Technical Analysis: Bullish Patterns Point to $0.25 Target

From a technical standpoint, HBAR’s daily chart indicates a bullish setup.

The token recently confirmed a double-bottom pattern at $0.1550, with local lows recorded on October 17 and November 10.

This pattern, combined with a bullish flag formation, suggests that upward momentum could extend toward the psychological resistance level of $0.25 — a potential 32% gain from current prices.

Additionally, HBAR has broken above its 25-day Exponential Moving Average (EMA), while the Relative Strength Index (RSI) has moved above the neutral 50 level and continues to trend upward.

Technical analysts interpret this as a short-term confirmation of bullish sentiment.

However, a decisive drop below the $0.1550 support zone would invalidate the bullish scenario, potentially signaling a deeper retracement.

Traders are closely watching this level as a key line between continued recovery and renewed downside pressure.

Hedera’s Role in Enterprise Blockchain

Hedera distinguishes itself from traditional layer-1 blockchains by using a hashgraph consensus mechanism, designed for high throughput and low fees.

This architecture has positioned it as a preferred network for enterprise and institutional applications, including supply chain tracking, tokenization, and digital identity projects.

Recent partnerships, such as integrations with Google Cloud and other corporate stakeholders, have strengthened Hedera’s brand as a reliable infrastructure provider.

Still, the network faces competition from Polygon, Avalanche, and Near Protocol, which also target enterprise-grade blockchain adoption.

For investors and developers alike, the key question remains whether Hedera can convert technical partnerships and ETF attention into sustained on-chain growth.

Momentum Meets Measured Optimism

In the near term, ETF inflows and improved technical structure may continue to support HBAR’s price.

Yet the network’s declining DeFi activity and lower stablecoin supply suggest that real usage metrics must catch up to maintain momentum.

If Hedera can leverage its BigQuery integration to attract more developers and institutional data users, the project could solidify its presence in the data-driven blockchain sector.

However, market participants remain cautious as volatility persists across digital assets heading into the final quarter of 2025.

Comments are closed.