Featured News Headlines

HBAR Price Holds Strong Above $0.23 as ETF News Fuels Breakout Hopes

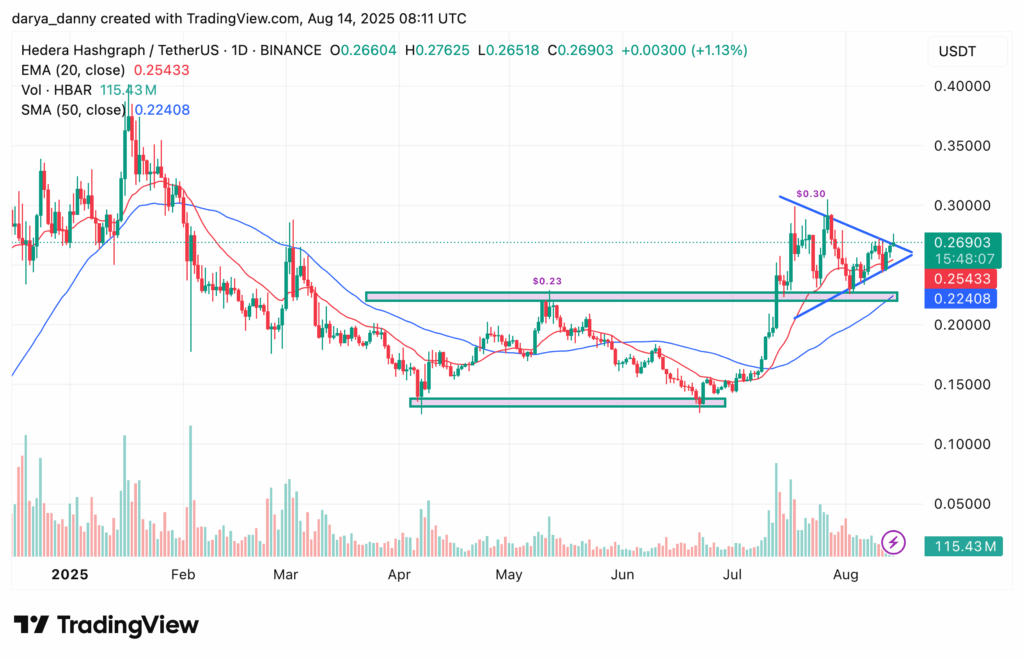

Hedera (HBAR) has shown signs of renewed bullish momentum after breaking out of a double bottom pattern with a neckline at $0.23. While the price briefly touched $0.30 on two occasions, resistance at that level held strong, leading to a mild retracement.

Bullish Pennant Pattern Takes Shape

After the pullback, HBAR has formed a bullish pennant — a technical continuation pattern that typically signals further upside. The price has compressed within converging trendlines, suggesting temporary market indecision. However, the broader trend remains bullish, supported by a positive crossover between the 20-day EMA and 50-day SMA.

Volume has steadily declined during this consolidation, which aligns with typical pennant formation behavior. Now, the daily candle is testing the upper trendline of the pennant, with volume jumping over 30% in the past 24 hours — a potential early signal of a breakout attempt.

If HBAR breaks above the pennant structure, the projected target is around $0.37, calculated from the height of the flagpole prior to consolidation.

Support Levels to Watch

There’s still room for HBAR to move sideways within the pennant. But as long as price holds above the lower trendline support — currently near $0.24 — the bullish outlook remains valid. A breakdown below that support, however, could invalidate the setup.

Grayscale ETF Filing Adds Fuel to Momentum

Beyond the technicals, HBAR is also getting a boost from a recent fundamental development. On August 12, Grayscale registered a Hedera Trust ETF in Delaware, alongside a Cardano (ADA) trust. Such registrations often precede SEC filings and can signal the early stages of a regulated investment product — a potential long-term driver for HBAR demand.

Comments are closed.