Dragonfly’s Bold Call: A Big Tech Crypto Wallet Is Closer Than You Think

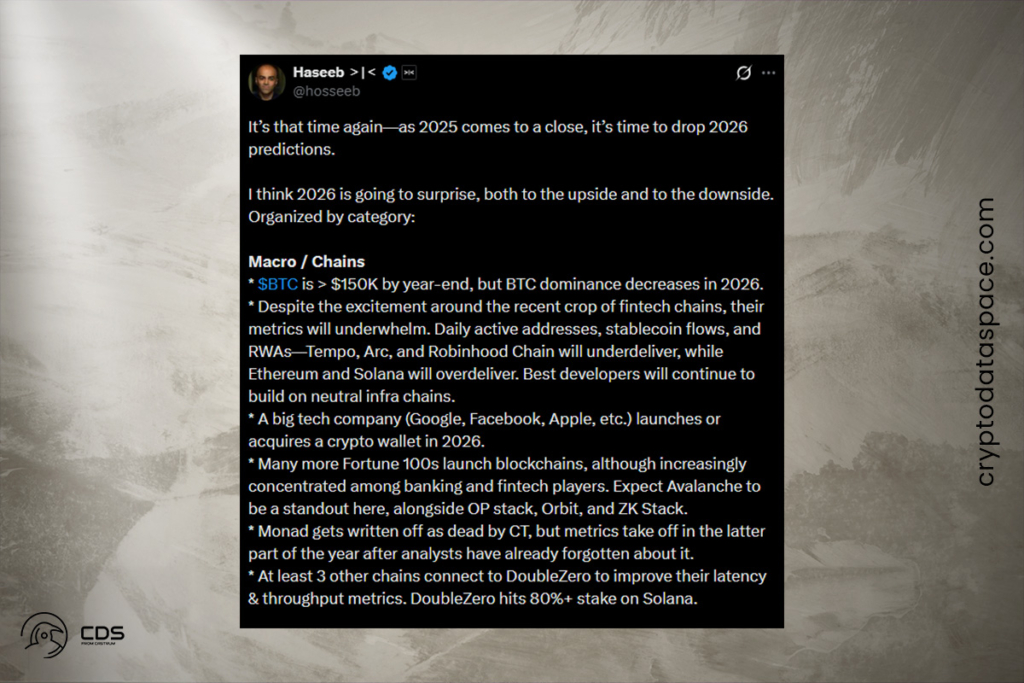

Dragonfly managing partner Haseeb Qureshi predicts that a Big Tech company will incorporate a cryptocurrency wallet in 2026. Additionally, Qureshi anticipates that more Fortune 100 firms will start their own blockchains. He predicted that fintechs that build L1s to compete with public chains like Solana and Ethereum won’t draw in enough consumers.

The banking and fintech industries are expected to account for a large portion of the Fortune 100 adoption, according to a post made by Qureshi on X on Monday. Many of these companies will make use of the Avalanche blockchain and current crypto toolkits like OP Stack, Orbit, and ZK Stack, he continued. These networks would be able to stay connected to a public blockchain while becoming more private and permissioned due to the configuration.

Banks and Tech Giants Prepare for Layer-1 Blockchain Launches

Private blockchain infrastructure is already being tested by several significant financial institutions, indicating that corporate adoption is transitioning from theory to early implementation. Internal blockchain solutions have been introduced by companies like IBM, Goldman Sachs, JPMorgan, and Bank of America. But the majority are still in experimental programs or have limited production use. However, momentum is increasing. Galaxy Digital predicted earlier this month that by 2026, at least one Fortune 500 bank, cloud service provider, or e-commerce behemoth would introduce a layer-1 blockchain. More than $1 billion in actual economic activity should be settled via this network. Additionally, bridges linking the blockchain to decentralized finance ecosystems would be included.

Big Tech Crypto Wallet Could Drive Mass Adoption in 2026

According to Qureshi, there will soon be disruptions that affect consumers. He thinks that in 2026, a major Big Tech company—possibly Google, Meta, or Apple—might introduce or buy a cryptocurrency wallet, allowing for the unprecedented mass acceptance of cryptocurrencies. He is still dubious about fintech-developed public blockchains challenging well-established networks, though. Qureshi predicts that Ethereum and Solana will continue to dominate on-chain activity as new fintech L1s struggle to draw in developers and users. He therefore anticipates that, rather than corporate-controlled chains, builders, liquidity, and actual usage will continue to consolidate around neutral, crypto-native infrastructure.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.