Featured News Headlines

Grayscale Investments Shifts Strategy Beyond BTC & ETH to Leading Altcoins

Grayscale Investments, the world’s largest digital asset manager, is quietly broadening its exposure to select altcoins—Chainlink (LINK), Zcash (ZEC), Stellar Lumens (XLM), and Filecoin (FIL)—in a move that could hint at where institutional capital is flowing next. With a mix of ETF filings, product rebrands, and steady accumulation patterns, Grayscale’s recent activity is shaping the narrative around altcoins poised for the next breakout.

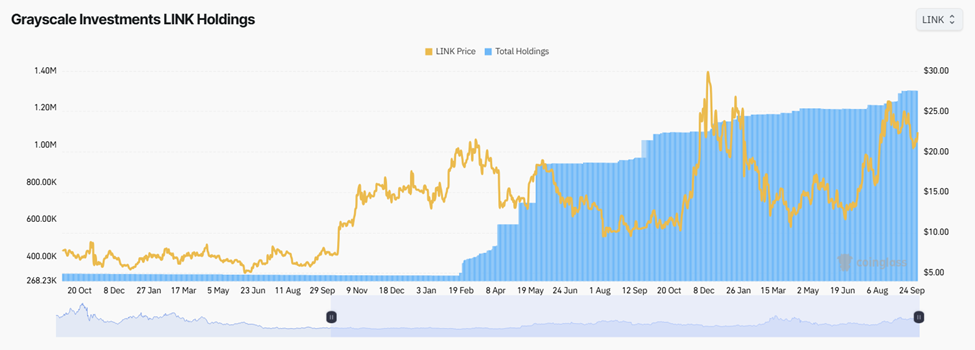

Chainlink (LINK): ETF Filing and Strong Fundamentals Align

Grayscale made headlines in early September with its filing for a spot Chainlink ETF, aiming to convert its existing Chainlink Trust into a publicly traded product under the ticker GLNK on NYSE Arca. The filing includes a potential staking component, with Coinbase Custody named as custodian—adding another layer of institutional-grade infrastructure.

This development comes at a time when Chainlink’s on-chain performance has shown resilience amid macro uncertainty, including during events like the U.S. government shutdown. Analysts from More Crypto Online have praised LINK for having one of the “cleanest macro setups” among altcoins.

Grayscale’s increasing LINK holdings throughout 2024, ahead of price rallies, suggest a pattern where institutional accumulation precedes market strength. This alignment between product strategy and on-chain momentum could indicate that some investors are already sitting on gains.

Zcash (ZEC): Privacy Narrative Gains Traction Again

Zcash (ZEC), known for its zk-SNARKs privacy technology, is also getting renewed institutional attention. Grayscale’s Zcash Trust remains open to accredited investors, and the asset’s price responded sharply—spiking over 110%—following Grayscale’s renewed spotlight.

From January to August 2025, Grayscale’s ZEC holdings rose from 320,000 to 380,000, with price climbing from $20 to $120 shortly after. Notably, this surge occurred with holdings remaining stable, hinting at strong conviction and minimal profit-taking.

Zcash advocate Thor Torrens, a former White House advisor and member of the Zcash Advisory Panel, revived a bold 2018 Grayscale thesis, noting that if just 10% of global offshore wealth—estimated at $32 trillion—were to enter ZEC, the price could theoretically reach $62,893. While speculative, the comment has reignited bullish sentiment within the privacy coin community.

On-chain metrics also support the momentum. Addresses holding over $10 million in ZEC are rising, and key indicators like Delta Growth Rate and MVRV Z-Score suggest fresh speculative inflows. Some analysts now compare ZEC’s long-term wedge pattern to the historic breakouts of XRP and XLM, potentially setting the stage for a technical breakout.

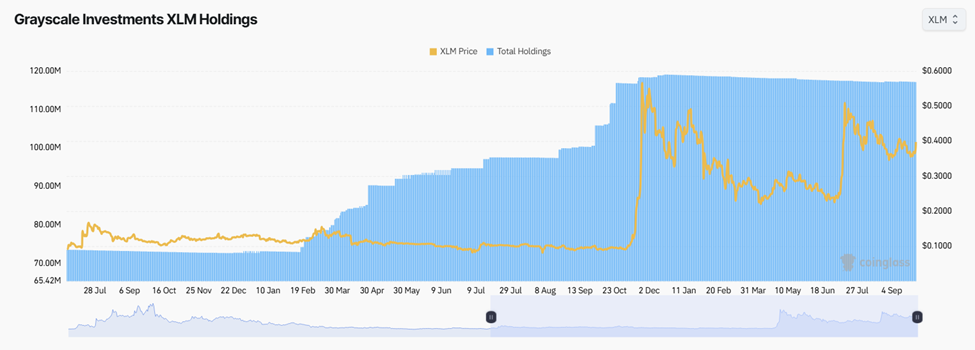

Stellar Lumens (XLM): From Closed Trust to Accessible ETF

Stellar Lumens (XLM) has also found its way into Grayscale’s expanding altcoin focus. Between July and October 2025, Grayscale’s XLM holdings increased from 100 million to 120 million, reflecting quiet accumulation despite price volatility.

Earlier in the year, Grayscale rebranded its Stellar Lumens Trust (GXLM) into an ETF listed on NYSE Arca, with features like volume-weighted pricing and redemption mechanisms aimed at reducing liquidity gaps. This shift mirrors broader trends in crypto ETFs, with approval momentum spreading beyond Bitcoin and Ethereum.

According to Cardano ambassador Lucas Machiavelli, the rebrand gives legitimacy to altcoins like XLM, positioning them as utility-driven assets worthy of institutional portfolios.

Filecoin (FIL): Accumulation Without the Headlines

While FIL has not seen the same price action as its peers, it is quietly being accumulated via Grayscale’s Filecoin Trust. The trust allows institutional investors to gain exposure to Filecoin without directly holding the asset, offering simplicity amid rising interest in decentralized storage.

Grayscale has also included FIL in its Decentralized AI Fund, alongside projects like TAO, NEAR, RENDER, and The Graph (GRT)—highlighting its strategic importance at the intersection of AI and decentralized infrastructure.

Despite subdued price movement, holdings data indicate that Grayscale may be positioning ahead of the curve, betting on rising demand for decentralized storage as AI continues to evolve.

Institutional Signals or Market Catalysts?

Grayscale’s expanded focus beyond Bitcoin and Ethereum is more than just diversification—it’s shaping narratives and potentially signaling the next wave of institutional altcoin interest.

From Chainlink’s ETF ambitions, to Zcash’s privacy use case, XLM’s ETF evolution, and Filecoin’s Web3 infrastructure role, each asset brings a distinct value proposition that aligns with emerging themes in the crypto space.

For market observers, keeping an eye on Grayscale’s product filings, trust holdings, and fund composition could provide early clues about which altcoins are being quietly backed by deep-pocketed investors—before the broader market catches on.

Comments are closed.