Featured News Headlines

How Stablecoins Are Reshaping Finance

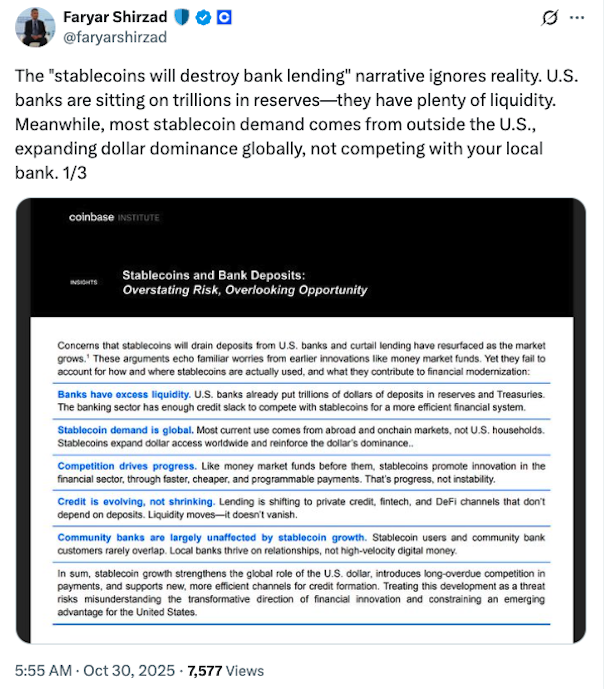

Concerns that stablecoins could threaten US banks by drawing deposits away may be overstated, according to research from Coinbase.

Faryar Shirzad, Coinbase’s policy chief, emphasized on Wednesday that “The ‘stablecoins will destroy bank lending’ narrative ignores reality.” He highlighted that most demand for stablecoins originates outside the US, “expanding dollar dominance globally, not competing with your local bank.”

Stablecoins and the Real-World Use Case

A market note shared by Shirzad argued that debates about stablecoins’ impact on US bank deposits and lending mirror past concerns raised during innovations like money market funds. Yet, these discussions often fail to consider the practical uses of stablecoins in today’s financial ecosystem.

US banking groups have expressed worries that stablecoins offering yield could compete with traditional bank accounts, potentially causing outflows. They have urged Congress to regulate services providing yield on stablecoins.

Global Demand Outpaces US Adoption

Coinbase’s analysis shows that the majority of stablecoin demand comes from international users seeking exposure to the US dollar, rather than from domestic consumers. In emerging markets, stablecoins are often used to hedge against local currency depreciation, providing “a practical form of dollar access” for the underbanked.

The note also pointed out that roughly two-thirds of stablecoin transfers occur on decentralized finance (DeFi) or blockchain platforms. In this sense, they serve as “the transactional plumbing of a new financial layer that runs parallel to, but largely outside, the domestic banking system.”

Shirzad summarized, “Treating stablecoins as a threat misreads the moment: they strengthen the dollar’s global role and unlock competitive advantages that the US shouldn’t constrain.”

Community Banks and Stablecoins

Coinbase dismissed concerns that community banks would suffer from widespread stablecoin adoption. According to the firm, typical stablecoin users and community bank customers rarely overlap. Shirzad stated, “Community banks and stablecoin holders barely overlap,” and suggested that banks could even enhance their services by integrating stablecoins.

The report also cautioned against overly optimistic forecasts predicting trillions of dollars flowing into stablecoins over the next decade. Coinbase noted, “Even if stablecoin circulation reached $5 trillion globally, a majority of that value would still be foreign-held or locked in digital settlement systems, not diverted from US checking or savings accounts.”

Comments are closed.