Featured News Headlines

USDX Price Falls 63%: What’s Behind the Stablecoin Meltdown?

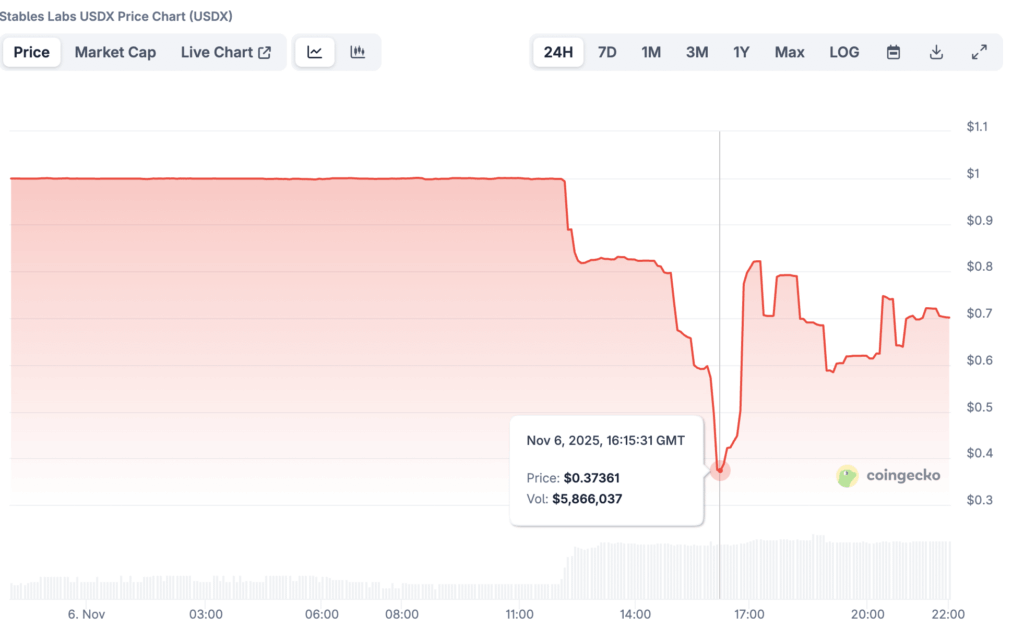

The stablecoin USDX plunged dramatically on 6 November, falling 63% from its $1 peg to just $0.37 around 4:15 PM GMT, according to CoinGecko data. The token later rebounded to around $0.70, but panic had already gripped the DeFi market.

USDX is designed to maintain a 1:1 peg with the U.S. dollar, but the sudden liquidity drain exposed vulnerabilities in its collateral structure. Traders and analysts immediately pointed fingers at Stables Labs founder Flex Yang, accusing him of manipulating liquidity across major DeFi protocols.

Founder Faces Accusations of Liquidity Drain

The controversy began on 5 November when a crypto analyst known as Arabe Bluechip posted on X (formerly Twitter) alleging suspicious activity linked to wallets tied to Yang.

“Someone drained all USDC / USD1 / USDT liquidity using sUSDX / USDX as collateral,” Arabe Bluechip wrote. “They’re paying 100% borrow interest with no intent to repay.”

The analyst questioned the logic behind borrowing against USDX at extreme interest rates rather than redeeming it directly for stable assets like USDT — a move that raised alarms across DeFi communities.

Lista DAO Takes Emergency Action

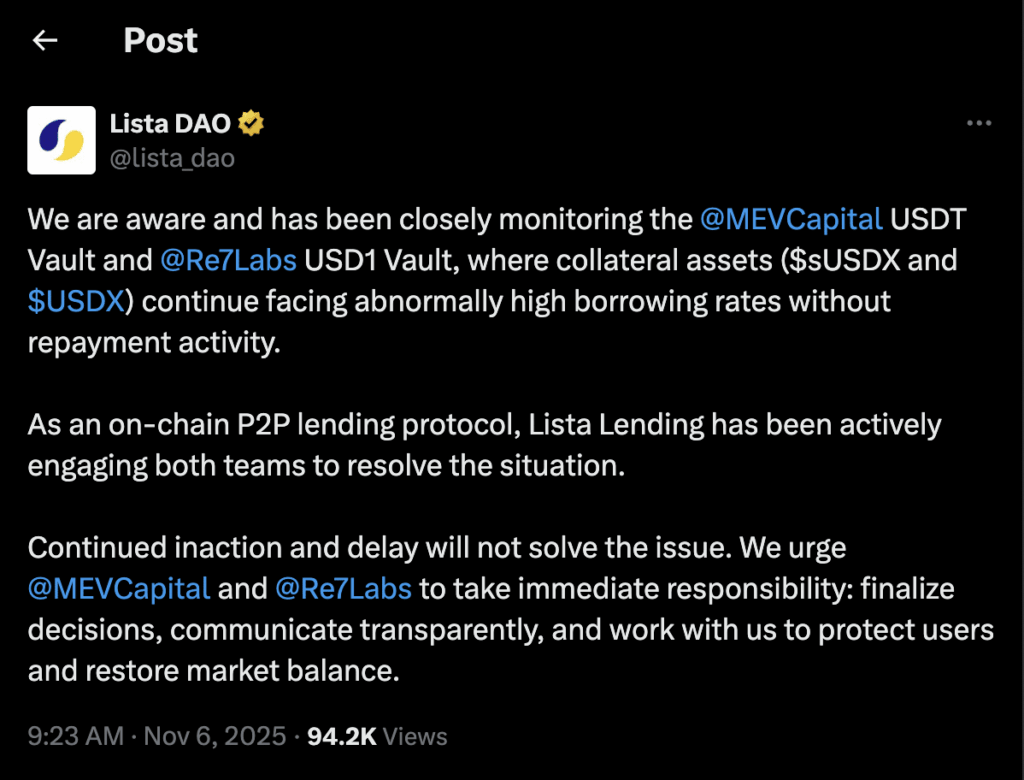

The lending platform Lista DAO confirmed the irregular activity early on 6 November, reporting “abnormally high borrowing rates without repayment activity” across vaults managed by MEV Capital and Re7 Labs.

In an urgent response, the protocol launched an emergency vote. Proposal LIP022 passed overwhelmingly, authorizing rapid liquidation of risky positions to safeguard user funds.

Lista DAO later announced that liquidations were “nearly complete” and that Re7 Labs had “taken proactive steps in users’ best interest.” Interest rates on the USDX/USD1 market were slashed to 3%, while remaining assets were transferred to a public liquidation pool.

Broader Implications for DeFi

The USDX crisis stands out as one of 2025’s largest stablecoin depegs, highlighting ongoing concerns around collateral management and transparency in decentralized finance.

A report from Rise noted that over nine stablecoins experienced depeg events this year, though most were resolved within hours and showed less than a 1% deviation. USDX’s steep decline marks a rare and severe failure.

Stables Labs has yet to issue an official statement addressing the allegations or outlining recovery plans for affected users. As the DeFi community awaits answers, the incident serves as a stark reminder of the fragility within algorithmic and collateralized stablecoin systems.

Comments are closed.