Featured News Headlines

Fartcoin Price Plummets: From $1 to $0.77 Amid Whale Sell-Offs

Fartcoin – On August 26, the crypto market tumbled sharply, with memecoins, DeFi tokens, and AI-related assets taking the heaviest blows. Among the losers, Fartcoin [FARTCOIN] plunged nearly 19% in a single day, according to CoinMarketCap, wiping out all the gains it made after last week’s Fed-driven rate cut optimism. On a monthly basis, the drop is even more brutal — over 40% down.

The sentiment shift around Fartcoin has been fueled by whale exits and suspicious wallet activity, including a Hyperliquid-linked wallet swapping FARTCOIN for Useless Coin [USELESS], sparking doubts about its short-term resilience.

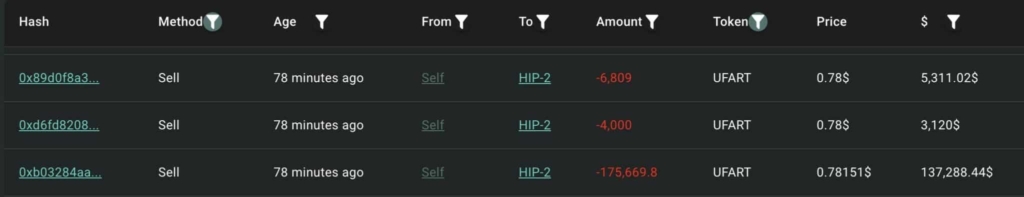

Whales dump millions, losses pile up

Whale activity has been a central factor in the decline. One major holder sold over 1.6 million FARTCOIN for $1.27 million, realizing a staggering $1.14 million loss. Fartcoin also emerged as the most liquidated asset among “Smart Money” wallets in the past 24 hours, with sell orders exceeding 21.

Other memecoins, including Popcat [POPCAT] and YZY Money [YZY], also suffered similar declines, signaling a wider collapse in Solana-based meme assets. Meanwhile, daily trading volume fell to $252.85 million, underscoring weakening on-chain strength.

Binance traders fuel further pain

On the derivatives side, Binance recorded 1.76 million futures trades, amplifying the sell-off through aggressive shorting. More than $5.8 million worth of long positions were liquidated, pushing FARTCOIN’s funding rates into negative territory at -0.0178, with lows near -0.04 — meaning shorts were paying longs.

Open interest also fell sharply from $130 million to $116 million, showing fading confidence in bullish bets.

What’s next for Fartcoin?

Technically, Fartcoin is testing support near $0.75. If this level holds, the token could bounce back toward $1. However, failure to maintain the zone may trigger deeper drops toward $0.70, $0.40, or even $0.20, as whales continue to exit.

For now, the daily candle structure hints at a bearish outlook, unless the move proves to be a liquidity hunt around the $0.90 zone.

Comments are closed.