Featured News Headlines

ETHZilla Sells $74.5M in ETH, Shifts Focus Away From Corporate Treasury Model

Peter Thiel-backed ETHZilla appears to be retreating from its Ethereum-focused corporate treasury strategy, just four months after embracing the trend, triggering sharp reactions across the crypto market.

In a recent statement, the firm confirmed it has sold 24,291 ETH, valued at approximately $74.5 million, to reduce outstanding debt. Alongside the move, ETHZilla announced it will discontinue its mNAV metric, which tracks the value of crypto holdings relative to enterprise value, and instead shift its strategic focus toward tokenization.

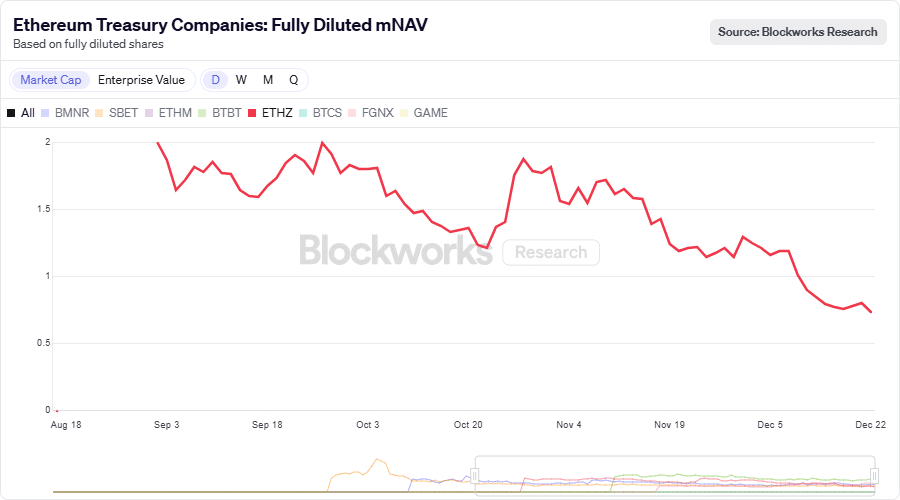

Market Backlash and mNAV Decline

The abrupt pivot sparked mixed responses from analysts and market observers. One critic described the shift as a “destruction of shareholder value,” pointing to the company’s rapid erosion in valuation over a short period. ETHZilla’s mNAV fell below 1 in early December, following earlier warnings of a potential strategy change in late October.

In an attempt to stabilize the metric, the firm previously sold $40 million worth of ETH to fund share buybacks. However, mounting debt obligations and the risk of further market contraction in 2026 have raised concerns about the sustainability of its Ethereum exposure.

With mNAVs below 1, raising additional capital or issuing shares to fund further ETH purchases becomes increasingly difficult—a challenge that has already influenced ETHZilla’s strategic retreat.

From Biotech to ETH — and Now Tokenization

Formerly known as 80 Life Sciences Corp, the company rebranded and shifted from biotech into crypto in August, aiming to scale its ETH holdings and generate yield through staking and on-chain strategies. At its peak, ETHZilla held 93.8K ETH, valued at around $280 million, making it the ninth-largest ETH treasury firm.

However, amid a broader Q4 crypto downturn, the firm has now redirected its efforts toward real-world asset tokenization, a move noted by industry observers as a rare departure from mNAV-driven treasury models.

Ethereum Faces Heavy Outflows

The shift comes as Ethereum continues to struggle. Over the past seven days, ETH treasury firms offloaded 107.7K ETH, while ETH ETFs recorded 116K ETH in outflows, totaling nearly $670 million. Amid sustained selling pressure, ETH has remained below $3,000, highlighting ongoing market headwinds.

Comments are closed.