Featured News Headlines

Ethereum ETF Demand Weakens Amid Uptober Optimism

Ethereum has experienced renewed optimism this October, buoyed by strong ETF inflows in Q3 and broad institutional interest across the crypto market. Despite this positive sentiment, on-chain data reveals several cautionary signs that investors should monitor closely.

Staking Growth Hits a Plateau

Since the Merge, a key driver for Ethereum’s strength has been the steady increase in staked ETH, which supports network security and limits circulating supply. However, CryptoQuant data indicates the Ethereum deposit contract’s valid ETH balance has stalled near 36 million ETH since late July. This stagnation signals growing investor caution toward staking in DeFi, possibly influenced by market uncertainty, yield compression, or a rotation of capital to Bitcoin.

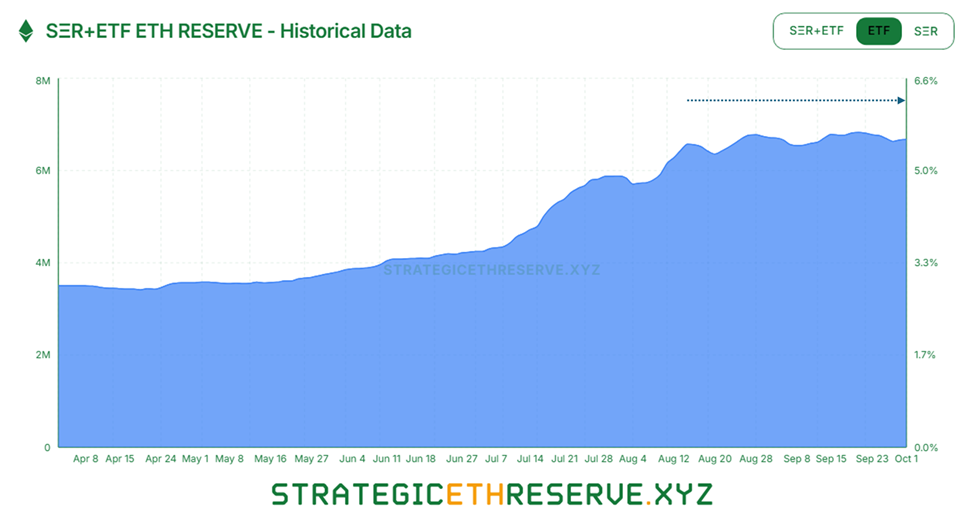

ETF Momentum Shows Signs of Weakness

Ethereum ETFs initially attracted considerable inflows earlier in 2024, reinforcing bullish narratives. Yet, data from StrategicETHReserve.xyz shows that ETH ETF holdings have plateaued since early August, as inflows and outflows balance out. This suggests institutional enthusiasm may be wavering, and a sustained price increase could depend on renewed ETF accumulation.

Stablecoin Liquidity Declines on Exchanges

Liquidity concerns add to the risks. On-chain metrics highlight that average stablecoin netflows to centralized exchanges have turned negative since September 22. Reduced liquidity could limit Ethereum’s price movement during critical market phases.

Balancing Optimism with Vigilance

Ethereum’s fundamental strengths remain intact, and October’s seasonal trends, along with Bitcoin’s ETF-driven inflows, continue to provide support. Still, the combination of stalled staking, plateaued ETF demand, and tightening liquidity signals caution in a market often swayed by sentiment shifts.

As noted in the analysis, understanding these underlying dynamics can help contextualize market movements and prevent unexpected losses, emphasizing the importance of careful observation during this pivotal period.

[…] happens next will not only test Ethereum’s chart structure — it will test the conviction of its […]