Featured News Headlines

Ethereum Network Sees Increased Validator Exits, Market Remains Calm

Ethereum (ETH) validator exit queue is expected to rise in the coming days, yet crypto experts stress that investors have little cause for concern. Ethereum educator Anthony Sassano explained that most of the ETH being unstaked will likely be restaked with new validator keys, rather than sold on the market.

Kiln Finance Initiates Orderly Validator Exits

The surge in the exit queue follows a precautionary measure by Kiln Finance in response to a recent hack of Swiss crypto wealth manager SwissBorg. Hackers exploited a vulnerability in Kiln’s API, draining approximately 193,000 Solana (SOL) tokens from SwissBorg’s Earn program.

To protect client assets across all networks, Kiln announced it has begun the orderly exit of all Ethereum validators. The process, which could take 10 to 42 days depending on the validator, is designed to safeguard the integrity of staked ETH rather than indicate impending selling pressure.

Market Perspective on Staking and Exit Queues

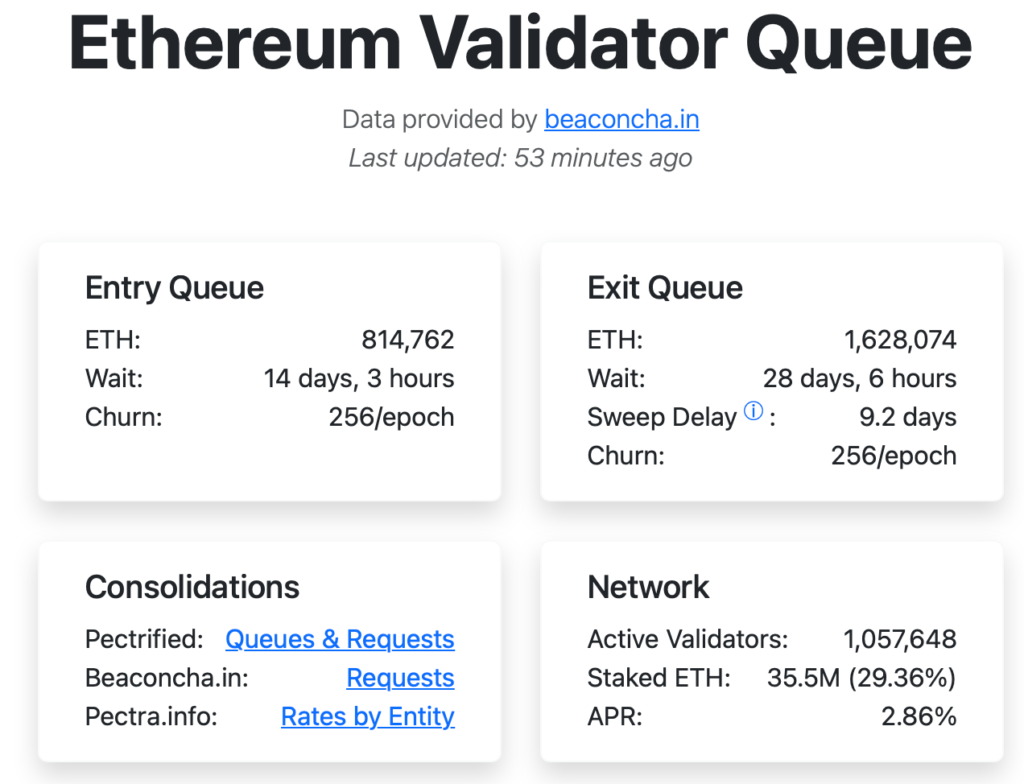

A high volume of unstaked ETH is sometimes perceived as a bearish indicator, as traders may fear it signals upcoming liquidations. According to ValidatorQueue data, the Ethereum exit queue currently stands at 1,628,074 ETH, with approximately 35.5 million ETH staked, representing 29.36% of total supply.

Ethereum has previously experienced periods of surging entry and exit queues. On August 28, Cointelegraph reported the largest validator exodus in crypto history, with over 1 million ETH waiting to be withdrawn. Conversely, on September 3, ETH staking queues surged to their highest levels since 2023 as institutional investors and crypto treasury firms aimed to maximize staking rewards.

Ethereum Holds Strong

Despite the fluctuations in staking activity, Ether is trading at $4,306 at the time of publication, according to CoinMarketCap. Experts like Sassano emphasize that these validator exits are part of network maintenance and risk management, rather than a sign of market panic.

Comments are closed.