Ethereum Surges to $4,719 as Fed Signals Rate Cuts

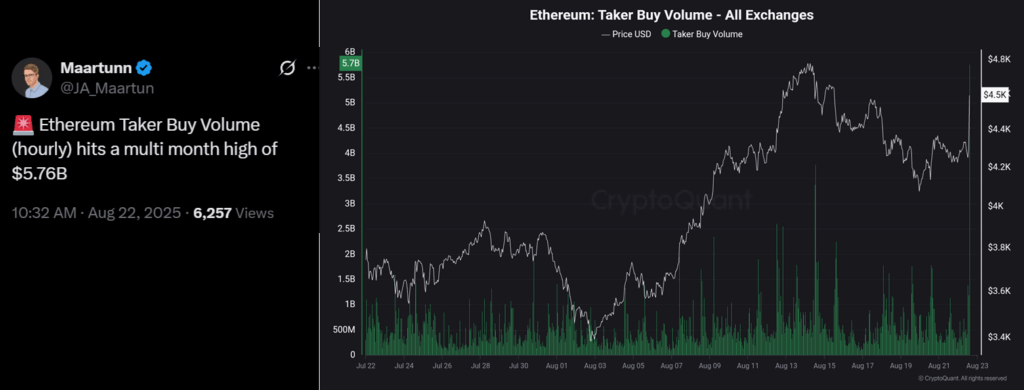

Ethereum surged to $4,719 on Friday, marking its highest level in nearly four years as investors responded enthusiastically to Federal Reserve Chair Jerome Powell’s dovish commentary at the Jackson Hole Economic Symposium. The rally triggered massive liquidations worth $351 million from leveraged bearish positions, highlighting the dramatic shift in market sentiment following Powell’s monetary policy signals.

The cryptocurrency’s impressive performance coincided with broader risk asset strength, as evidenced by the Nasdaq Index’s 1.8% climb. This correlation suggests investors are abandoning defensive positioning in favor of growth-oriented assets, with Ethereum emerging as a primary beneficiary of this risk appetite rotation.

Network Activity Surge Supports Price Momentum

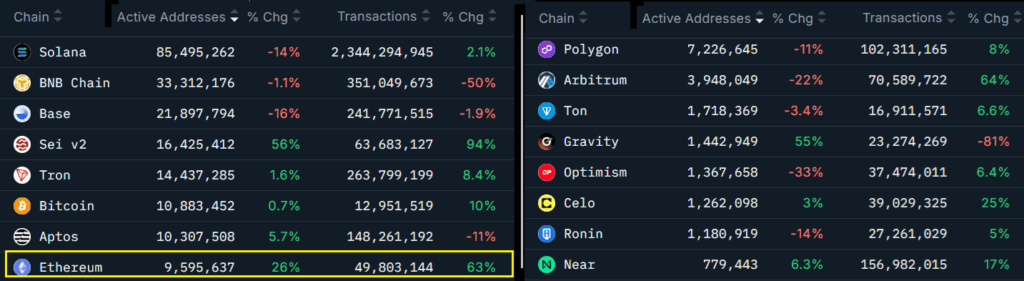

Beyond macroeconomic factors, Ethereum’s fundamental metrics paint an increasingly bullish picture. Network activity has experienced remarkable growth, with transaction volumes jumping 63% over the past month while active addresses increased by 26%. This surge in on-chain engagement demonstrates genuine utility expansion rather than speculative trading alone.

The contrast with competing blockchain networks further underscores Ethereum’s dominance. While Ethereum posted substantial activity increases, Solana managed only a modest 2% transaction growth, accompanied by a concerning 14% decline in active addresses. BNB Chain fared even worse, recording a steep 50% drop in transaction count, according to Nansen data.

Powell’s Jackson Hole remarks have fundamentally altered market expectations regarding monetary policy trajectory. The Fed Chair’s statement that “the baseline outlook and the shifting balance of risks may warrant adjusting our policy stance” provided the catalyst for widespread risk asset rallies.

“The baseline outlook and the shifting balance of risks may warrant adjusting our policy stance,” Powell stated during his closely watched speech.

The CME FedWatch tool reveals bond markets now assign a 45% probability to rates falling to 3.5% or below by March 2026, up from 37% the previous week. This shift toward easier monetary policy reduces borrowing costs and systemic risks, creating favorable conditions for cryptocurrency appreciation.

Comments are closed.