Featured News Headlines

Ethereum Price Prediction- Why Analysts Say $9,000 Is Next

Ethereum Price Prediction– Ethereum (ETH) has surged over 50% in just two weeks, roaring back to life after a slow stretch—and analysts say the rally may only be warming up.

Currently trading near $3,730, ETH still sits 23% below its 2021 all-time high, but on-chain signals, investor flows, and blockchain activity all suggest a major breakout could be forming.

Why ETH Still Looks Undervalued

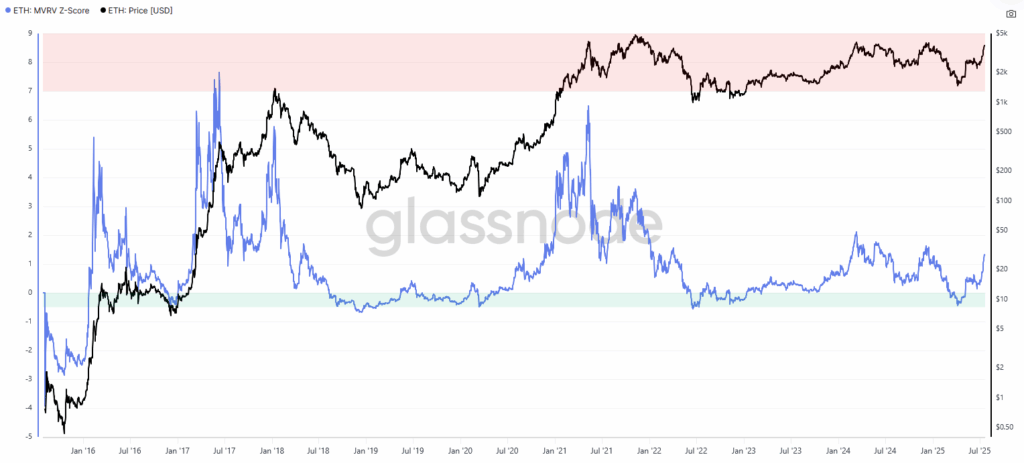

Despite recent gains, Ethereum remains far from the overheated zones seen in previous bull runs. Glassnode’s MVRV Z-score shows ETH is no longer in a bear phase—but still well below euphoric peaks. In simple terms? ETH may be undervalued.

Relative to Bitcoin, Ethereum has lagged badly. While BTC soared 74% in the last year, ETH dropped 28%—a performance gap that has many experts calling ETH “under-owned and in catch-up mode.”

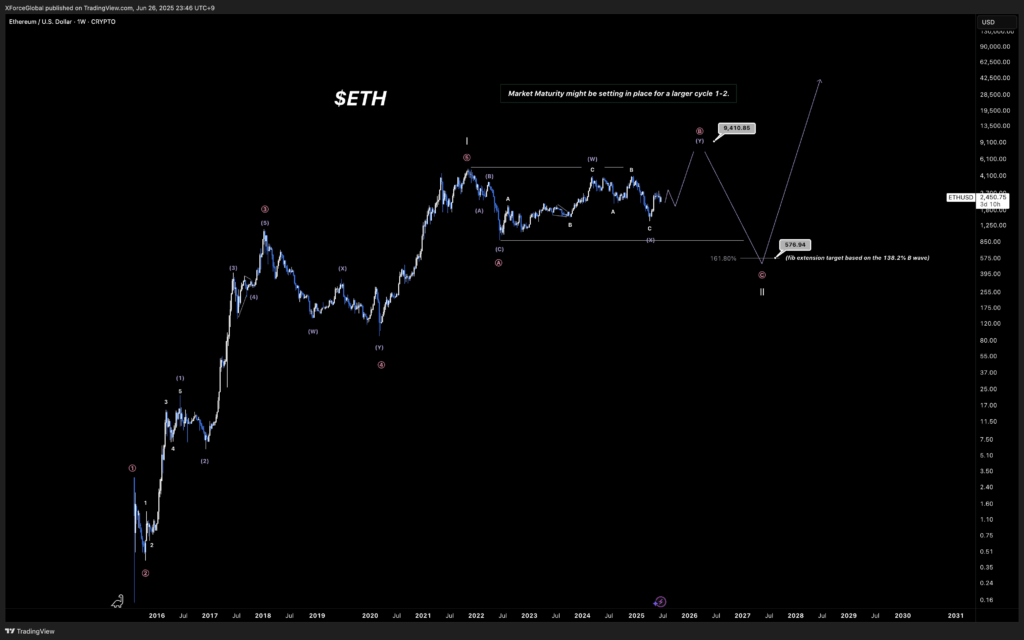

If ETH breaks above the $4,000 resistance, analysts predict rapid acceleration. Some models, including Elliott Wave analysis, see ETH targeting $9,000 by early 2026.

Tight Supply, Growing Demand

On-chain data reveals a supply crunch may be brewing. Over 34 million ETH is staked, while exchange balances have plunged to their lowest since 2016. Meanwhile, first-time buyers are surging, and spot ETH ETFs just saw $4B in inflows in two weeks.

Ethereum Is Running at Full Speed

Despite ultra-low fees, Ethereum is busier than ever. Block space gets consumed immediately after each gas limit upgrade—a clear sign of pent-up demand. Tuesday’s upgrade confirmed the trend: Ethereum isn’t slowing down—it’s scaling up.

Bottom line: ETH isn’t just climbing—it’s gaining momentum. If current trends hold, Ethereum could be the crypto market’s next big move.

Comments are closed.