Featured News Headlines

- 1 Ethereum Price Rally Accelerates as Investors Withdraw Over $1 Billion From Exchanges

- 2 Investors Withdrawing Over $1 Billion Worth of ETH from Exchanges

- 3 NUPL Indicator Signals Possible Short-Term Correction Ahead

- 4 Can Ethereum Break Through $4,000 Resistance?

- 5 The Road Ahead Depends on Market Sentiment and Investor Conviction

Ethereum Price Rally Accelerates as Investors Withdraw Over $1 Billion From Exchanges

Ethereum (ETH) has been on a remarkable upward trajectory, hitting a 7-month high of $3,745 this week. The altcoin surged by 27% over the past seven days, fueled by aggressive investor accumulation and strong market momentum. However, as the price nears a critical psychological barrier at $4,000, experts warn of a possible saturation point that could shape Ethereum’s next move.

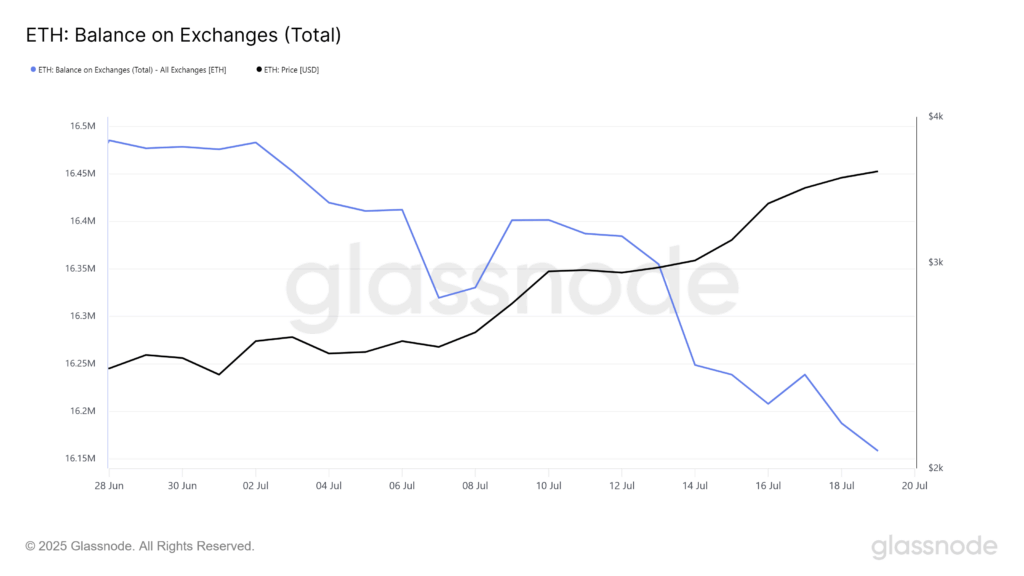

Investors Withdrawing Over $1 Billion Worth of ETH from Exchanges

Since the beginning of July, Ethereum holders have been pulling out substantial amounts of ETH from exchanges — more than 317,000 ETH, currently valued at over $1.18 billion. This large-scale withdrawal highlights growing investor confidence, as market participants prefer to hold their coins rather than sell.

This shrinking supply on exchanges is a strong bullish signal, suggesting that demand is outpacing supply and helping drive Ethereum’s rally upward. The accumulation trend reflects widespread optimism, with many speculating ETH may soon surpass the $4,000 mark, intensifying buying pressure.

NUPL Indicator Signals Possible Short-Term Correction Ahead

Ethereum’s Network Value to Transactions (NUPL) ratio has now approached the “Belief-Denial” zone — a crucial level used by traders to gauge market sentiment and potential reversal points.

Historically, whenever the NUPL enters this zone, Ethereum’s price tends to face a short-term correction as some investors start locking in profits. This “saturation” point often acts as a psychological barrier where optimism meets caution.

If ETH crosses above $4,000, it may trigger significant selling pressure as traders take gains. This pattern has repeated multiple times over the past 16 months, suggesting that a pullback could be on the horizon if bullish momentum continues unchecked.

Can Ethereum Break Through $4,000 Resistance?

At the time of writing, Ethereum trades at $3,745, just 6.8% away from breaking the $4,000 resistance — a level that has previously acted as a strong psychological hurdle during past bull runs.

If accumulation continues, ETH is well-positioned to test this resistance in the near term. A decisive break above $4,000 would likely invalidate bearish forecasts and open the door to new all-time highs, sustaining the current uptrend.

However, caution is warranted. Should the market enter a profit-taking phase, ETH might fail to clear this barrier. A pullback could send prices down to support levels around $3,530. Losing this support could further extend losses to $3,131, potentially erasing recent gains and confirming a short-term trend reversal.

The Road Ahead Depends on Market Sentiment and Investor Conviction

Ethereum’s near-term price action will largely depend on whether buyers maintain their aggressive accumulation or if profit-taking pressures mount. The ongoing battle between bullish momentum and possible market corrections creates a delicate balance.

Market watchers will be closely observing Ethereum’s ability to hold above key support levels while testing the critical $4,000 resistance. Should the bulls prevail, ETH could continue its impressive rally, but a failure to break through could signal consolidation or a brief correction.

Ethereum’s recent 27% surge has brought renewed energy to the altcoin market, with strong investor demand pulling over 317,000 ETH off exchanges. Approaching the psychologically significant $4,000 level, ETH faces potential profit-taking pressures indicated by the NUPL belief-denial zone. Whether Ethereum breaks through this resistance or pulls back depends on investor conviction and overall market dynamics. For now, the altcoin remains one of the most closely watched assets in crypto, with the potential for new highs or a short-term correction just around the corner.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrencies and stocks, particularly in micro-cap companies, are subject to significant volatility and risk. Please conduct thorough research before making any investment decisions.

Comments are closed.