Featured News Headlines

Ethereum Price- Mass Validator Exit Hits Ethereum: Is a Price Crash Coming?

Ethereum Price– Ethereum (ETH) has slipped over 7% from its recent 2025 high, dipping below $3,550, just days after hitting $3,844. Behind the price movement? A massive uptick in validator exits, raising questions across the crypto community.

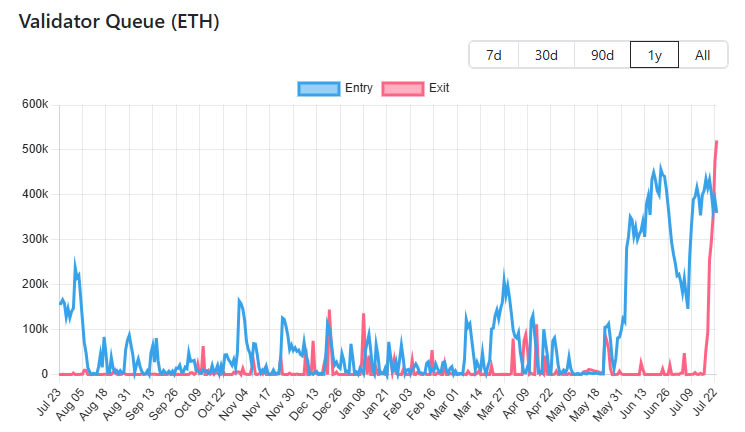

Record Validator Exit Queue Hits $2.34B

Staking protocol Everstake reports that Ethereum’s validator exit queue has surged to its highest level in 18 months. Over 644,000 ETH, worth approximately $2.34 billion, is currently waiting to exit—an 11-day queue. This comes just months after a similar spike in January 2024 triggered a 15% drop in ETH.

Still, Everstake calls it a “shift,” not a panic. Validators may be rotating operators, restaking, or optimizing, rather than abandoning the network.

Not Just Exiting — New Stakers Are Pouring In

While exits are grabbing headlines, 390,000 ETH (around $1.2 billion) is also queued for entry. Net outflow? Just 255,000 ETH.

The entry queue has soared since June, driven by corporate treasuries like SharpLink and Bitmine, who are accumulating ETH aggressively. The total number of active validators now sits just below 1.1 million, with 35.7 million ETH staked, or nearly 30% of total supply.

ETFs, Institutional Inflows, and Market Sentiment

Despite the dip, ETH remains up over 50% this month. U.S. spot Ethereum ETFs have drawn $2.5 billion in just six days.

According to Apollo Capital’s Henrik Andersson, Ethereum has seen $8 billion in DeFi bridge inflows in the past three months—outpacing Bitcoin ETF interest.

Lido’s stETH Briefly Depegs

Adding fuel to the fire, Justin Sun withdrew $600M ETH from Aave, briefly depegging stETH and sparking panic among yield farmers. This may have triggered further exit activity as users raced to convert or sell stETH.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrencies and stocks, particularly in micro-cap companies, are subject to significant volatility and risk. Please conduct thorough research before making any investment decisions.