Featured News Headlines

ETH ETFs See Outflows as Big Holders Accumulate

Ethereum’s market behavior has become increasingly complex. “While much of the market is pulling back and cutting risk, there’s more that you’re not seeing. Caution is the obvious sign, but long-term ETH holders are staying put,” analysts note. This split in investor behavior, though often overlooked, can signal important trends in the long run.

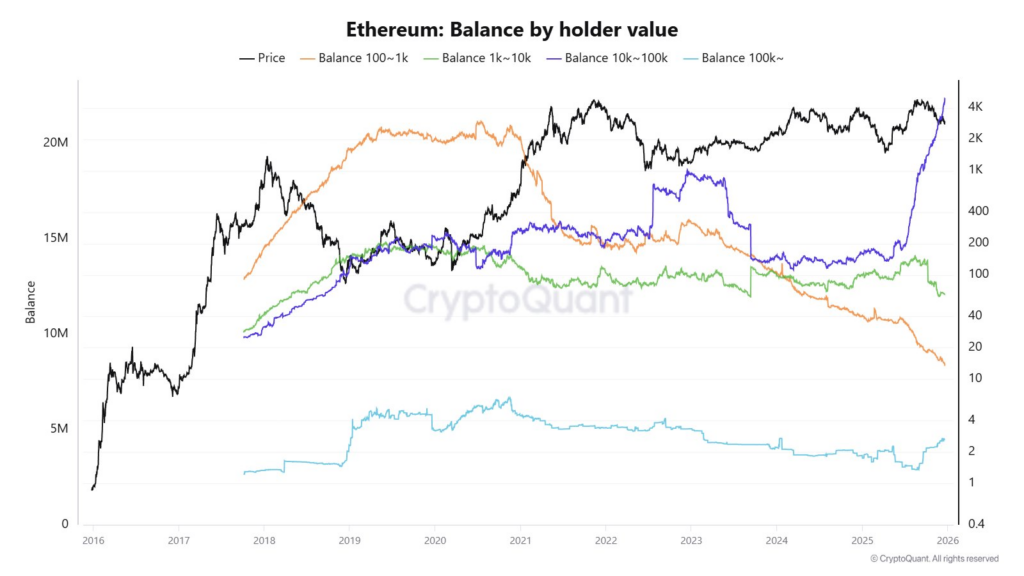

Whale Activity vs. Smaller Investors

Ownership trends in Ethereum are beginning to diverge. Smaller whales have been reducing their holdings in recent months, reflecting heightened uncertainty. Conversely, the largest whales—those holding more than 10,000 ETH—have been steadily increasing their balances since July. “The fact that they’re buying in good pace makes their confidence in ETH’s long-term trajectory evident,” experts say. Historically, these major holders rarely chase rallies, which makes their current accumulation particularly noteworthy.

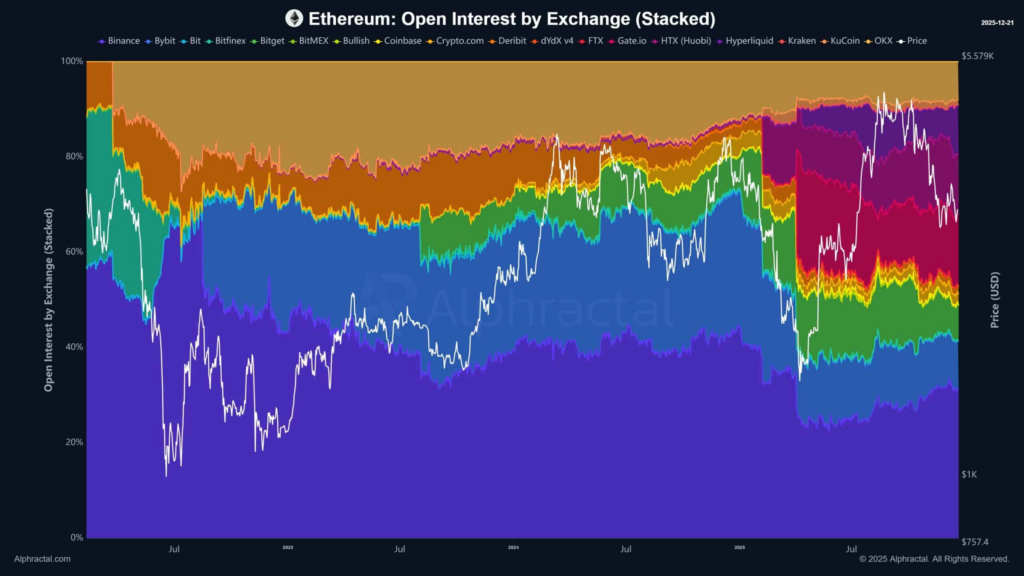

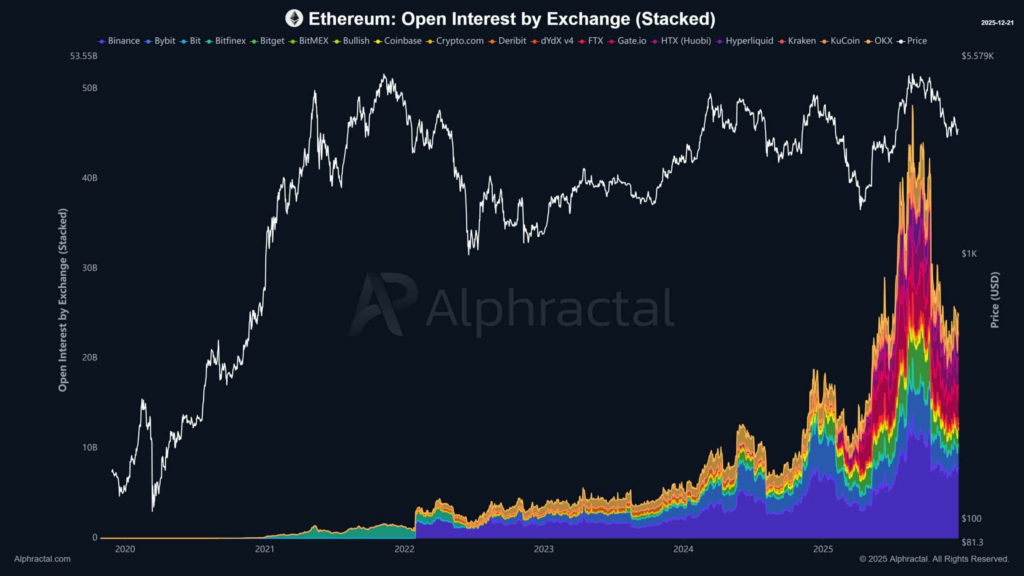

Decrease in Leverage

Meanwhile, leveraged traders are stepping back. Ethereum’s Open Interest (OI) has fallen nearly 50% since August, indicating that positions across major exchanges are being closed. Binance remains the most active platform, albeit at lower levels than before. Analysts suggest that reduced leverage typically results in smaller short-term price swings, often preceding periods of consolidation or significant market moves.

Institutional Shifts

Ethereum ETFs are also experiencing changes. Last week alone, outflows totaled approximately $644 million, contributing to the prevailing risk-off sentiment. “Institutions, much like leveraged traders, seem to be waiting for a sign,” reports indicate. However, these outflows do not necessarily indicate a market collapse. Instead, they reflect a temporary pause, allowing for risk management and potential rebalancing.

Taken together, the contrasting behavior of whales and leveraged traders suggests that the market is clearing excess risk. While smaller investors and institutions reduce exposure, large whales continue accumulating, pointing toward a period of consolidation or preparation for future developments in Ethereum’s trajectory.

Comments are closed.