Featured News Headlines

Ethereum News- Institutional Buyers and Staking Records

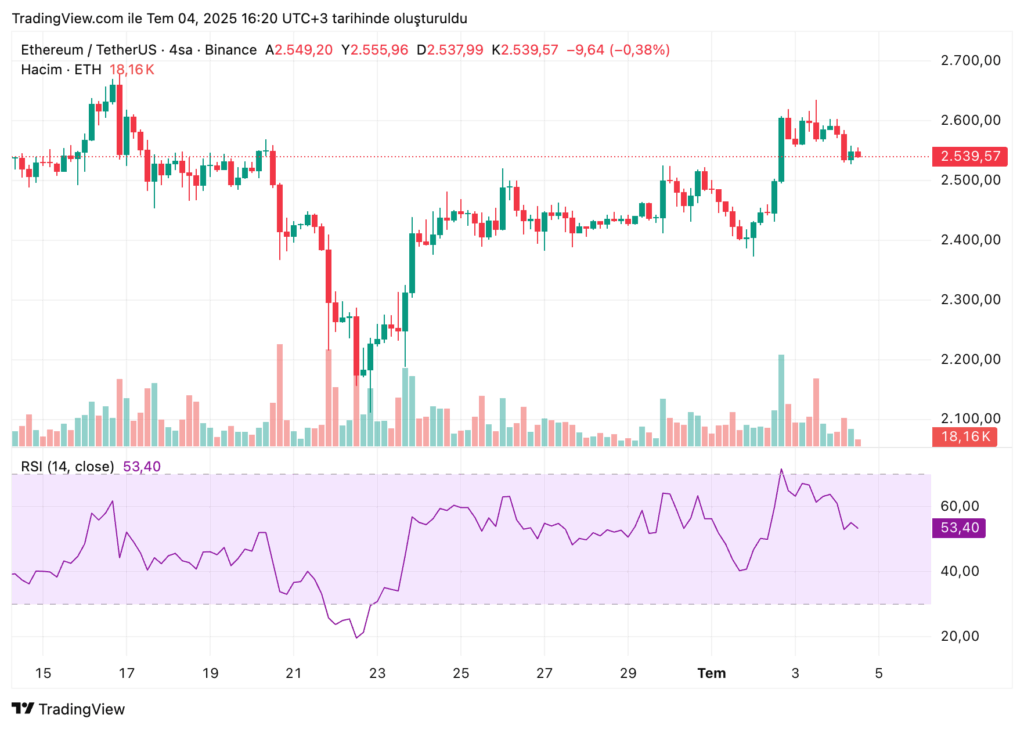

Ethereum News– Although Ethereum’s price remained relatively flat throughout June, on-chain data tells a different story. Behind the scenes, Ethereum’s network activity and metrics quietly surged to historic levels. This hidden momentum began to surface in early July, coinciding with broader market gains driven by news of the US-Vietnam trade deal and increased money supply measures.

On July 3, Ethereum (ETH) saw a sharp 6% increase within 24 hours, climbing above $2,600. This movement suggests the market is beginning to recognize the steady buildup of strength within Ethereum’s ecosystem.

Record-Breaking Staking and Accumulation Activity

Soaring Accumulation Addresses

Data from CryptoQuant’s ETH Cohort Study reveals a significant rise in accumulation addresses—wallets holding Ethereum (ETH) without major outflows and excluding centralized exchanges. By June 30, these wallets held a record 22.7465 million ETH, marking an impressive 36% increase from 16.7281 million at the start of June.

These accumulation addresses made their highest single-month purchases in June, adding over 6 million ETH. The realized price for these holdings was approximately $2,114.70 as of July 1, while ETH traded at $2,565 on July 2, indicating unrealized gains of over 21%. This accumulation trend signals strong investor confidence, particularly from long-term holders.

Liquid Staking Hits New Milestones

Liquid staking on Ethereum (ETH) also surged, growing from 34.5461 million ETH on June 1 to 35.5265 million ETH by the month’s end — a nearly 3% increase representing the largest monthly growth in Ethereum staking history. By July 1, liquid staking further hit a new all-time high at 35.5644 million ETH.

This growth is largely driven by institutional investors, exchange-traded funds (ETFs), and large holders who are choosing to lock up ETH for yield generation while awaiting price appreciation. Protocols such as Lido and Binance ETH Staking have been key beneficiaries, offering scalable solutions that attract institutional capital.

Despite Ethereum’s price lagging bullish expectations in June, these accumulation and staking trends highlight robust institutional faith in ETH’s long-term potential. The growing number of locked tokens and increased accumulation activity hint that the market is positioning for a sustained upward trajectory.

The Rise of Ethereum Treasury Strategies

Corporations Embrace ETH for Treasury Management

Ethereum is increasingly capturing the interest of corporate treasuries. Following reports from CryptoPotato, Ethereum may be entering a “MicroStrategy era,” with companies stacking ETH as part of treasury diversification strategies that seek both yield and asset growth.

Leading this charge are firms like BitMine and SharpLink. SharpLink, in particular, is planning a $250 million ETH allocation and pioneering an “ETH per share” model that aligns investor exposure with Ethereum holdings.

Market commentators such as Tom Lee suggest Ethereum will benefit further as stablecoin adoption grows and decentralized finance (DeFi) continues to migrate on-chain. Meanwhile, Joe Lubin’s SharpLink recently raised $425 million to stack and stake ETH, signaling strong industry conviction.

Institutional Momentum Sets Stage for Broader Adoption

Industry analysts widely consider these recent developments to mark the beginning of a significant wave of Ethereum treasury companies emerging across the corporate landscape. As more firms become aware of Ethereum’s unique dual utility—not only serving as a highly liquid reserve asset but also generating consistent yield through staking and other mechanisms—there is growing anticipation that institutional treasury interest in ETH will continue to expand substantially in the coming months and years.

This growing trend highlights Ethereum’s transformation from being perceived merely as a speculative cryptocurrency to becoming a strategic, multifaceted asset that plays an increasingly important role within corporate balance sheets. Companies are starting to recognize the advantages of holding ETH not only for potential capital appreciation but also as a productive asset that can generate passive income and provide diversification benefits. This shift reflects a broader maturation within the cryptocurrency ecosystem, where Ethereum’s infrastructure, network effects, and evolving financial tools position it as a preferred asset for long-term institutional treasury management.

As a result, the expanding adoption of Ethereum by corporate treasuries signals a new chapter in the mainstream acceptance and integration of digital assets into traditional financial strategies. Industry experts believe this momentum will drive further innovation and institutional involvement, fostering greater stability and liquidity within the Ethereum ecosystem while solidifying its status as a cornerstone asset in the modern financial world.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrencies and stocks, particularly in micro-cap companies, are subject to significant volatility and risk. Please conduct thorough research before making any investment decisions.