Featured News Headlines

Ethereum Outpaces Bitcoin in ETFs, Derivatives, and Market Flows

Ethereum (ETH) continues to gain market strength as Bitcoin (BTC) retreats from its recent highs. While BTC briefly touched $124,000, it has struggled to maintain momentum—closing the month in red. Meanwhile, ETH is up 16%monthly and testing key resistance levels.

Ethereum Dominance Rising Across the Board

Since May, Ethereum’s market dominance (ETH.D) has climbed from 8% to 14%, while Bitcoin’s (BTC.D) slipped from 60% to 59%. This trend is reinforced by both on-chain data and capital flows into Ethereum-based products.

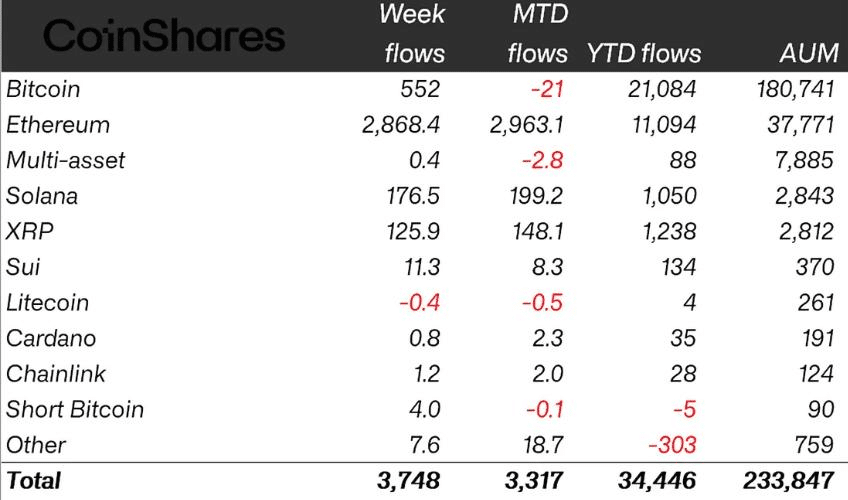

ETH-focused ETFs are playing a major role. Last week, Ether ETFs accounted for $2.9 billion of the total $3.75 billionin crypto ETP inflows. In comparison, BTC-related funds only attracted $552 million, despite Bitcoin hitting an all-time high.

Spot and Derivatives Flows Favor Ethereum

Spot ETH ETFs have reached $17 billion in weekly volume, becoming a central piece of the total $40 billion combined BTC and ETH ETF activity. This shift reflects a broader capital rotation into Ethereum.

Beyond spot markets, ETH is also leading in derivatives. In the first half of the month, Ethereum captured $10 billion in leveraged positions, with Open Interest reaching a record $65 billion. BTC saw only $1 billion in comparison.

Is the ETH/BTC Trend Reversing?

ETH/BTC has posted two consecutive green months for the first time since 2022—up more than 70% since May. The data suggests Ethereum is now the preferred asset in a risk-on market.

A recent 4% pullback looks more like a short-term correction than a reversal, possibly setting the stage for further upside heading into 2025.

Comments are closed.