Ethereum Outpaces Bitcoin: Is ETH the Smarter Bet in 2025?

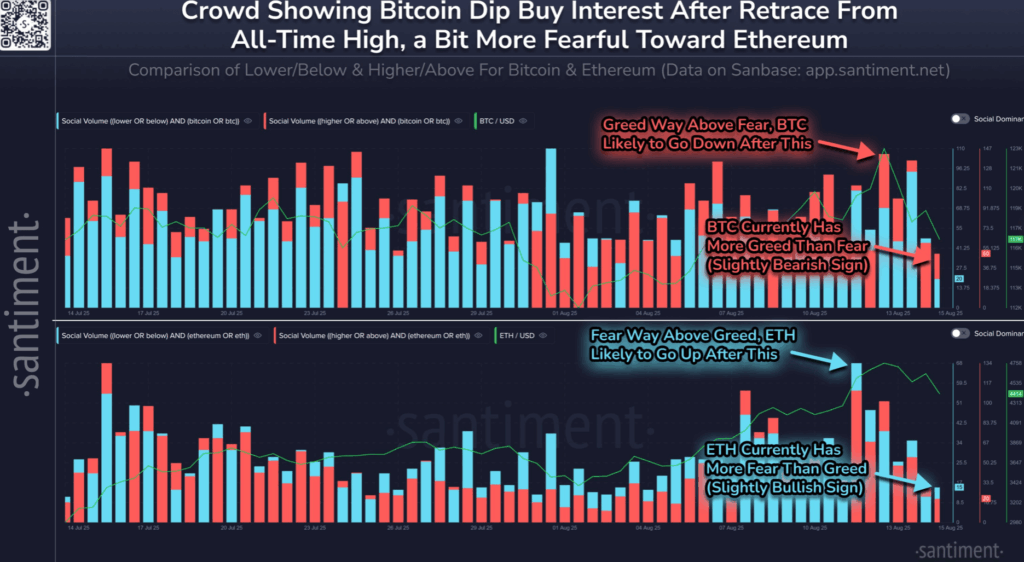

Ethereum (ETH) is quietly outperforming Bitcoin (BTC) in the short term, with recent sentiment data pointing to a more sustainable trend in its favor.

According to on-chain analytics platform Santiment, social media interest around Bitcoin has become “overheated,” while Ethereum’s online discussions remain relatively calm — despite ETH posting stronger gains recently. Over the past 30 days, the ETH/BTC ratio has risen by nearly 33%, showing Ethereum’s relative strength against Bitcoin, based on TradingView data.

Bitcoin Sentiment Peaks as Ethereum Stays Under the Radar

Santiment noted that bullish sentiment for Bitcoin surged alongside its recent all-time high (ATH) of $124,128. The platform flagged signs of “greed” in social posts, which often indicate market tops. In contrast, Ethereum has maintained a more measured tone on social media — even as it came within 2% of its 2021 ATH of $4,878.

At the time of writing, ETH trades around $4,448, down slightly from its recent peak, while Bitcoin has retreated 5% to about $117,939.

What’s Next for ETH?

Traders are now speculating about Ethereum’s upside potential. If Bitcoin reaches $150,000 — a level some analysts view as possible in this bull cycle — ETH could rise to $8,500, according to historical patterns that show Ethereum typically reaches around 35% of Bitcoin’s market cap.

Supporting this view, Standard Chartered recently upgraded its ETH price target for 2025 from $4,000 to $7,500.

While both assets have strong fundamentals, current sentiment and price action suggest Ethereum may offer a more stable path in the near term — especially if hype around Bitcoin continues to cool.

Comments are closed.