Ethereum Records Transaction Surge in 2025

Ethereum’s mainnet processed 2.2 million transactions in a single day this week, marking a new all-time high for the layer-1 blockchain, while average transaction fees dropped to just $0.17.

According to data from “block explorer Etherscan,” the record was set on Tuesday, highlighting a sharp contrast between rising network activity and declining user costs. Historically, Ethereum transaction fees have been a major pain point for users. In May 2022, peak congestion pushed average fees above $200 per transaction, significantly limiting accessibility.

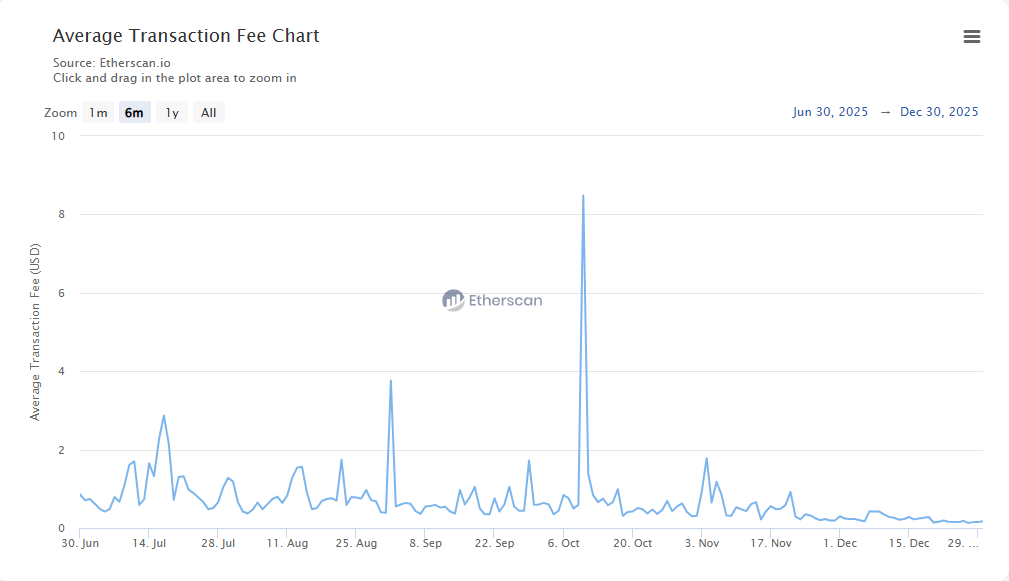

Despite sustained growth in network usage, fees have steadily declined following a series of protocol upgrades. Since October 10, when fees briefly spiked to around $8.48 during a major market-wide liquidation event, transaction costs have continued trending downward.

High fees have traditionally driven users toward lower-cost alternatives such as layer-2 networks. However, the surge in mainnet transactions suggests renewed activity directly on Ethereum’s base layer, pointing to broader adoption and improved efficiency.

Developer Activity and Network Confidence Increase

Developer engagement on Ethereum is also accelerating. Data from “Token Terminal” shows that the number of smart contracts created and published on Ethereum reached 8.7 million in the fourth quarter, the highest level recorded to date. This trend reinforces Ethereum’s growing role as a preferred settlement layer for decentralized applications.

Network confidence is further reflected in staking behavior. Earlier this week, Ethereum’s staking queue flipped in favor of new deposits for the first time in six months, with nearly twice as much ETH queued for staking as for withdrawal. Staking is commonly interpreted as a signal of long-term network participation, while unstaking is often associated with liquidity needs.

2025 Upgrades Drive Efficiency Gains

Two major protocol upgrades in 2025 appear to have played a central role in these developments. The Pectra upgrade, implemented in May, focused on validator improvements, staking flexibility, and future scalability preparation.

Later, Fusaka increased Ethereum’s gas limit from 45 million to 60 million, enhancing throughput, data handling, and overall network efficiency. In February, more than 50% of validators signaled support for raising the gas limit, enabling higher transaction capacity per block.

Comments are closed.