Featured News Headlines

Whales Accumulate While Analysts Sound the Alarm

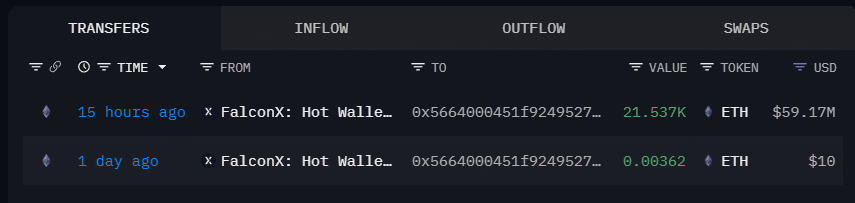

A blockchain address linked to Bitmine has accumulated millions of dollars worth of Ethereum (ETH), even as analysts warn that the asset now sits on its final major support before what some describe as a potential “air pocket” in price.

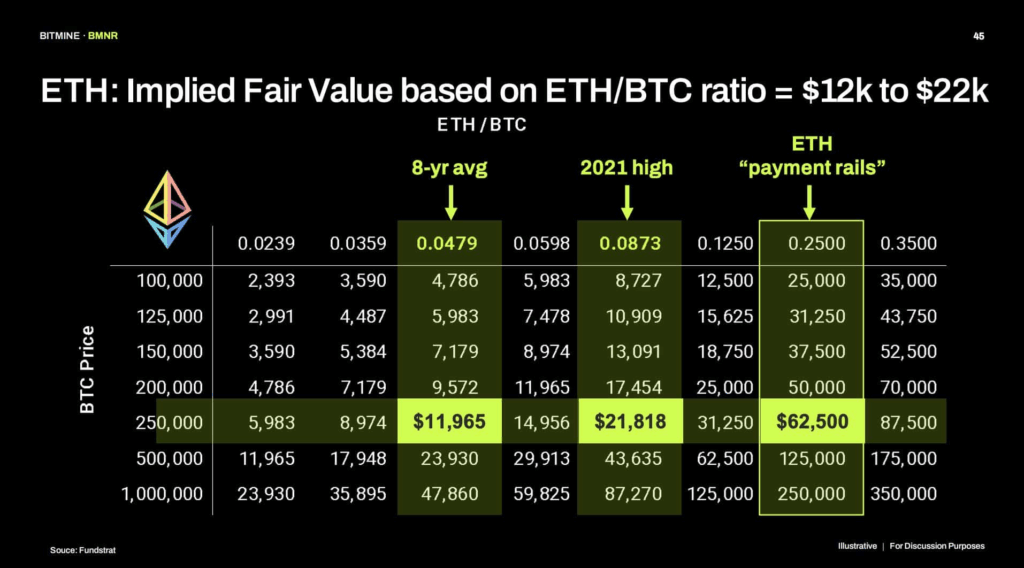

Adding to the debate, Fundstrat’s Tom Lee has introduced a valuation range so broad that it has captivated the market. His latest model now estimates ETH could be worth anywhere between $12,000 and $62,500, a spread wide enough to make even long-time believers pause.

What happens next will not only test Ethereum’s chart structure — it will test the conviction of its supporters.

ETF Outflows Surge as Spot Buyers Step In

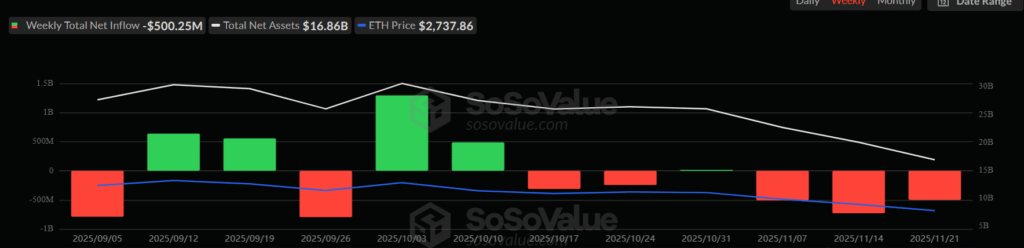

The latest weekly data from SoSoValue shows that Ethereum ETFs have now faced approximately $500 million in net outflows, marking one of the largest pullbacks in recent months. Total net assets have slipped from recent highs, suggesting ETF participants are reducing exposure amid macro uncertainty and price weakness.

But the contrast is striking: while ETF outflows accelerate, large market players have been buying millions in spot ETH, showing no signs of hesitation. This divergence highlights a rift between regulated ETF investors and whales acting directly on-chain.

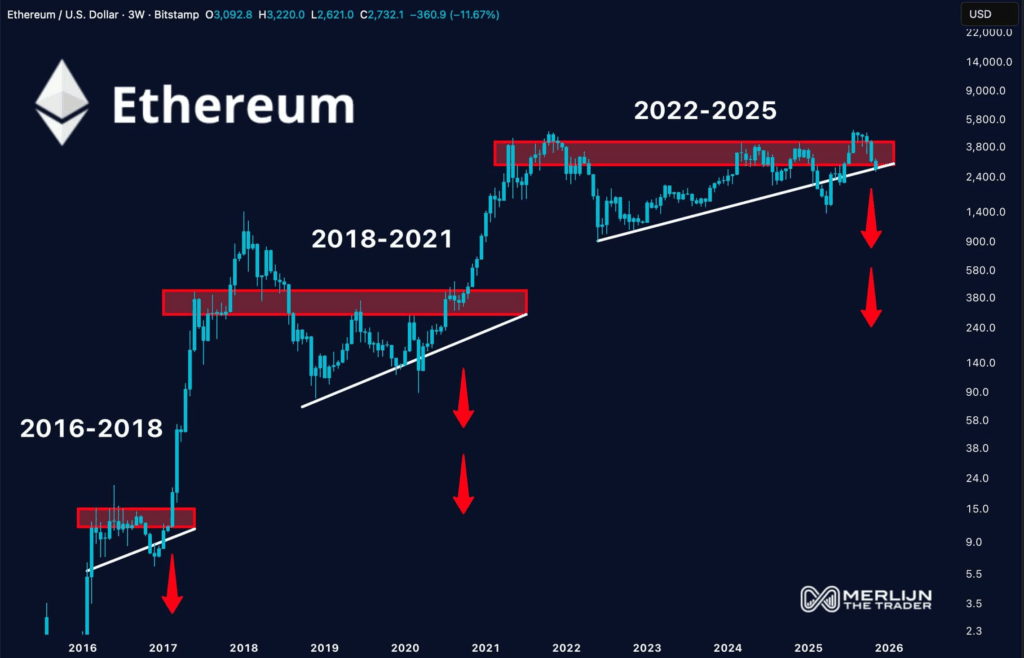

Ethereum’s Last Structural Support

Ethereum now sits directly on its final major support — the same structural base that anchored the entire 2022–2025 trading range. Analysts warn that a break beneath this zone could open the door to significantly lower levels, similar to what occurred during both the 2016–2018 and 2018–2021 cycles.

The concern is not only the price level but also the candle behavior. Sellers are showing renewed strength, and rising volume confirms the pressure. Price is weakening exactly where the chart suggests it cannot afford to.

Yet market sentiment tells a different story. Whales are accumulating. Social sentiment is tilting bullish. ETF investors are withdrawing while spot buyers are stepping in. This contradictory mix is what analysts find unsettling — optimism is rising even as the structural chart trend deteriorates.

If ETH loses this support, the next meaningful level is not “slightly below.” It is much lower, with little technical structure beneath the current zone. As one analyst described it, “This is the cliff.”

The Path Forward

What happens next hinges entirely on whether this support holds. If it does, recent whale buying may be interpreted as strategic accumulation, Bitmine’s activity may be seen as a signal, and long-term valuation models could gain renewed credibility.

But if the current zone breaks, the combination of ETF outflows, weakening structure, and the large gap beneath price could become relevant very quickly. With limited support below, the market could face conditions unlike anything seen in recent months.

The next move will determine whether this becomes a turning point — or the beginning of a deeper decline.

Comments are closed.