Featured News Headlines

ETH Price Update: Market Divided as Bulls Seek Confirmation

Ethereum [ETH] has edged closer to the $4,000 mark, gaining 2.2% over the past 24 hours to trade around $3,940. While the move signals renewed strength, market sentiment remains divided, with institutional and smart traders taking opposing positions on the asset’s next move.

Institutional Investors Pull Back

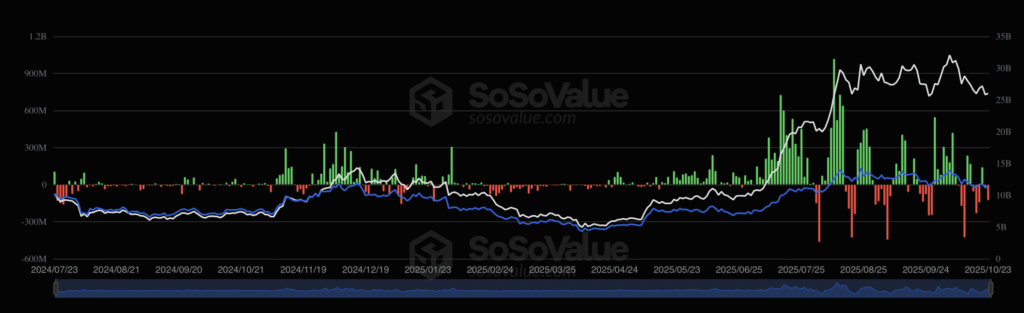

Institutional activity in Ethereum has shown clear signs of caution this week. According to on-chain data, U.S. spot ETH ETFs saw a significant $145 million outflow on Monday, reflecting renewed bearish pressure.

That trend briefly reversed on Tuesday, when $141 million flowed back into the market, suggesting a momentary shift toward neutrality. However, the balance quickly faded as outflows surged again midweek.

On October 23, institutional investors pulled a massive $127.51 million, a 6.7x increase compared to the previous day. Such heavy withdrawals often indicate reduced confidence and a bearish market tone among large investors.

Smart Money Counters the Trend

While institutions appear cautious, smart traders are positioning for a potential breakout.

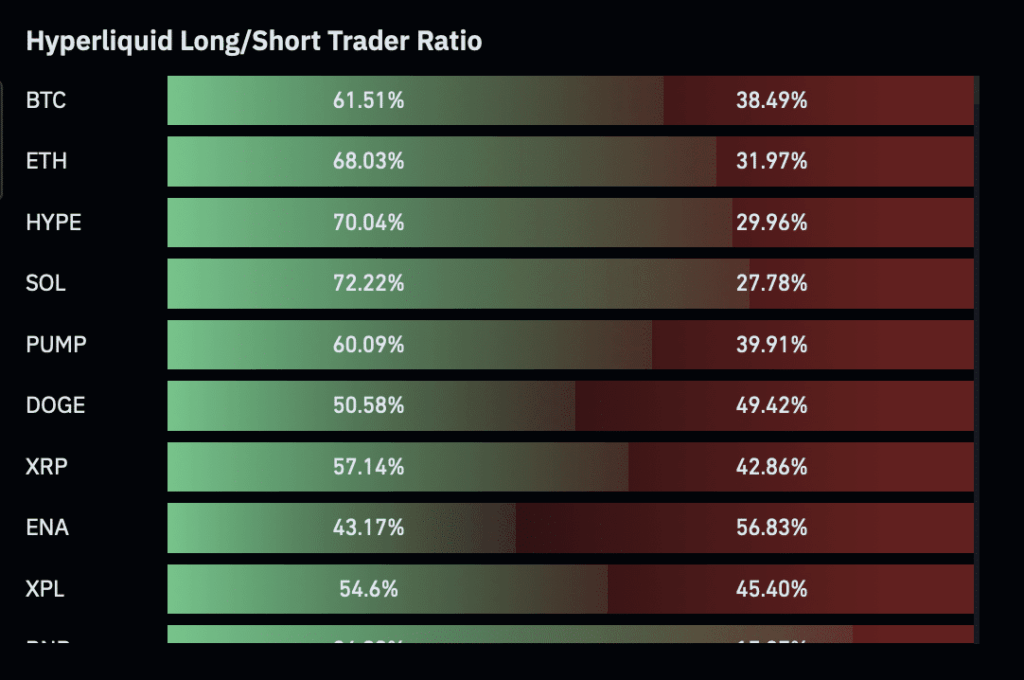

According to Hyperliquid Whale Tracker, 67% of open ETH contracts are now long positions, showing strong conviction for an upside move.

Reports also highlight one high-performing trader—“with a 100% win rate”—who expanded their long exposure on ETH, betting on continued price strength. Overall, long positions reached $132.24 million in the past day, signaling growing optimism among active market participants.

Technical Outlook: Bulls Await Confirmation

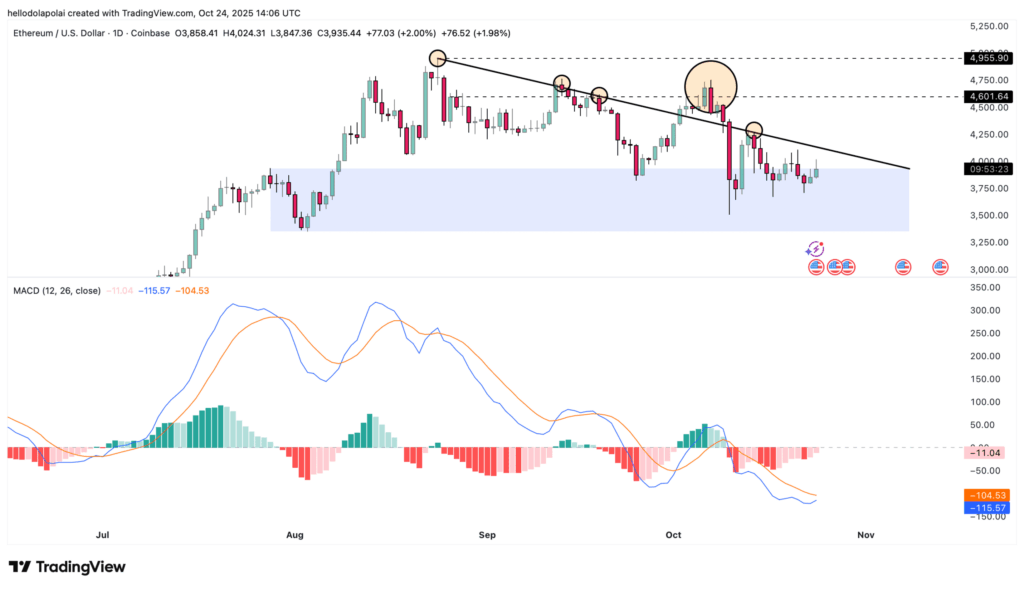

Ethereum’s chart shows a descending resistance line that has historically triggered multiple pullbacks. ETH is now testing this level again.

Meanwhile, the MACD indicator is trending upward, with the blue MACD line nearing a crossover above the orange signal line.

If a breakout coincides with this crossover, it could confirm bullish momentum; otherwise, ETH risks another short-term retracement.

[…] Ethereum (ETH) is once again interacting with a trendline that has played a pivotal role in its price action for nearly ten years. Historically, this level has acted as a key turning point in multiple market cycles. […]

[…] Ether (ETH) has risen 15% from last week’s $2,623 low, yet market sentiment shows little conviction behind the move. Despite the price recovery, derivatives data suggests that traders remain hesitant to take on bullish leverage. Combined with declining Ethereum network fees and shrinking on-chain deposits, the path toward reclaiming the $4,000 level remains uncertain. […]

[…] Ethereum (ETH) has rebounded nearly 10% from this week’s low of $2,600, and as of today, it shows a modest 1% gain. While this recovery may appear positive at first glance, market signals suggest that the rally might not sustain. […]