Featured News Headlines

Ethereum (ETH) Rally Incoming? Fundstrat Eyes $5,500 Target After Minor Correction

Ethereum (ETH) may be headed for a short-term pullback to $4,200, but a bigger rally could be on the horizon, according to analysts at Fundstrat Global Advisors. Managing Director Mark Newton believes the recent weakness in crypto markets is temporary and expects ETH to bottom out within days before pushing higher toward $5,500.

Minor Pullback Seen as Buying Opportunity

Newton pointed to a “minor three-wave pullback” in ETH’s price action, a move he said was expected to wrap up by the weekend. “I do not make much of crypto weakness in recent days,” Newton said, noting that a dip to $4,200 would serve as an “optimal area of support.”

Ether reached a weekly high of $4,750 on Tuesday before retreating below $4,300 on Thursday. By early Friday, ETH had recovered to near $4,400, but remains trapped in a range-bound channel that has persisted since breaking above $4,000 in early August.

Institutions Are Accumulating

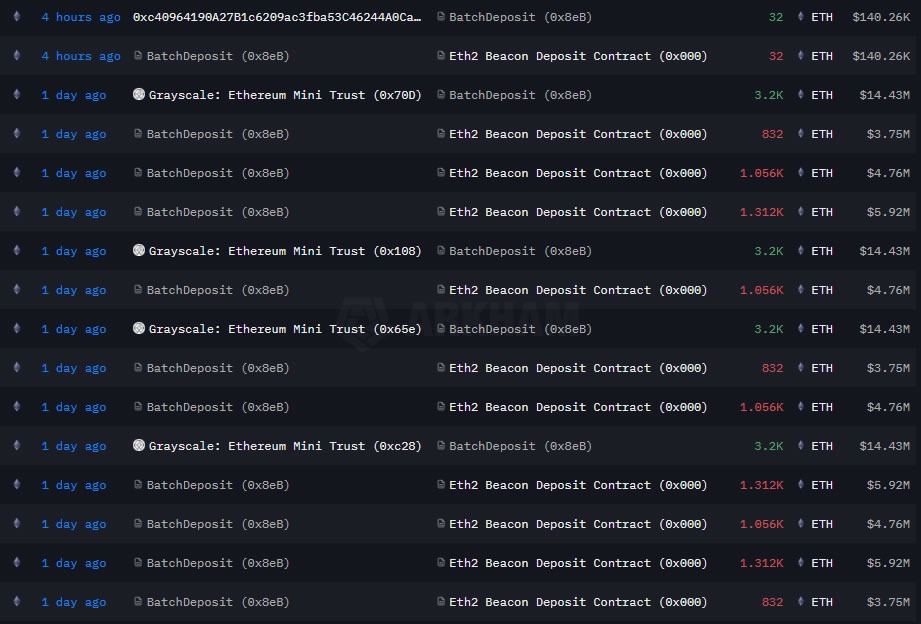

Despite short-term volatility, institutional confidence remains strong. Blockchain data from Arkham Intelligence shows that Grayscale has been actively stacking and staking ETH, depositing hundreds of millions onto the Beacon Chain in recent days.

SharpLink Gaming, the second-largest Ethereum treasury globally, now holds 838,730 ETH—valued at approximately $3.67 billion. Co-CEO Joseph Chalom called Ethereum the “trust layer for the next financial system” and “the most important structural opportunity of this decade.”

Meanwhile, Tom Lee’s BitMine added another 23,823 ETH, worth around $103 million, to its treasury on Thursday.

Market Outlook: Choppy but Constructive

Crypto analyst Benjamin Cowen said investors should expect continued choppy price action until Ethereum’s “bull market support band” catches up—something that could take several more weeks.

According to CoinW’s Chief Strategy Officer Nassar Achkar, ETH’s upside potential is increasing amid a weakening U.S. economy and possible Federal Reserve policy easing. He noted that near-term dips are strategic accumulation opportunities ahead of a projected rally.

Comments are closed.