Ethereum Accumulation Alert: BitMine Boosts Ether Holdings

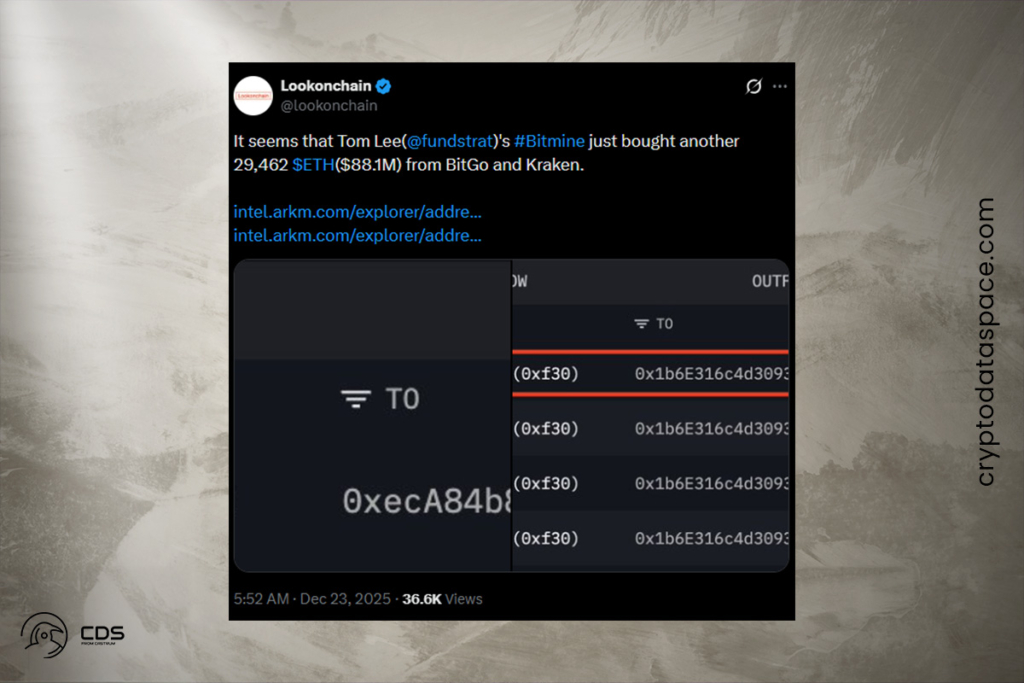

According to reports, BitMine, the Ethereum treasury company run by Tom Lee, increased its holdings of ETH by $88 million on Monday. On-chain researcher Lookonchain revealed that BitMine purchased 29,462 ETH from BitGo and Kraken, citing data from Arkham. However, BitMine has not formally validated these transactions.

BitMine Expands Ethereum Holdings as ETH Treasury Tops $12 Billion

The NYSE-listed company BitMine formally revealed on Monday that it purchased 98,852 ETH last week. At an average price of $2,991 per Ether, it now has 4,066,062 ETH. At current prices, this corresponds to a treasury value of about $12 billion. The top corporate Ethereum holder in the world has doubled down on its aggressive purchase strategy and has been stacking ETH throughout the year to solidify its position in the market. The company’s goal of obtaining 5% of the circulating supply and its strong belief that Ethereum will transform international finance are the foundation of its ongoing buying binge.

We are making rapid progress towards the ‘alchemy of 5%’ and we are already seeing the synergies borne from our substantial ETH holdings. We are a key entity bridging Wall Street’s move onto the blockchain via tokenization. And we have been heavily engaged with the key entities driving cutting edge development in the DeFi community.

Lee

Strategic ETH Buying Shows BitMine’s Belief in Ethereum’s Future

Rather than a short-term trading strategy, BitMine’s ETH accumulation is consistent and scalable, indicating a long-term conviction. The company demonstrates its faith in Ethereum’s function as the foundational technology for tokenization, decentralized finance, and institutional adoption by gradually raising its ETH exposure during times of market turbulence. Additionally, this strategy lowers the liquid supply on exchanges. If demand is strong, it might eventually improve price stability.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.