Ether Smashes Bitcoin in ETF Race: Are Investors Ditch BTC?

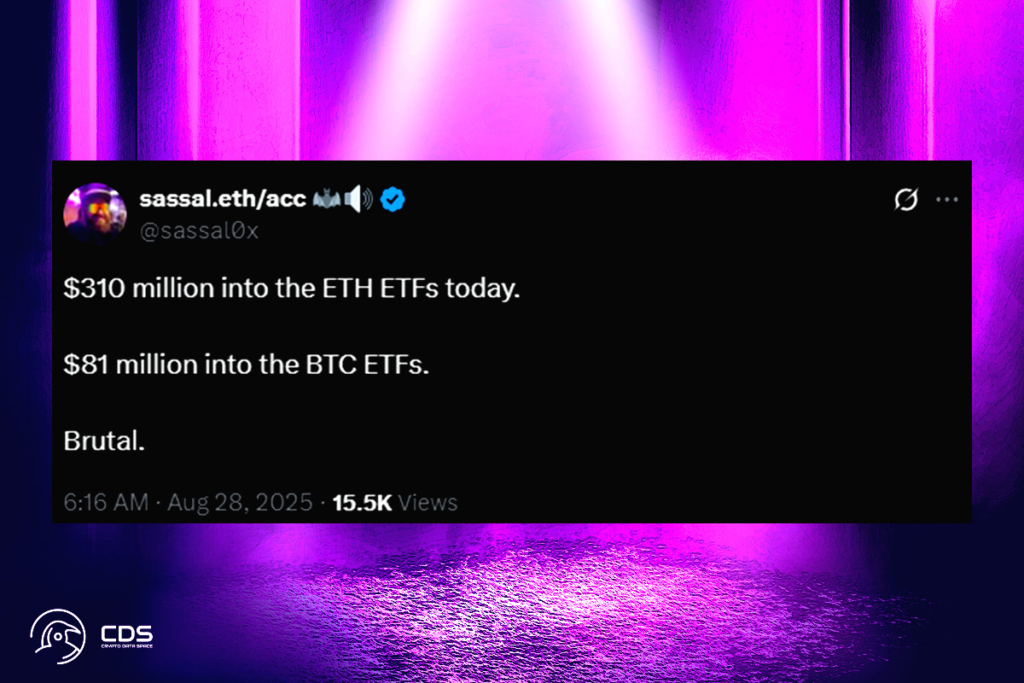

Over the last five trading days, spot Ether exchange-traded funds have attracted inflows that are more than ten times greater than those of their spot Bitcoin counterparts, and they are selling like hotcakes in the US. Since August 21, spot Ether ETFs have experienced a huge inflow of $1.83 billion, according to CoinGlass. Bitcoin funds, on the other hand, have only received $171 million, or a tenth of that total. The trend was maintained on Wednesday, the most recent trading day, when inflows into nine Ether funds totaled $310.3 million, compared to just $81.1 million into the eleven spot Bitcoin funds.

Spot Ether ETFs Grow Rapidly as Investors Shift From Bitcoin

Nate Geraci, president of NovaDius Wealth Management, also noted that since the beginning of July, inflows into spot Ether ETFs have now approached $10 billion. After 13 months of trading, spot Ether ETFs have received $13.6 billion in total inflows, most of which have occurred in the previous two months. On the other hand, with a total inflow of $54 billion over the course of 20 months, spot Bitcoin ETFs have been in existence for a longer period of time.

Ether’s Dominance in Stablecoins Could Reshape Wall Street Investments

Since the GENIUS Act stablecoin law was passed in July, it appears that the momentum has been moving in favor of Ethereum. As of right now, the network dominates the stablecoin and tokenized real-world asset markets.

It’s very much what I call the Wall Street token,

VanEck CEO, Jan van Eck

According to industry analysts, Ethereum is the blockchain of choice for institutional adoption because of its supremacy in stablecoins and tokenized assets. Ethereum has a distinct advantage over rival networks due to its strong infrastructure and extensive developer support, as banks and other financial institutions look more and more for blockchain solutions to manage stablecoin transactions. As VanEck pointed out, Ethereum is quickly emerging as the “Wall Street token,” connecting DeFi and traditional finance while fostering previously unheard-of levels of innovation and liquidity in the digital asset markets.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.