Ether Outflows Hit Record Highs: Bulls Eye $5,000 Rally

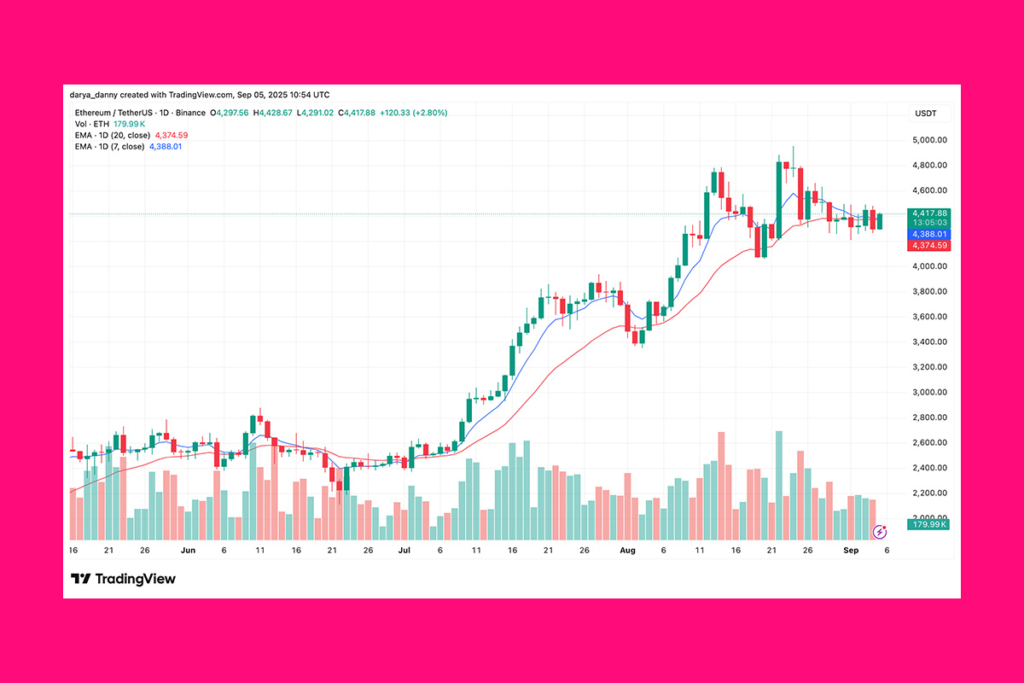

The price of ETH is set to rise further as on-chain data indicates that investors are taking record amounts out of exchanges. Despite a brief Sunday peak of $4,957, the price has recently experienced another rejection near the $4,800 mark. However, ETH is currently stabilizing above the $4,200 horizontal support. It also maintains the uptrending market structure by staying well above the prior higher low of $4,060.

ETH Nears Critical Breakout

Bulls are maintaining the price movement above the 20-day EMA from a technical standpoint. The short-term upward momentum is still present because the 7-day EMA is above the 20-day EMA. Further gains may be possible if bulls can push the price of ETH over the psychological $4,500 level and subsequently the horizontal $4,800 barrier. In that scenario, ETH might perhaps retest the most recent high, which was close to $5,000, and possibly surpass it.

Ethereum Net Outflows Hit Record as Traders Shift to Private Wallets

The exchange flux balance for Ethereum has just gone negative for the first time in its history, according to Joao Wedson, the creator and CEO of Alphractal. By adding together the daily inflows and outflows, the Exchange Flux Balance shows the total net flow of an asset over time across all exchanges. If the value is negative, it means that more Ethereum has been taken out of exchanges than has been put in. This implies that rather than keeping their assets on exchanges for possible sale, investors are transferring them to private wallets for long-term storage.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.