Ether Liquidation Madness: Last Breakout Crushes Bears

A notable wave of short liquidations has been sparked by Ethereum’s surge beyond the $4,000 level, indicating the growing demand for the top altcoin. A rebound in interest and accumulation is shown by on-chain statistics, indicating that short sellers may sustain further losses if Ethereum’s upward momentum continues.

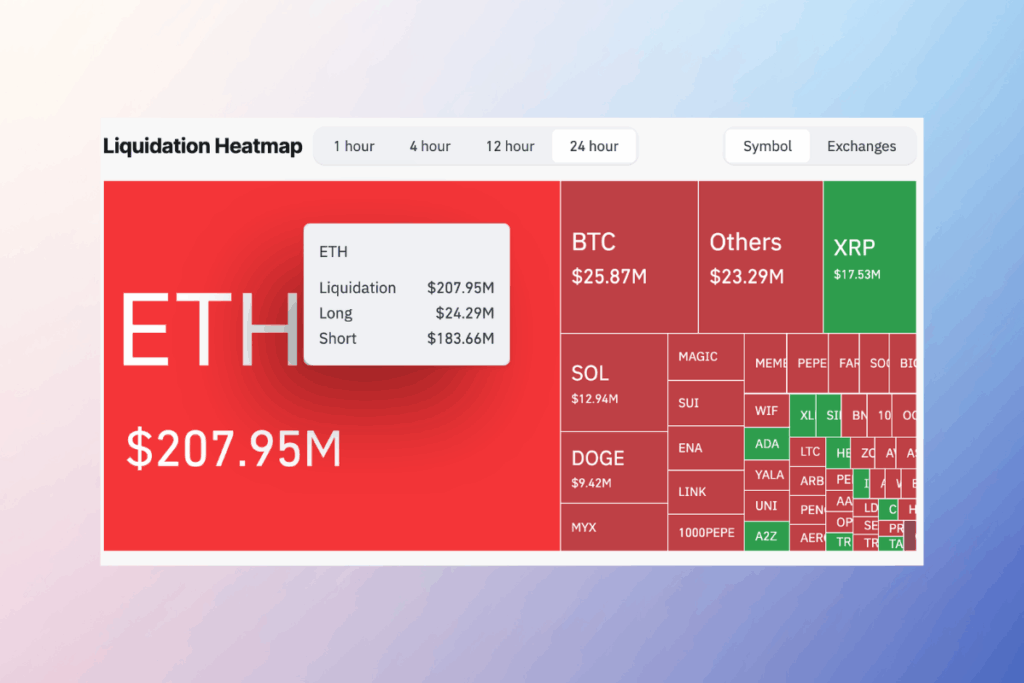

Over the previous week, ETH’s price has increased by 21.63% due to the spike in new demand. Yesterday’s surge above the $4,000 price mark, which sparked short seller liquidations, was the result of strong buying momentum and increasing market sentiment. According to Coinglass data, long liquidations have remained relatively low at about $24 million, while short liquidations have totaled $184 million over the last 24 hours.

ETH Price and Open Interest Surge

This demonstrates how severe the short squeeze is as traders rush to cover their bets during the upswing. On-chain data, however, suggests that this investor group may suffer further losses in the future, with ETH expected to continue rising. For instance, the open interest in ETH futures has increased in tandem with its price, indicating significant market activity. This amounts to $51.61 billion at the time of writing, a 10% increase over the previous day.

The amount of outstanding futures or options contracts in the market is measured by the asset’s open interest. When an asset’s price and open interest increase at the same time, it implies that traders are highly confident that the current trend will continue. This indicates that more investors are actively opening new positions in ETH and are optimistic about the continued upward trend.

Institutional Investors Fuel Ethereum’s Push Toward Key Resistance

Furthermore, this optimistic perspective is strengthened by the renewed institutional interest. As market confidence improves, SosoValue reports that there have been fresh inflows into ETFs backed by ETH this week. The new institutional capital inflow demonstrates the larger investors’ restored confidence. It offers a crucial layer of support that might keep ETH on its current upward trajectory.

With a newly created support level close to $3,909, ETH is currently trading around $4,215. ETH’s price may rise toward $4,430, testing and possibly breaking past that resistance, if current support solidifies and purchasing enthusiasm increases.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.