Ether ETFs See Record Outflow, Yet Bulls Hold Strong

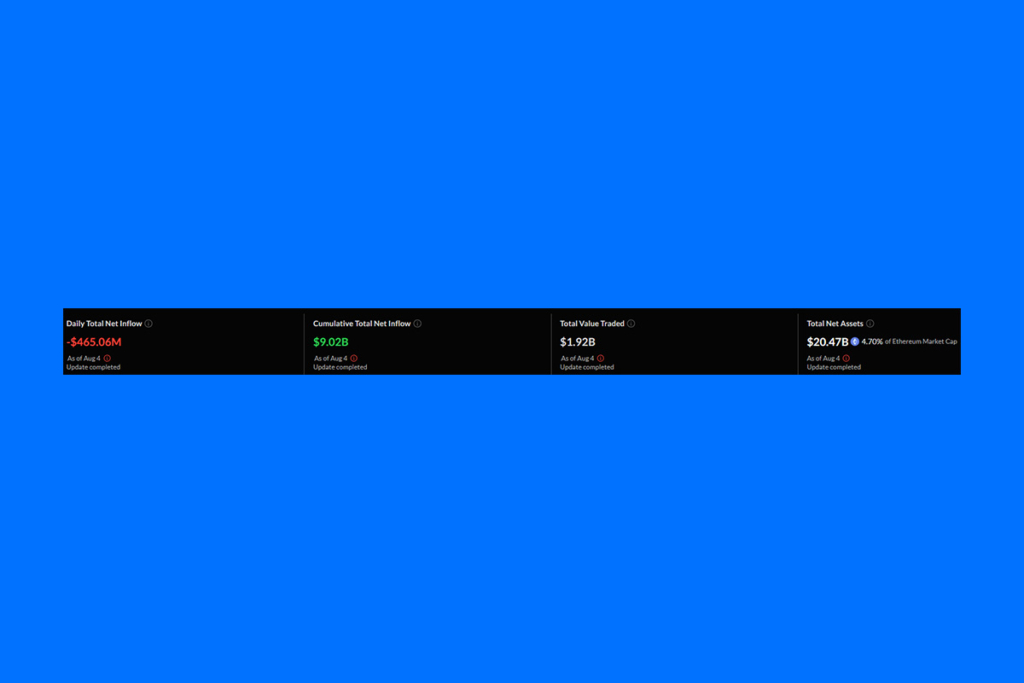

As per SoSoValue’s data, Ethereum ETFs had catastrophic withdrawals of over $465 million on Monday. This was the largest hit to BlackRock’s iShares Ethereum Trust ETF (ETHA), which lost $375 million. Second place goes to the Fidelity Ethereum Fund (FETH), which has $55.1 million.

Several Ethereum ETFs were flat on Monday, and not a single one was in the green. The bulls are not deterred by the large outflows, though, as ETH has increased by about 2.29% in the last day.

Ethereum ETF Inflows Hit $9B Despite August Outflow Setback

An incredible $5.4 billion was invested in Ethereum ETFs in July. This is a very astounding amount, especially since Ethereum only makes up one-fifth of Bitcoin’s market capitalization. With a roughly 50% price increase last month, the flagship altcoin came dangerously close to regaining its $4,000 mark.

However, Ethereum has had two days in a row of inflows, which has put it on a poor start to August. An exceptionally remarkable 20-day run of uninterrupted inflows came to an end on August 1st when these goods likewise bled a total of $152.26 million. This month’s total inflows to date have come to $617 million. Even with the latest withdrawals, the overall inflows into Ethereum ETFs remain at $9.02 billion.

BTC ETF Flows Prove Wildly Unpredictable After Massive Weekly Swings

On the other hand, with $333 million in inflows, Bitcoin ETFs also suffered a great deal. But for these products, today is by no means the worst day. The second-largest outflows to date occurred on Friday, when they hemorrhaged $812.25 million. Bitcoin ETFs have demonstrated that inflows can increase as quickly as withdrawals, highlighting the fact that ETF flows can be highly erratic.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.