Ether Dominates Crypto Inflows: Here’s Why Investors Are Piling In

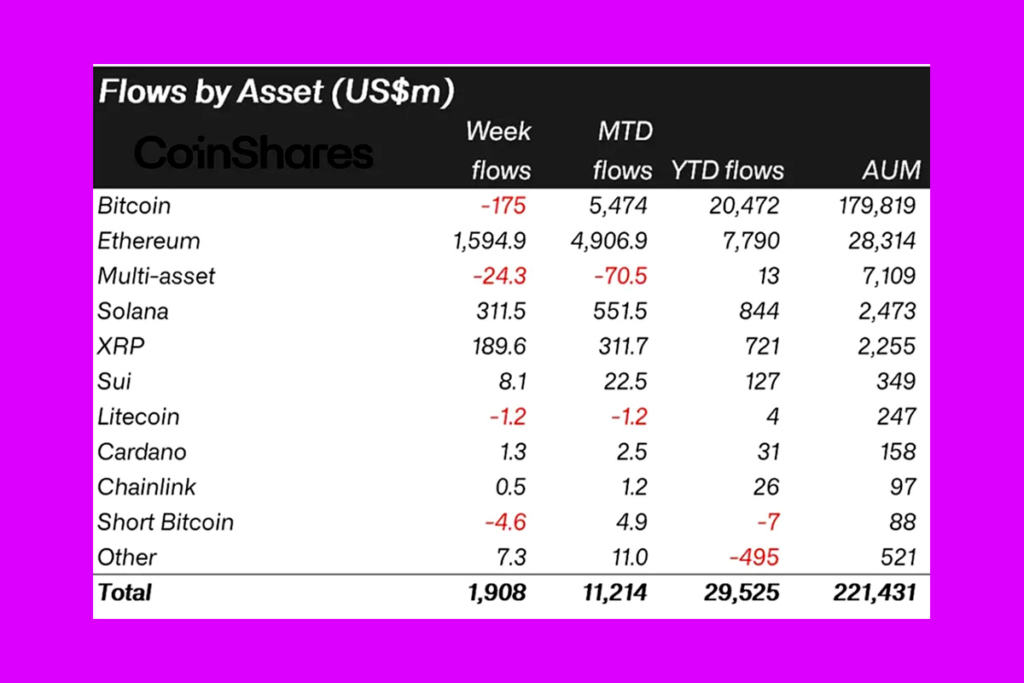

The multi-week run of positive flows was continued by cryptocurrency inflows, which increased month-to-date flows to $11.2 billion. Bitcoin (BTC) saw large outflows, while altcoins outperformed Ethereum (ETH), which led the flows. According to the most recent CoinShares data, cryptocurrency inflows last week were $1.908 billion, a substantial rise over the $1.049 billion recorded for the week ending July 19.

Bitcoin defied the trend and recorded $175 million in negative flows at the time of this decline. Ethereum, meanwhile, maintained its lead with inflows of $1.594 billion last week. With year-to-date (YTD) flows exceeding 2024 totals, this is Ethereum’s second-largest week ever, according to CoinShares head of research James Butterfill.

Ethereum stood out, unusually leading with US$1.59bn in inflows last week, its second-strongest week on record. Year-to-date inflows into Ethereum have now reached US$7.79bn, surpassing the total for all of last year,

Butterfill

CoinShares Exec Questions Bitcoin’s Weakness Amid Growing ETF Hype for Altcoins

The CoinShares executive criticizes Bitcoin for deviating significantly from general altcoin patterns, citing robust inflows into Solana and XRP. Butterfill claims that rather than a broad altcoin season, the turnout suggests possible ETF anticipation.

This has raised the question of whether we are entering an altcoin season…These altcoin inflows may be driven less by broad-based enthusiasm and more by anticipation surrounding potential US ETF launches,

the report

Ethereum’s noteworthy performance in the cryptocurrency inflows last week, however, is not surprising. The altcoin has experienced a notable increase in institutional interest ahead of its tenth anniversary. These include the $1 billion Ethereum shift being pursued by Bit Digital and the departure of BlackRock’s head of digital assets to join SharpLink Gaming, an Ethereum Treasury firm.

Ethereum Gains Institutional Traction: Could $4,500 Be the Next Stop?

Shawn Young, Chief Analyst at MEXC Research, points out that Ethereum is gaining speed as it approaches the $4,000 threshold. Young points to a positive macroenvironment and high institutional demand. He points out that Ethereum is becoming more and more regarded as the foundation of on-chain financial infrastructure, as seen by the more than $5 billion in inflows into US spot ETH ETFs over the course of 16 days.

This growth reflects the increased conviction in Ethereum’s utility, sustainability, and long-term staying power, particularly due to its use in tokenization, stablecoins, and on-chain settlement,

Young

He highlights ETH’s ability to bounce back from recent market declines, its increasing market capitalization dominance, and its pivotal role in the trend of capital shifting from Bitcoin to altcoins. Ethereum has demonstrated relative strength and held important support levels technically. A wider change in market sentiment is shown by increasing depth across altcoins, the expert claims. Accordingly, Young suggests a potential breakout toward $4,500 in the event that a risk-on rally is triggered by impending GDP and FOMC data.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.