Featured News Headlines

ENA Token Falls but Signals Long-Term Strength

In the last 24 hours, Ethena (ENA) experienced a 7.75% price drop, wiping out nearly half of its 30-day gain of 15%. Despite this sharp correction, on-chain data reveals a growing divergence between spot and derivatives investor behavior — hinting at a deeper market narrative.

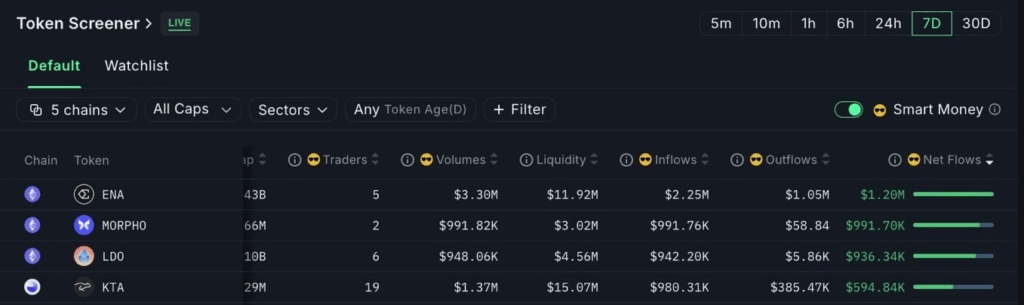

Smart Money Signals Undervaluation

According to AMBCrypto, Smart Money has been steadily accumulating ENA, injecting $1.2 million into the market over the past seven days. This group, often seen as early movers on undervalued assets, appears to be positioning for long-term upside.

New wallet activity has also surged. Nansen reports that first-time buyers purchased $4.8 million worth of ENA within the same period. This influx of fresh capital suggests increasing retail interest and reinforces the idea that ENA may be trading below its intrinsic value.

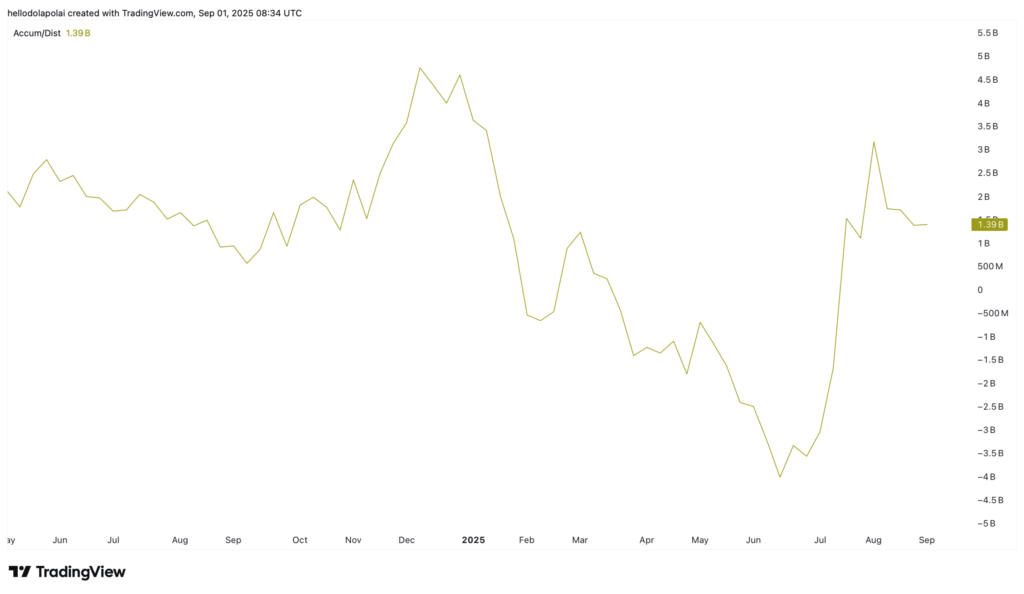

Spot Investors Show Strong Conviction

Spot market activity has been a major bullish force. CoinGlass data shows $46.45 million in net inflows to spot exchanges over the past week, indicating strong accumulation as investors moved assets to private wallets. The Accumulation/Distribution Indicator echoed this sentiment, showing that over 1.39 billion ENA tokens were absorbed — a notable bullish signal.

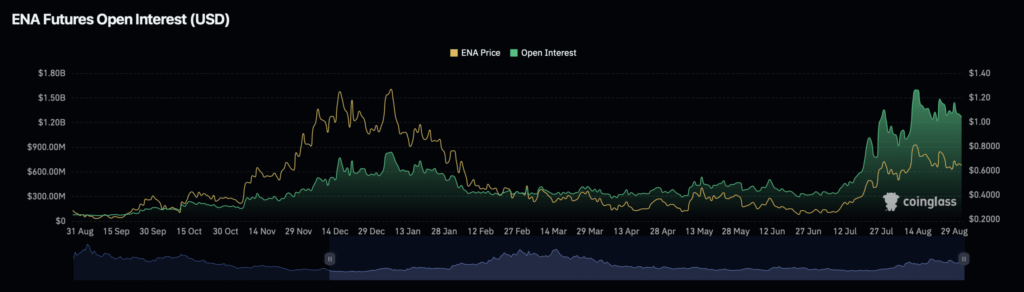

Derivatives Market Weighs on Price

However, the short-term price dip was largely driven by derivatives traders. Open Interest fell by 7.54% to $1.25 billion, reflecting a $94 million outflow from futures contracts. CoinGlass also reported rising sell volume in the derivatives space, suggesting a bearish tilt in the short run.

That said, the Liquidation Heatmap presents a more complex picture. While liquidation clusters appeared both above and below ENA’s current price, heavier resistance bands were identified above — potentially hinting at a longer-term upside breakout.

Comments are closed.