Eli Lilly Stock Plunges: Is Novo Nordisk the New King?

Eli Lilly (LLY) shares fell on Thursday after the company’s daily pill fell short of expectations. An analyst described this as a rare setback for the obesity brand. Patients who took orforglipron daily lost up to 11.5% more body weight than those who took a placebo over a 72-week period. This was less than the 12% to 13% placebo-adjusted weight loss that Novo Nordisk’s (NVO) Wegovy weekly injections cause patients to experience.

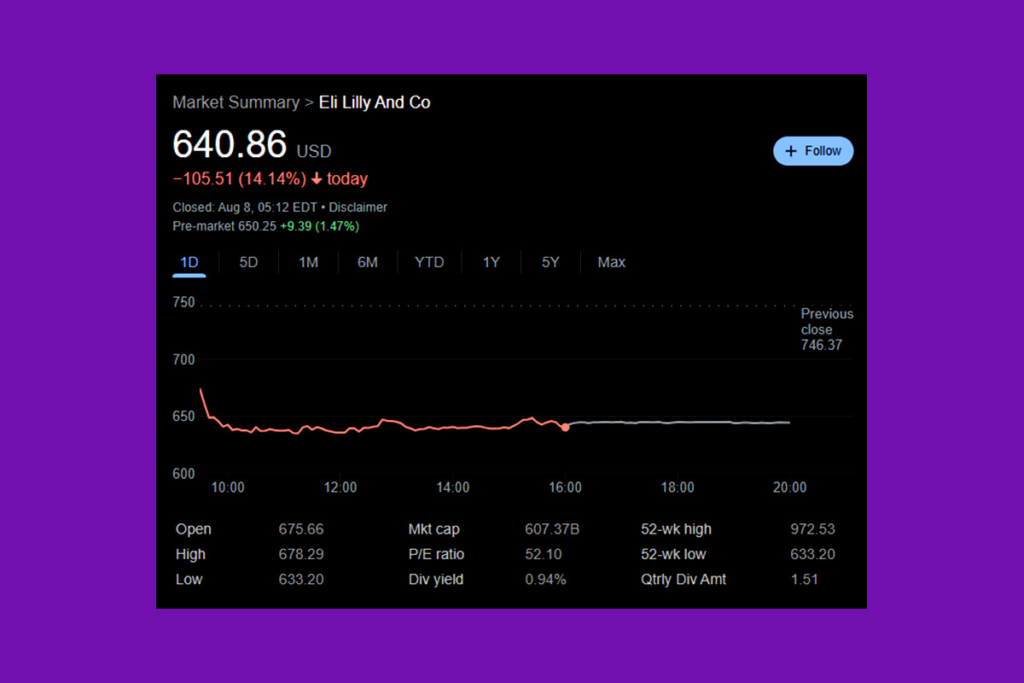

Eli Lilly’s beat-and-raise in the second quarter was overshadowed by the results, which also increased the stock of competitors Novo Nordisk, Viking Therapeutics (VKTX), and Structure Therapeutics (GPCR). Each is developing a medication to treat obesity. While Novo shares increased 7.5% to 48.76, Eli Lilly’s stock fell 14.1% to 640.86. In contrast to Structure, which reversed early gains and dropped a fraction to 16.20, Viking’s shares rose 11.5% to close at 35.56.

Eli Lilly Price Target Slashed as Obesity Drug Falls Short of Expectations

David Risinger, an analyst at Leerink Partners, lowered his Eli Lilly price target from $944 to $715. He says he no longer anticipates upward pressure on long-term consensus expectations and instead projects orforglipron to generate $13.5 billion in sales, down from his previous prediction of $21.6 billion.

Threats from competition are also increasing. Novo Nordisk is having trouble and might have to lower its price to compete with Eli Lilly. Additionally, according to a study by Andy Hsieh, an analyst at William Blair, a few more patients left Lilly’s test because of adverse effects than in the pivotal test for Wegovy. Depending on the dosage, Lilly reported dropout rates ranging from 5.1% to 10.3%, while Wegovy reported dropout rates of 7%.

From a stock perspective, we believe that Eli Lilly’s rare miss from its otherwise impenetrable obesity franchise could create an opening for smaller competitors,

Hsieh

Zepbound and Mounjaro Power Eli Lilly to Record-Breaking Quarter

Lilly exceeded expectations for the second quarter in spite of the clinical setback. The kingpin of obesity reported sales of $15.56 billion, up 38%, and adjusted earnings of $6.31 per share, up 61%. Analysts’ estimates of $5.60 and $14.7 billion were surpassed by both metrics.

Notably, Zepbound, a medication used to treat weight reduction, made $3.38 billion in sales, while Mounjaro, a medication used to treat diabetes, made around $5.2 billion. The Street projected $3.02 billion and $4.71 billion, respectively. Lilly increased their sales forecast for the year from $60 billion to $62 billion in this regard.

For more up-to-date crypto news, you can follow Crypto Data Space.

[…] global sales. Now, investors are concentrating on Lilly’s oral obesity medication, orforglipron, which is anticipated to receive approval early next year. The most recent generation of GLP-1 […]