Featured News Headlines

Bitcoin-DXY Correlation: Macro Trends Explained

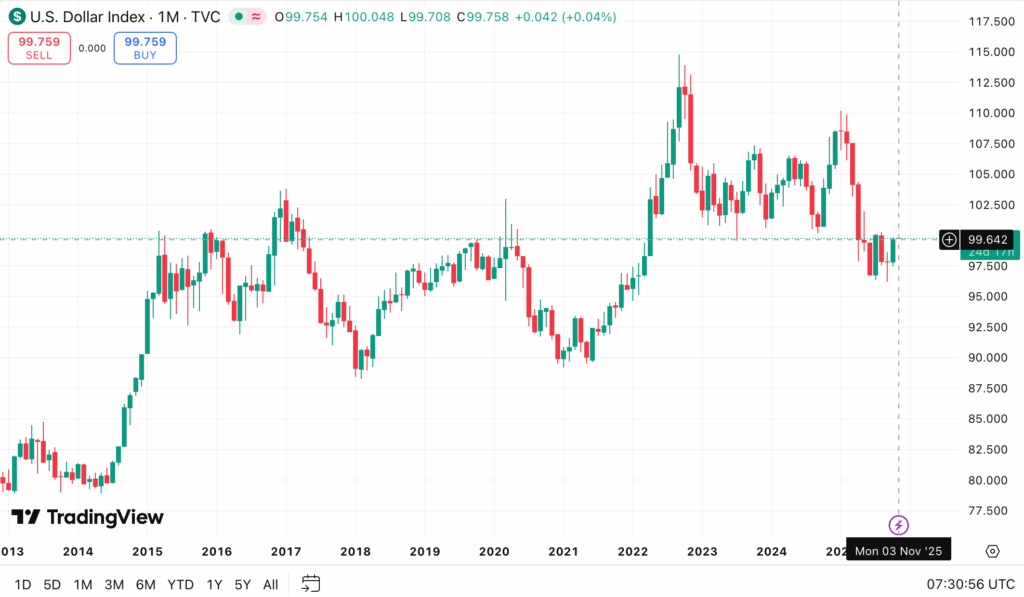

The US dollar is showing renewed strength, prompting analysts to assess whether this is a temporary technical rebound or the start of a broader liquidity-tightening phase that could impact risk assets, including cryptocurrencies. According to TradingView, the US Dollar Index (DXY) recently surged past the 100 mark, reaching 99.98—a two-month high—following the Federal Reserve’s decision to leave interest rates unchanged.

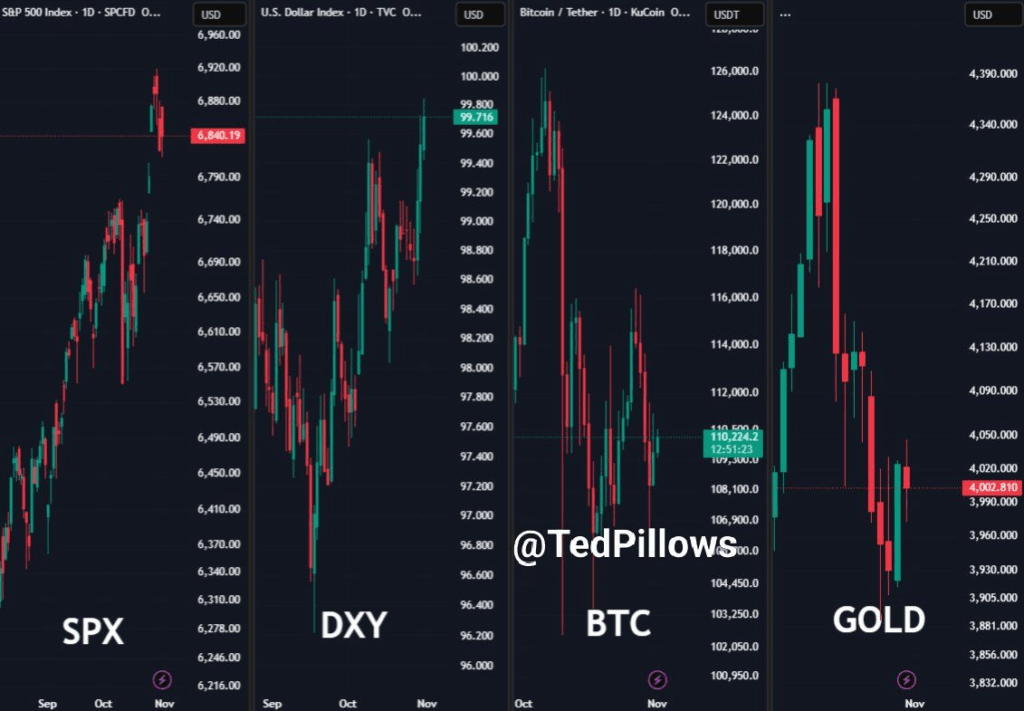

Analyst Ted notes, “The dollar keeps on getting stronger, and this isn’t a good sign for the crypto market.” He highlights that DXY is forming a golden cross on the daily chart, a technical pattern commonly associated with a sustained bullish trend.

Key Technical Levels Under Scrutiny

Experts on social media platforms emphasize that the DXY is approaching a critical resistance zone near the 200-day moving average. This area may determine the next directional trend for the dollar. Some analysts argue that this rally could be a technical back-test before a possible short-term pullback. As one commentator explained, “DXY’s monthly structure suggests a bearish retest, implying a possible short-term pullback before resuming a medium-term uptrend.”

Regardless of the immediate direction, the dollar’s resurgence is exerting psychological pressure across risk assets—from equities to cryptocurrencies.

Bitcoin and DXY: A Persistent Inverse Correlation

Historically, Bitcoin (BTC) has displayed an inverse relationship with the DXY. When the dollar strengthens, risk appetite tends to decline, often coinciding with Bitcoin price corrections. Data shared by Ted Pillows illustrates this correlation: from September onward, DXY rose from 98 to nearly 99.7, while Bitcoin declined more than 12%, and gold fell by approximately 6%.

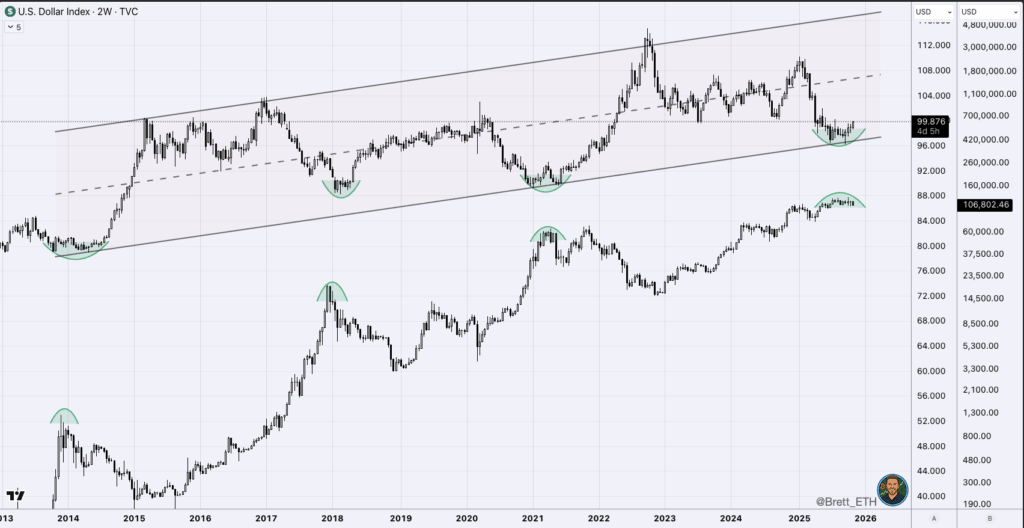

Brett’s analysis highlights that the 100 level remains a crucial support on the weekly DXY chart. In May 2025, a rebound from this level corresponded with Bitcoin achieving new all-time highs, driven by a temporary USD pullback. While history could repeat, analysts caution that a more sustained dollar recovery may lead to different outcomes.

Macro Trends Continue to Shape Crypto

Traders consistently watch the BTC-DXY relationship as a key macro indicator. One analyst noted, “Bitcoin’s next major move will likely hinge on DXY’s trajectory: if the dollar breaks above 101, a bearish continuation scenario for BTC could unfold; conversely, if DXY fails to hold the 100 zone, it might signal a short-term relief rally for crypto markets.”

Ultimately, the interplay between the dollar and risk assets underscores that broader macroeconomic trends often influence digital markets more than on-chain metrics alone.

Comments are closed.