Featured News Headlines

Dogecoin Price Near Key Support as Volatility Tightens

Dogecoin (DOGE) trades near the $0.20 level as the market contemplates whether the recent pullback represents a normal consolidation or the start of a deeper correction. Price action has tightened around the $0.197 support, while on-chain and derivatives data indicate mixed sentiment among traders.

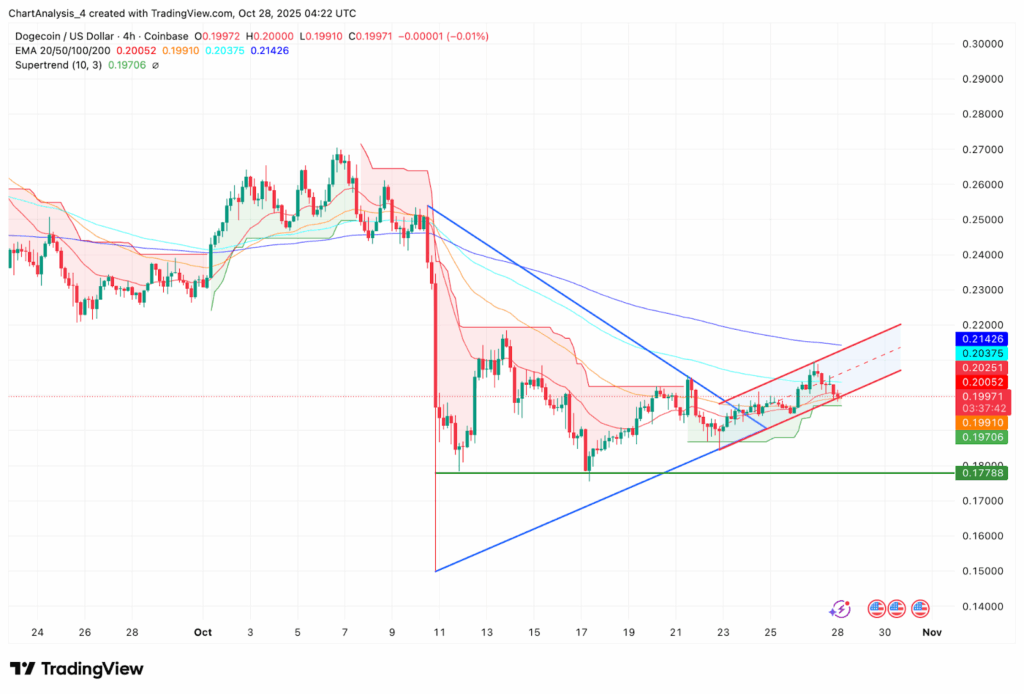

$0.20 Support Maintains Short-Term Stability

On the 4-hour chart, Dogecoin remains within a narrow ascending channel after recovering from its October lows. The 20, 50, and 100 EMAs have converged between $0.199 and $0.203, forming a compact support cluster that traders are defending.

“The Supertrend line near $0.197 has held multiple times this week, giving bulls a short-term base,” market analysts noted.

Above the current price, immediate resistance is found at the 200 EMA and the upper channel line near $0.214. A clean move above this level could trigger a potential rally toward $0.22–$0.23, while a breach of the $0.197 floor would expose the lower demand zone at $0.178 and threaten the ascending channel structure.

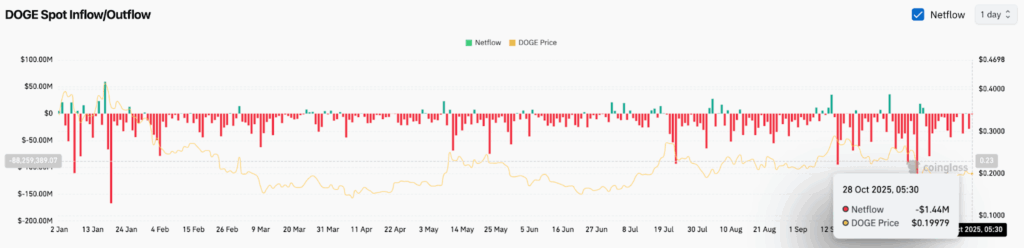

Spot Flows Show Defensive Behavior

On-chain metrics reveal modest net outflows of around $1.4 million on October 28, contrasting with the heavy withdrawals observed earlier in 2025. Analysts suggest that this limited outflow points to a market in balance, with neither panic-selling nor aggressive accumulation taking place.

The neutral flow reflects traders waiting for conviction. Exchange wallets show fewer large transfers, indicating low urgency on both buying and selling sides. A shift toward larger outflows and higher spot volume could signal renewed confidence, but current patterns suggest caution remains dominant.

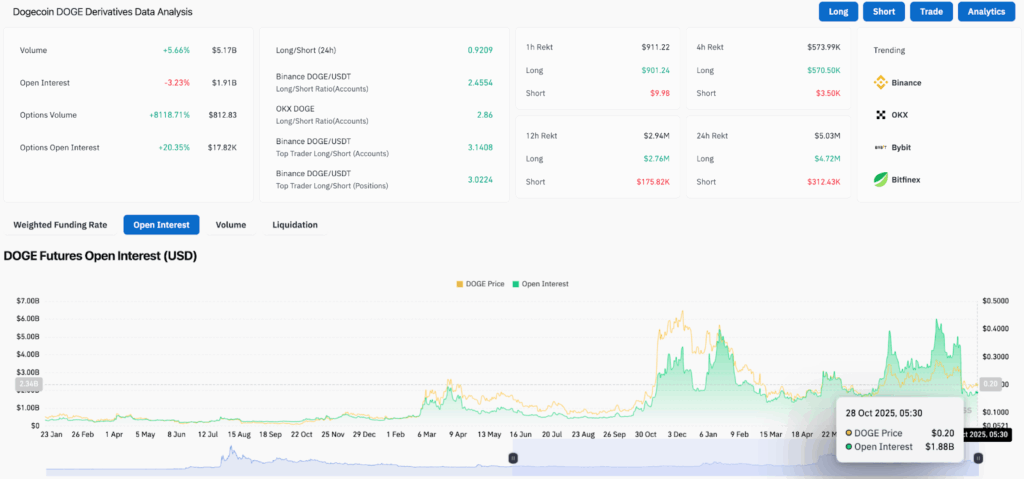

Derivatives Market Signals Caution

Dogecoin’s derivatives landscape is cooling following last week’s liquidations. Futures open interest declined 3.2% to $1.91 billion, even as trading volume increased 5.6% to $5.17 billion. This combination points to short-term unwinding rather than fresh leveraged positioning.

Options volume, however, spiked to $812 million—the highest daily increase this month. Much of this came from speculative upside plays, coinciding with Binance and OKX long/short ratios above 2.5. While sentiment appears bullish, overall participation remains below the peak levels seen during midyear rallies.

“Open longs are still dominant, but new leverage is entering slowly,” analysts observed.

A sustained buildup in open interest near $2 billion could signal a stronger trend continuation, though current conditions remain measured.

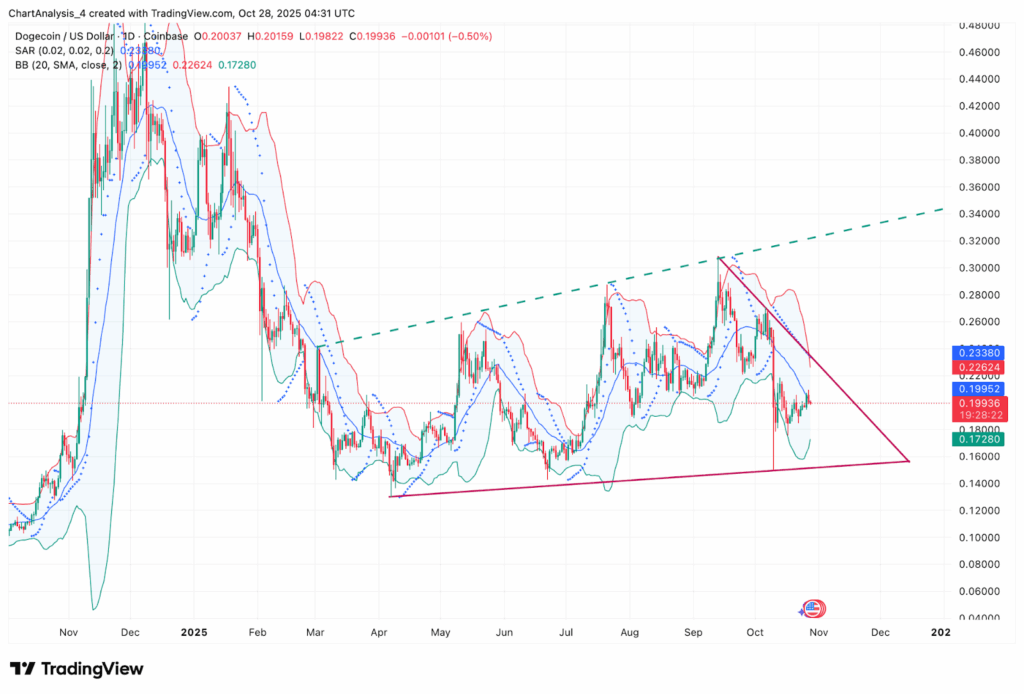

Daily Chart Forms Symmetrical Triangle

On the daily chart, Dogecoin is compressing within a symmetrical triangle that has guided price since June. The lower trendline at $0.172 has contained previous corrections, while the upper boundary near $0.23 serves as the key breakout threshold.

Bollinger Bands have narrowed to one of the tightest ranges this quarter, indicating potential volatility expansion. The Parabolic SAR remains above price, maintaining a slightly bearish bias until a daily close above $0.21 flips the signal. Historically, similar squeezes precede impulsive moves when price breaks major boundaries with strong volume.

Short-Term Outlook

Dogecoin’s short-term uptrend remains intact as long as it holds above $0.197. Breaking through $0.214 could pave the way toward $0.23 and potentially $0.25, completing a medium-term reversal setup.

“Failure to hold $0.197 would weaken structure and likely lead to a retest of $0.178,” analysts noted.

Exchange flows remain subdued, suggesting that any significant increase in spot activity or changes in derivatives funding would be key signals to monitor. For now, price movement is largely range-bound, with higher lows indicating resilience while approaching the triangle’s apex.

![Virtuals Protocol [VIRTUAL] Sees Significant Weekly Surge Amid Market Fluctuations](https://cryptodataspace.com/wp-content/uploads/2025/08/image-403.png)

Comments are closed.