On-Chain Data Reveals Bullish Trends for Dogecoin Investors

On-chain data reveals a clear pattern of hodling among long-term Dogecoin (DOGE) investors, suggesting strong conviction and the potential for sustained upward momentum.

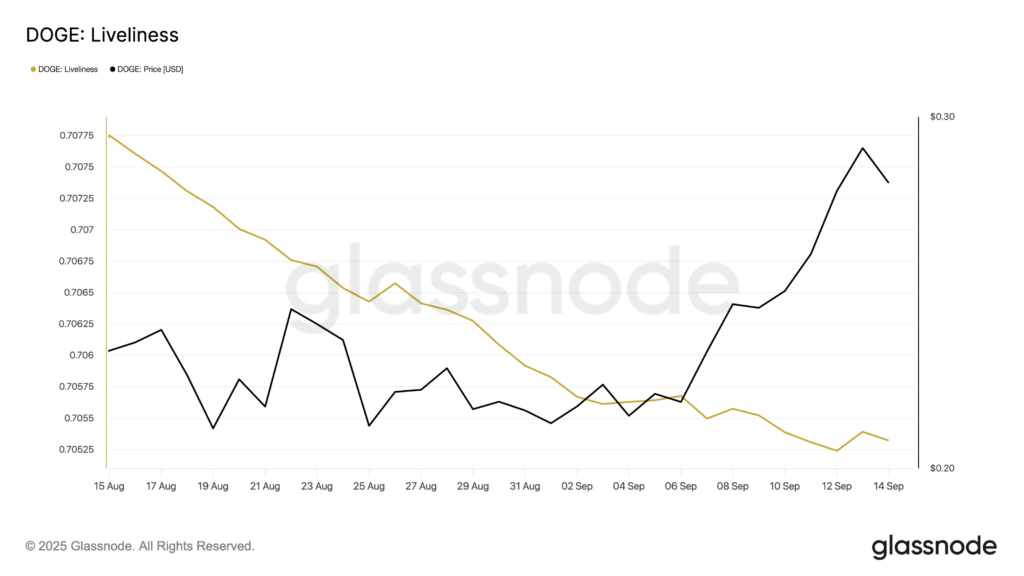

One important indicator reflecting this sentiment is DOGE’s liveliness metric, which tracks how actively long-term holders are spending their coins. According to Glassnode, DOGE’s liveliness has steadily declined over the past month, dropping to 0.705. This decrease points to a significant slowdown in sell-offs among long-term holders, indicating many coins are becoming dormant. As a result, this behavior supports the idea of conviction-driven holding that could lead to short-term price gains.

Increasing Long-Term Storage

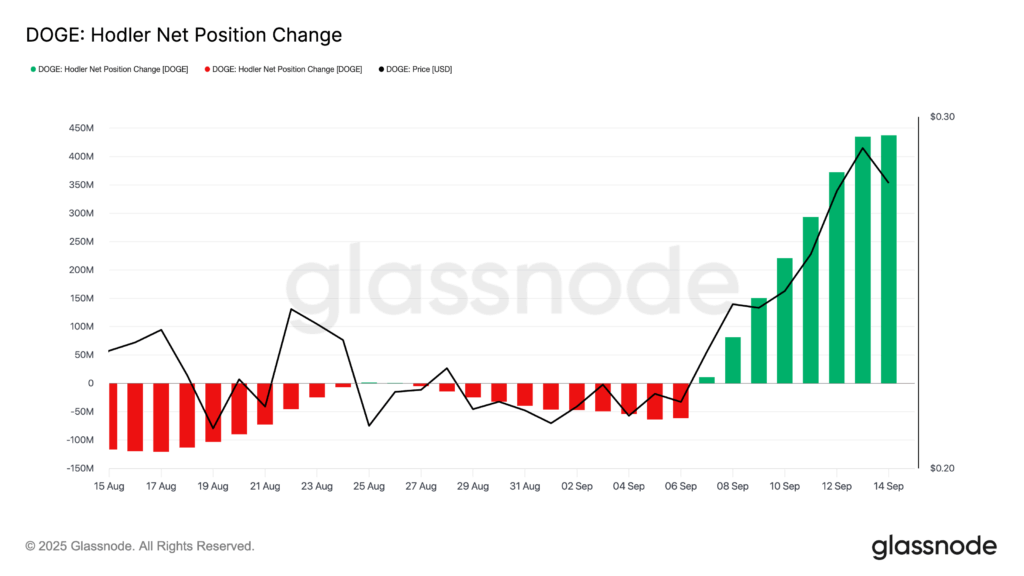

Another key metric, the Hodler Net Position Change, shows a consistent increase since September 7. This means more DOGE coins are being moved into long-term storage wallets. Glassnode explains this metric tracks whether long-term holders are increasing or decreasing their exposure, with a positive value signaling accumulation. For DOGE, this trend reduces circulating supply and represents confidence from dedicated investors.

Momentum and Potential Resistance Levels

This wave of accumulation sets the stage for possible continued price growth. If this trend persists, DOGE might break through resistance at $0.29 and target $0.33 — a level last reached in January.

However, caution comes from the Money Flow Index (MFI), which measures buying and selling pressure. Currently hovering around 80.29, the MFI indicates DOGE is in the overbought zone. Values above 80 typically suggest a peak in buying pressure, signaling a potential short-term pullback or consolidation phase ahead.

In summary, long-term holders are showing strong commitment to DOGE, potentially fueling further gains, but technical signals suggest investors should watch for possible corrections.

Comments are closed.