Dogecoin ETFs Hit Record Lows: Is Investor Interest Fading Fast?

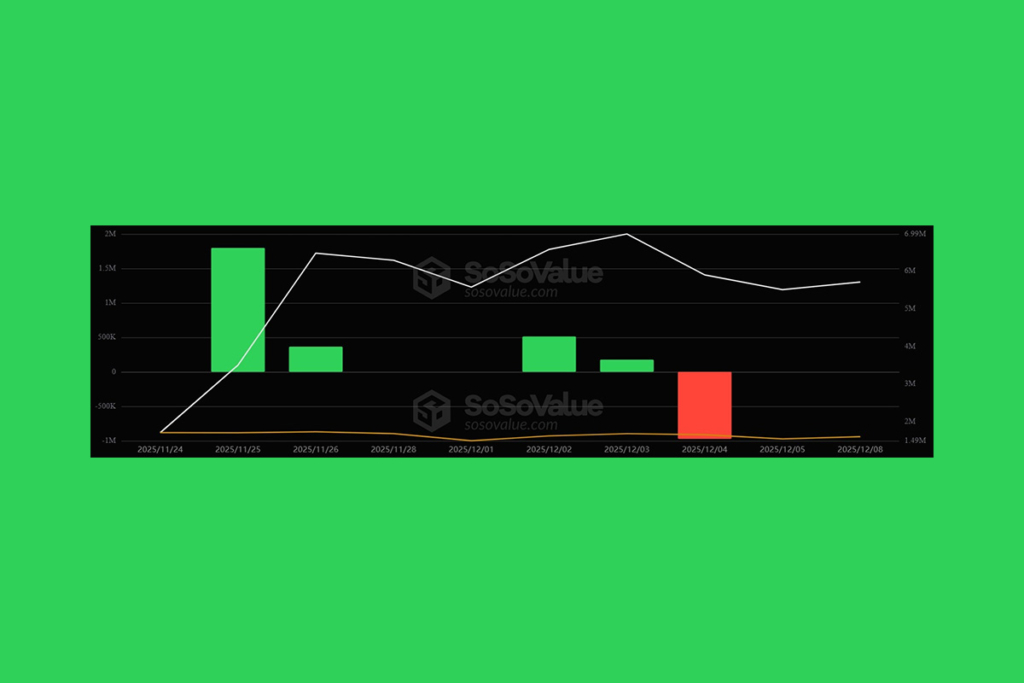

As total value traded (TVT) has dropped to its lowest level since its debut, US spot Dogecoin ETFs are beginning to exhibit early indications of decreasing demand. Dogecoin ETFs’ TVT dropped to $142,000 on Monday, the lowest level since their debut, according to SoSoValue statistics. Compared to late November, when the funds saw days where value exchanged over $3.23 million, this represented a significant decline.

Massive Gap: DOGE Market Volume Climbs as ETF Interest Fades

When contrasted to Dogecoin activity in the larger cryptocurrency market, the difference is striking. According to CoinGecko data, DOGE’s spot trading volume during the past 24 hours exceeded $1.1 billion. This suggests that its market value is $22.6 billion. This demonstrates that, despite its ETF coverings, the underlying asset is still very liquid. This disparity implies that instead of using conventional market vehicles, traders are gaining direct access to DOGE through exchanges.

Is Dogecoin Losing Hype? ETF Volume Suggests Investor Caution

The Dogecoin ETF from Grayscale debuted in November. The ETF, however, significantly underperformed the initial volume projections. At the time, ETF researcher Eric Balchunas projected that the ETFs would receive at least $12 million in activity. But on its first day, the ETF only saw $1.4 million. The lackluster start, according to analysts, may indicate waning consumer interest in meme-coin investment products, particularly when the market is more unpredictable. However, some think that if Dogecoin gains new momentum or if liquidity in cryptocurrency ETFs improves, trading activity might increase.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.