Featured News Headlines

Is Dogecoin Ready for a Breakout or a False Move?

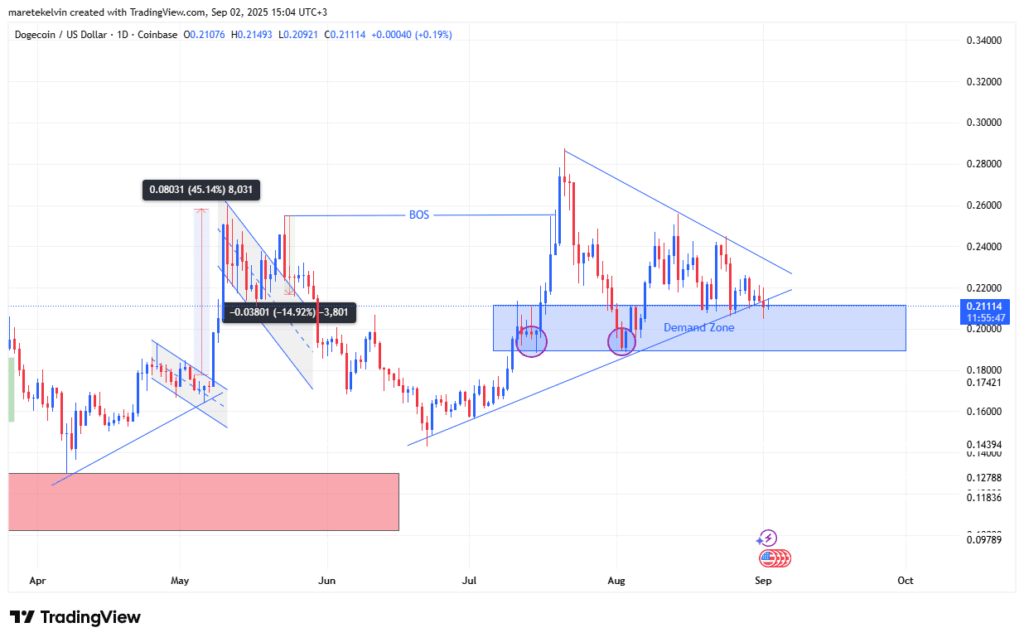

Dogecoin (DOGE) has spent the last two months consolidating within an ascending triangle pattern—a formation closely watched by traders and investors for potential continuation signals. At the time of writing, the price appeared poised near a breakout, gaining momentum after testing the $0.20 support level once again.

Rising Trading Volume Indicates Positioning Ahead of Move

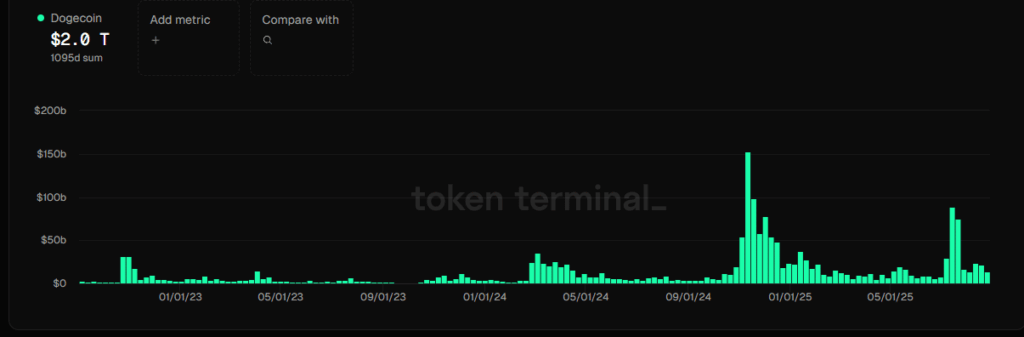

A notable shift during this consolidation phase is the increase in trading volume. Rather than declining, volume surged, suggesting that market participants may be preparing for the next significant move. Historically, such spikes have preceded sharp price actions in DOGE; for instance, a similar volume increase in late 2024 preceded an explosive bullish run.

Data from Token Terminal revealed that weekly trading volumes hit $13.49 billion during the week of August 25, reinforcing the idea that traders might be accumulating positions in anticipation of a breakout.

Market Cap Reflects Growing Investor Interest

Dogecoin’s circulating market capitalization rose to approximately $31.7 billion as of September 1, according to Token Terminal. This increase points to renewed investor attention but also hints at potential volatility if the price breaks out of its narrowing range. Typically, a rising market cap reflects heightened retail activity.

Breakout or False Signal?

The critical question remains whether DOGE can sustain this setup for a genuine rally. A clear break above the triangle’s resistance would likely trigger technical buying. However, as often seen with such patterns, false breakouts can occur, especially given Dogecoin’s significant retail investor base, which can lead to swift sentiment shifts.

Currently, traders are closely monitoring whether demand at current levels holds and whether volume confirms a bullish breakout. If so, the case for upward momentum will strengthen. Otherwise, DOGE might drift back towards its lower support zones.

Comments are closed.