DOGE and XRP ETFs Delayed: SEC Shows Clear Bias Towards BTC and ETH

New crypto ETFs linked to DOGE and XRP have been delayed in their deployment. Although both funds were anticipated to be significant milestones for their respective communities, there is a noticeable contrast in how the SEC handled them. The more established spot BTC and ETH ETFs that are now trading in the nation are not on par with experimental products.

Dogecoin ETF Launch Looms as XRP Awaits Regulatory Clarity

The SEC postponed its final decision deadline for the Franklin XRP ETF from September 15 to November 14, 2025, on September 10. The need for additional time to consider comments and possible hazards was mentioned by the regulator. Since the product was initially registered in March, this is the second extension. Bettors on Polymarket have placed the likelihood of approval by year-end at over 90%, notwithstanding the delay. This suggests that before the end of 2025, investors still think Ripple will create its own ETF.

As XRP waits for clarification, focus has turned to Dogecoin. Originally set to begin on September 12, the Rex-Osprey DOGE ETF (DOJE) is now expected to launch mid-next week, most likely on September 18, according to Bloomberg ETF analyst Eric Balchunas. Whales have been hoarding the meme coin in anticipation of the ETF, according to recent data from Santiment.

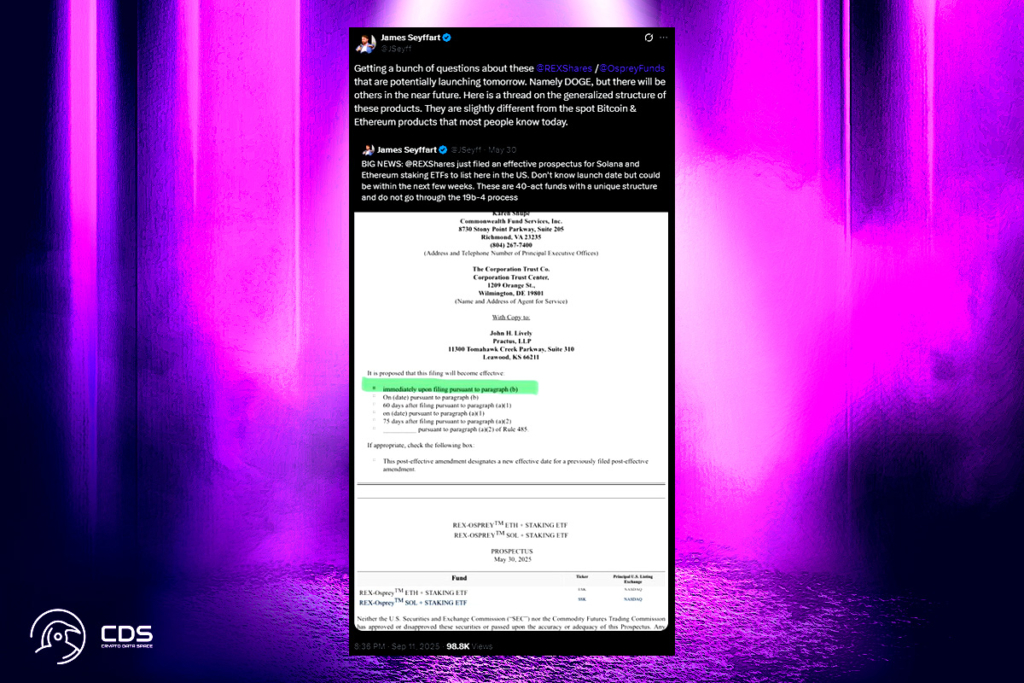

SEC Strategy Shows Major Structural Differences in Crypto ETF Approvals

The SEC‘s strategy reveals a significant gap in the strategy used to introduce crypto ETFs to the market. Under the Securities Act of 1933, for instance, spot Ethereum and Bitcoin ETFs are set up as grantor trusts. Though it requires a rigorous approval procedure that includes a formal comment period, the ’33 Act framework is currently the industry standard for crypto goods that are physically backed. In the meantime, the Dogecoin product is set up in accordance with the Investment Company Act of 1940, according to industry expert James Seyffart. As opposed to the typical structure employed by more well-known cryptocurrency ETFs, this enables it to function as a Registered Investment Company (RIC).

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.