Featured News Headlines

DocuSign Stock Surges After Strong Q2 Earnings and Board Changes

DocuSign (DOCU) shares gained about 6% following the release of its latest quarterly results and news of a leadership transition at the board level.

Strong Earnings Beat Expectations

DocuSign reported earnings per share (EPS) of $0.92, outperforming Wall Street consensus forecasts of $0.85. This favorable surprise helped bolster investor confidence in the company’s performance.

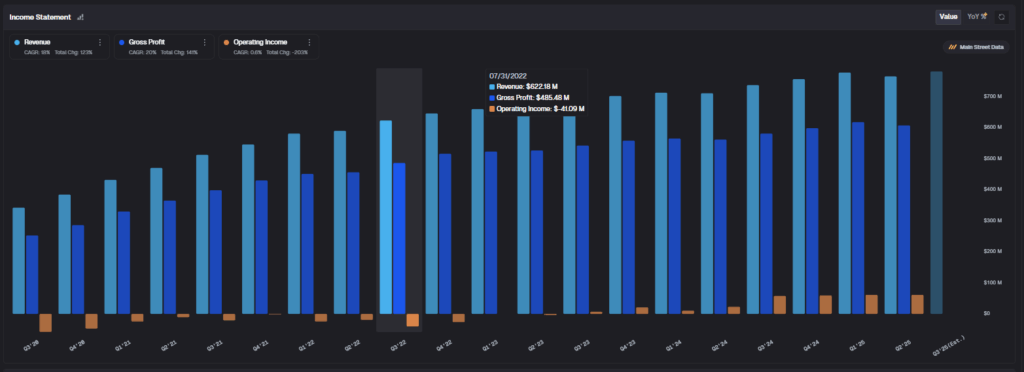

Meanwhile, revenue reached $800.6 million, exceeding the projected $780.9 million and reflecting 8.8% growth year-over-year. Such topline strength underscores solid demand for DocuSign’s suite of electronic signature and document management solutions.

Upgraded Revenue Outlook Reflects Optimism

Buoyed by healthier-than-expected results, management raised its full-year revenue guidance. The midpoint was lifted to $3.20 billion, up from $3.16 billion previously. This upward revision signals growing optimism around the remainder of the fiscal year.

DocuSign also reported an operating margin of 8.1% for the quarter and billings of $818 million, marking a 12.9% increase from a year earlier. Both metrics highlight improving operational efficiency and expanding customer uptake.

Board Shakeup: New Chair Takes the Helm

In tandem with the earnings release, DocuSign confirmed two leadership changes on its board.

- Mike Rosenbaum has joined the Board of Directors, effective September 3.

- James Beer will step into the role of Board Chair.

These adjustments signal a refreshed leadership structure aimed at navigating the company through its next phase of growth and transformation.

DocuSign’s stock has demonstrated strong recent motion, jumping 6% following the update. However, this rebound follows a prolonged retracement; shares are still down approximately 63% over the past five years, reflecting a steep correction after pandemic-era highs.

During the COVID‑19 pandemic, demand for DocuSign surged as remote work became the norm. Since then, as offices reopened and digital transformation momentum moderated, DocuSign has faced headwinds in maintaining that elevated growth trajectory.

Analyst Consensus and Price Targets

As of now, 17 Wall Street analysts provide a consensus rating of “Moderate Buy” for DOCU stock. This rating stems from a breakdown of five “Buy” recommendations and twelve “Hold” recommendations issued over the past three months.

Their average price target is $91.87, which implies a potential upside of around 21% from current levels—even after the recent 6% pop.

DocuSign’s latest quarter delivered meaningful beats in both EPS and revenue, accompanied by improved margin and billing metrics. The upgrade in full-year revenue guidance adds further positive momentum.

Simultaneously, the appointment of a new board chair and an additional board member underscores a commitment to refreshed governance and strategic direction. Together, these developments reinvigorated investor enthusiasm, despite lingering long-term stock underperformance compared to its pandemic‑era peak.

Comments are closed.